Stablecoins are no longer just for a tool for cryptocurrency traders, and are now increasingly being adopted for real-world payments, especially cross-border transactions, according to an analysis by FXC Intelligence, a financial data company specializing in payments and e-commerce.

The report, released in December 2025, explores the rise of stablecoin in payments, highlighting key market trends, the most prominent players, and ongoing developments. It emphasizes growing use of stablecoins for cross-order payments, and surging interest from corporates amid regulatory clarity.

GENIUS Act fuels stablecoin discussions

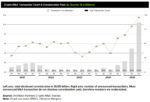

According to the analysis, while interest in stablecoins among cross-border payment companies was significant throughout 2024, it intensified in 2025, coinciding with progress on the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act.

Signed into law on July 18, 2025, the GENIUS Act represents the first major crypto regulation in the US. It aims to regulate the stablecoin market, creating a clearer framework for banks, companies and other entities to issue digital currencies.

Mentions of stablecoins increased notably in Q1 2025 earnings calls as the GENIUS Act advanced through Congress and more companies began exploring partnerships with infrastructure providers. Discussions surged in Q2 2025, following Circle’s blockbuster public listing, with many companies, including Remitly, Payoneer, and Western Union, mentioning stablecoins in earnings calls for the first time in Q2 2025.

Visa, Mastercard and Remitly among top adopters

The FXC Intelligence analysis reveals that, across the past four earnings seasons, Visa and Mastercard have not only been the most vocal but also the most active in deploying stablecoins. Both payment networks had offerings ready before the passing of the GENIUS Act, and continued to announce further solutions afterward, likely a response to concerns that stablecoin-based networks may pose a threat to their business model.

Visa’s products include stablecoin-linked cards and USDC settlement for institutions in April and December 2025, respectively. Mastercard, meanwhile, launched an end-to-end stablecoin acceptance and payment ecosystem and Mastercard-branded cards supporting stablecoins in partnership with MoonPay in April and May, 2025, respectively.

Cross-border payment specialist Remitly has also been particularly active in the stablecoin sphere. Since 2021, it has supported fiat off-ramps for crypto platforms like Novi, a Meta Platforms company, and Coinbase.

In September 2025, Remitly launched Remitly One, a suite of product including Remitly Wallet, a multi-currency store of value for both fiat currencies and stablecoins; Remitly Flex, a “send now, pay later” financing solution; the Remitly Card; and Cash Back Rewards. In the same month, the company added stablecoin rails to its global disbursement network through a new partnership with Bridge, a Stripe company, enabling customers to receive stablecoins into a wallet of their choice, routed from its established fiat infrastructure.

Investment gains momentum

Growing interest in stablecoins is fueling investment. Over the past year, over a US$1 billion has been invested in companies related to stablecoin-based cross-border payments, with some of the biggest payouts going toward established players.

Crypto firm Ripple secured US$500 million in November at a US$40 billion valuation as the firm expands its suite of products. Ripple provides blockchain-based payment infrastructure for banks, payment providers, and businesses to move money across borders.

In October, Tempo, a payments-focused blockchain developed by fintech giant Stripe and blockchain venture firm Paradigm, raised US$500 million in a Series A at a US$5 billion valuation. Tempo is a blockchain platform designed for stablecoin-based payments and real-world financial flows.

According to FXC Intelligence, at least 19 stablecoin payment players raised rounds of more than US$10 million in 2025, totaling over US$1.5 billion in cumulative capital.

Cross-border payments as top stablecoin use case

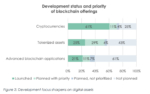

Among major payment companies who have already announced stablecoin products, solutions or offerings, cross-border payments have been a major area of focus. In this model, a payment begins in traditional currency, is converted into a stablecoin for transfer, and is then converted back into traditional currency at the destination. Early adopters include Corpay and Clear Junction.

Another growing use case is internal treasury operations, where companies use stablecoins to move money between their own accounts or entities. This application overlaps with cross-border payments but is easier to implement at scale and delivers quicker operational benefits, such as faster settlement and lower costs. Adopters include MoneyGram, and dLocal.

Stablecoin payouts, where merchants, contractors, or other recipients receive stablecoins into their own digital wallets, are also see growing adoption, with cross-border payment specialists Rapyd and Thunes offering this capability.

A few players have also announced their own stablecoin, including PayPal with PYUSD, Klarna with KlarnaUSD, and Western Union’s planned US Dollar Payment Token (USDPT).

Historically, stablecoins were used by crypto traders to quickly move in and out of volatile cryptocurrencies, and store value without converting to fiat. Today, they have entered the mainstream, attracting traditional finance for their potential to offer a fast and low-cost alternative for transferring money globally.

Regulatory clarity has further accelerated stablecoin adoption. In addition to the US, the European Union (EU), Singapore, and the United Arab Emirates (UAE) have established clear frameworks for fiat-backed digital money, allowing enterprise integration to pick up pace.

The UK is currently working on on its own regulatory framework, with final rules and detailed requirements expected to come into force in 2026 or later after consultations. The UK Financial Conduct Authority has identitied stablecoin payments as a priority for 2026.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik

The post Top Stablecoin Trends to Watch in 2026 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: cryptocurrency,Featured,newsletter,payments