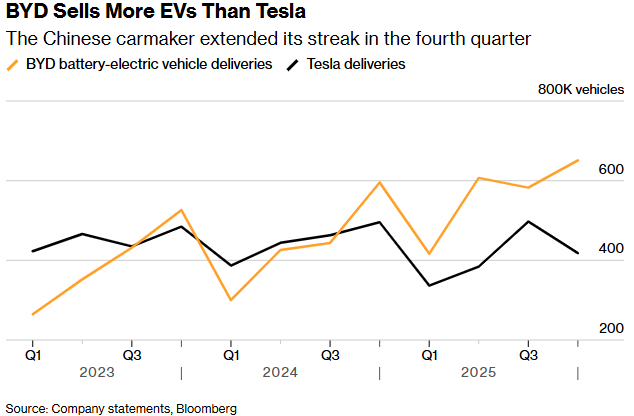

Tesla EV deliveries totaled 1.64 million vehicles in 2025, leaving the company behind China’s BYD, which delivered more than 2.2 million EVs for the year. The result marks a second consecutive annual decline in Tesla EV deliveries, reinforcing the growing pressure on the company’s core automotive business. Fourth-quarter deliveries fell sharply year over year, underscoring the slowdown.

Despite the weakness in Tesla EV deliveries, investor focus has shifted away from near-term vehicle fundamentals. The stock continues to trade on expectations surrounding artificial intelligence, autonomy, and longer-term optionality rather than current auto demand. In effect, Tesla is being valued less as an EV manufacturer and more as a future AI platform.

That disconnect matters. As government incentives fade and competition intensifies, Tesla EV deliveries face increasing headwinds. While the company’s energy storage segment continues to grow, it's small relative to the scale implied by Tesla’s market valuation. Investors are betting that future technologies can offset a slowing core business. However, that wager leaves little margin for disappointment if those promises take longer to materialize.

What To Watch Today

Earnings

- No earnings today

Economy

Market Trading Update

The trading week of January 2, 2026, closed with the S&P 500 at 6,858.47. Despite substantial annual gains, the index ended the week modestly lower, losing momentum into year-end. The decline broke a three-week advance as the “Santa Claus Rally” failed to materialize.

The Santa Claus Rally, traditionally measured as the final five trading days of December and the first two of January, often serves as a short-term sentiment gauge. Historically, when this period posts gains, the S&P 500 finishes the following year higher roughly 75 percent of the time. When it fails, forward returns tend to weaken. For 2025, the rally did not arrive, with the S&P 500 slipping nearly 0.8% over the seven-session window; however, that did not deter the substantial gains for last year.

From a technical standpoint, the index remains firmly above its long-term trend lines, though short-term signals turned neutral. The 20-day moving average sits at 6856.67, just below Friday’s close, as the market bounced off that support on Friday. The 50-day moving average, near 6,805.01, marks the next layer of trend support, while the 200-day average remains far below at 6,292.67. The weakness into year-end triggered a short-term momentum sell signal, which may pressure stocks somewhat next week. Furthermore, the 14-day RSI, hovering near 52, has also weakened and remains in a negative divergence to the market.

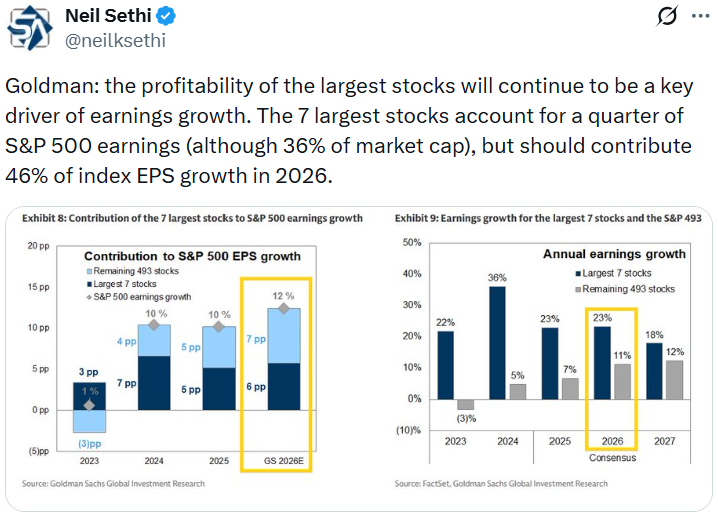

Trading volume into year-end was thin, typical for the holiday period, but breadth readings narrowed. Mega-cap technology and communication services names held up better than cyclicals, while energy and small-caps lagged. Analysts at LPL Financial and Carson Investment Research both noted that the lack of a year-end push suggests a more selective market entering 2026, which won't be much different than 2025; however, their interpretation aligns with prior historical patterns, where failed Santa rallies have preceded higher volatility in Q1 rather than immediate trend reversals. Additionally, with the market posting gains over the last eight consecutive months, a down month is becoming increasingly likely.

Overall, the market continues to consolidate the massive gain from the April lows. The 6,900 level has acted as a ceiling since mid-December, capping attempts to push higher, while buyers have consistently stepped in near 6,800. A decisive breakout above 6,900 would reassert bullish control and pave the way for targets of 7,000 and 7,200. Conversely, a close below 6,800 could signal a test of the 6,700 region, which coincides with the December swing lows and the rising 100-day moving average.

Despite the mild weakness, the broader market structure remains constructive. The index continues to respect key support, volatility remains contained, and investor sentiment, while tempered, is far from fearful. If early-2026 data confirm easing inflation and steady earnings, the failed Santa rally may end up being a brief pause before another leg higher. If not, the pattern could mark a short-term top after an exceptional 2025 advance.

SUPPORT AND RESISTANCE, S&P 500

| Level Type | Price | Technical Significance |

|---|---|---|

| Resistance 3 | 7,200 | Target level if markets can break above previous all-time highs. |

| Resistance 2 | 7,000 | Major psychological level; first upside test following breakout.. |

| Resistance 1 | 6,920 | Major psychological level. Previous intraday all-time high. |

| Pivot / Close | 6,858.47 | Friday, January 2, 2026, close. |

| Support 1 | 6,856.67 | 20-day moving average; intraday pivot range. |

| Support 2 | 6,805.01 | 50-day moving average; key trendline support. |

| Support 3 | 6,720 | December swing low area; likely strong demand zone. |

| Support 4 | 6,292.67 | 200-day moving average; long-term trend floor. |

The Week Ahead

The first full week of the new year will bring some important economic data with it. Today, the data kicks off with the ISM manufacturing PMI for December 2025. Economists expect manufacturing activity to improve slightly from November but remain in contractionary territory. Wednesday will bring an update on the services economy with the release of December’s ISM services PMI. The data is likely to show that the services sector remained in expansionary territory, but economists expect it to contract slightly compared to November.

The JOLTS survey for November and the ADP payrolls for December are also released on Wednesday. The ADP payrolls report will provide an early look at private sector employment trends in advance of the non-farm payrolls report on Friday. The star of the show this week will be the non-farm payrolls report on Friday, along with an update on the unemployment rate. Investors will be closely watching the report following the questionable data released for October and November in the aftermath of the government shutdown.

Estate Planning Essentials: Protecting Your Legacy

Trusts can add flexibility, privacy, and structure. A revocable trust or revocable living trust is commonly used to help manage assets during life and transfer property more smoothly at death, often reducing the need for probate. A living trust can also help keep plans private.

An irrevocable trust is different; it generally involves giving up certain control in exchange for potential tax planning, asset protection, or legacy planning benefits. Whether a trust makes sense depends on your goals, your wealth level, and the types of assets involved.

If a trust is used, someone must serve as trustee, and your plan should be clear about who that person is, how management works, and how beneficiaries receive distributions.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Tesla EV Deliveries Continue to Lag Global Rivals appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter