A Danish pension fund, Akademiker Pension, which manages roughly $25 billion in retirement assets for teachers, announced that it plans to sell all of its U.S. Treasury holdings by the end of January. Their action is a symbolic rebuke against rising tensions over Greenland’s sovereignty. The fund claims:

The decision is rooted in the poor U.S. government finances, which make us think that we need to make an effort to find an alternative way of conducting our liquidity and risk management.

While their action provides an interesting twist on how Europe may counter Trump’s Greenland goals, Akademiker holds only approximately $100 million in US Treasury bonds, which, even if liquidated at once, would not move the US bond market given its enormous size. For context, RIA Advisors, a relatively small wealth manager, holds many more Treasury bonds than it does. The concern is that Akademiker’s decision might gain traction with other European countries. However, that risk is extremely low, as Europe can't easily sell US Treasuries in a coordinated way because most holdings are in private hands (pension funds, banks, individuals) rather than government-controlled, which requires complex coordination across many nations. Furthermore, a sell-off would backfire by devaluing their own assets and disrupting global markets they rely on, making it a financial "nuclear option" with mutual destruction.

At the World Economic Forum in Davos, Treasury Secretary Scott Bessent publicly downplayed the idea that European governments or institutions would retaliate against U.S. policy by selling off U.S. debt. Further, he said that such actions don’t make sense given the central role that the US Treasury debt plays in global trade and finance. Regarding the market reaction, Bessent advised investors:

Why are we jumping there? Why are you taking it to the worst case?... Calm down the hysteria. Take a deep breath.”

What To Watch Today

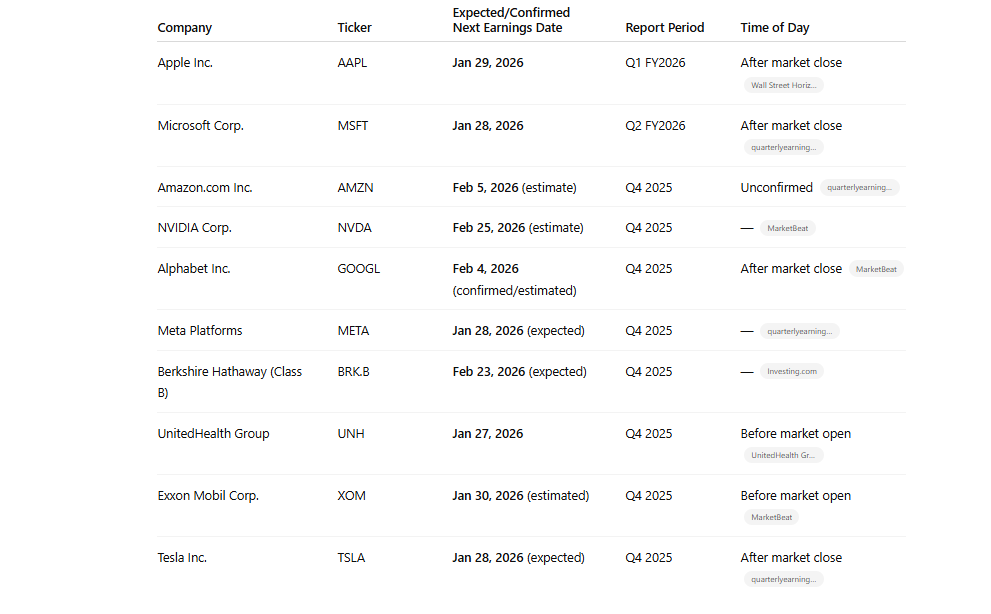

Earnings

Economy

Market Trading Update

Yesterday, we stated that while the market sell-off was not unexpected, investors should not make any rash decisions. In our Before The Bell segment, we discussed the breakdown of the market from its recent consolidation pattern. As shown, the market break took out several supports at the rising trend line, and the 20 and 50-day moving averages. Notably, these types of corrective actions are not uncommon after a long period of complacency. However, it is important that, even when we sometimes "feel" we need to do something, it is often best to wait.

Yesterday, both Scott Bessent and President Trump lowered the temperature around Greenland, and stocks rallied sharply out of the gate, regaining the broken support at the 50-day moving average. We have seen these kinds of reversals in the past as algorithms "hunt" investor "stops." Such is why it is often better to wait for a day or two to allow the market to settle and determine the next best course of action.

Technically, the sell-off on Tuesday reversed the market's overbought conditions but triggered a momentum "sell signal," which may keep stocks under pressure for a few days. The rising trend line from the mid-November lows, and the 20-day moving average are immediate resistance levels for any rally. If the rally fails by Friday and takes out Tuesday's lows, the 100-day moving average and the mid-November lows become the next two primary support levels.

The market should garner some support over the next two weeks from the top-10 names in the index. (Nvidia is the outlier and reports at the end of February.) Furthermore, as the earnings reports are released, both insider buying activity and share buybacks will return.

The point here is that volatility is part of the game. Structurally, the market remains well intact, and while risks have risen, the bullish bias remains for now. Trade accordingly, and continue to manage risk, but look for opportunities to add exposure to quality companies during declines rather than selling them.

Dimon Warns Trump About Credit Card Caps

President Trump recently proposed capping credit card interest rates at 10%. This is part of his broader push to ease the cost of living that is taking a financial toll on consumers and harming sentiment. The proposal would potentially save consumers tens of billions of dollars. While the cap may seem like a great idea, there are significant cons to consider. For example:

- Reduced credit availability: Banks and financial-services companies warn that a hard credit card cap would make it uneconomical to lend to many consumers, especially those with lower credit scores and historically high default rates. Banks' response would be to eliminate or reduce credit lines for a large number of credit card users. Jamie Dimon, CEO of JPMorgan, claims it could deprive as many as 80% of Americans of essential credit access and broadly constrain lending. The Tweet of the Day says Dimon's estimate could be low.

- Tighter credit markets and economic drag: Reduced credit availability would harm small businesses that rely on credit cards to purchase inventory. Furthermore, they would lose customers without credit cards, further impeding their businesses. Lastly, consider the impact on internet shopping, which requires customers to have credit cards.

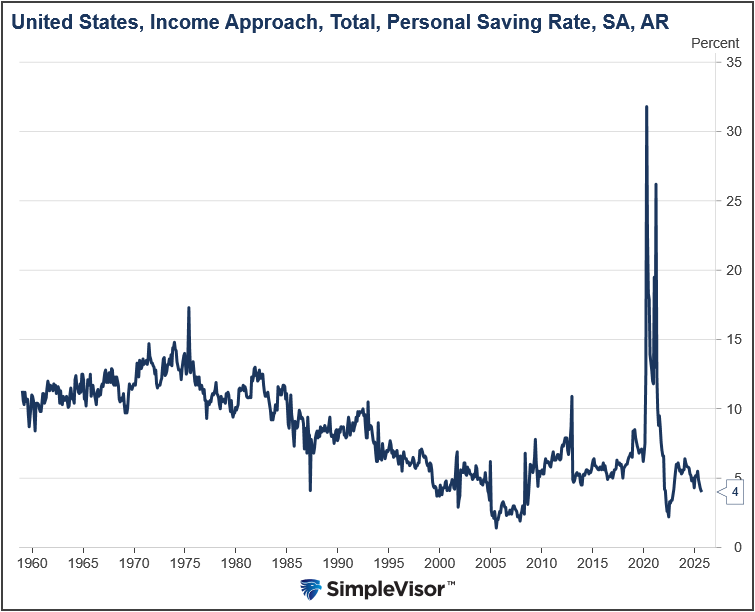

- Shift to riskier alternatives and savings: The action could push consumers toward higher-cost options such as buy now - pay later and payday loans, which carry much higher interest rates. Doing so would worsen debt burdens for the most vulnerable consumers. Moreover, the nation's already low savings rate, shown below, would likely decline further as consumers drain their savings to replace credit.

Our business, you know, we would survive it by the way. In the worst case, you’d have to have a drastic reduction of the credit card business - Jamie Dimon.

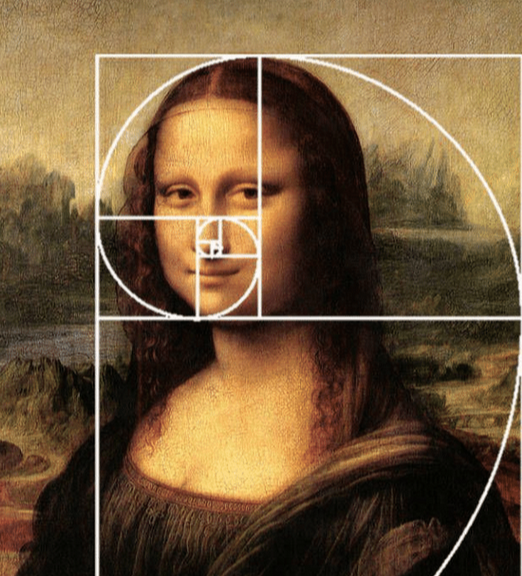

Fibonacci In Mona Lisa And Markets

Did you know there is a kind of technical analysis that shares structural similarities with hurricanes, nautilus shells, sunflowers, music, and human dimensions? These examples, along with countless others, follow proportions related to the sequence of numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89… This endless sequence of numbers that form ratios, known as the Fibonacci sequence, provides a technical analysis tool for managing financial securities. Before thinking we’ve lost our minds and are relying on biology or even worse, mysticism to predict stock prices, let us explain.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Akademiker Pension Serves The US A Warning appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter