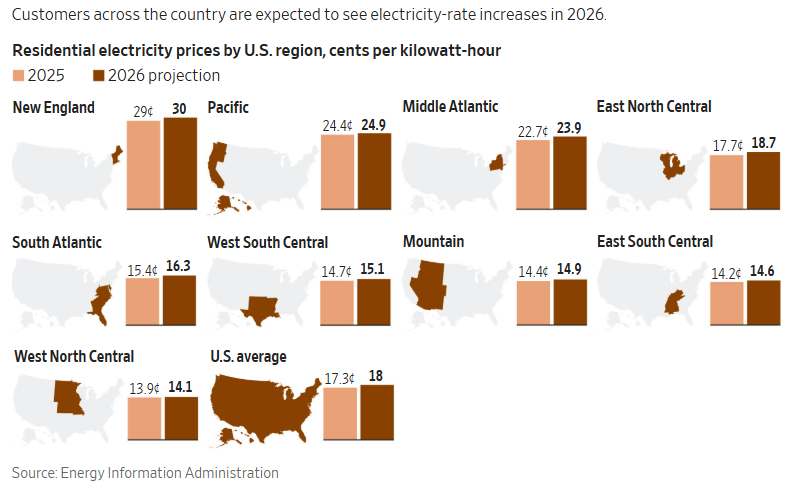

Most Americans are paying higher electricity prices, and the pressure is unlikely to ease anytime soon. According to the Wall Street Journal, electricity prices have risen meaningfully across much of the country since 2022, and the drivers extend well beyond the frequently cited surge in data-center demand.

While electricity prices had historically tracked inflation, that relationship broke down after Russia’s invasion of Ukraine sent natural gas prices sharply higher. Since then, utilities have faced rising fuel costs, storm damage from hurricanes and wildfires, and the need to replace aging grid infrastructure. State-level renewable energy mandates have also driven up costs in regions where wind and solar resources are less efficient, particularly in the Northeast and Mid-Atlantic.

Looking ahead, the pressure is set to intensify. The Energy Department expects average residential electricity prices to rise another 4% in 2026, following a nearly 5% increase this year. Investor-owned utilities are projected to spend roughly $1.1 trillion between 2025 and 2029 on transmission, distribution, and generation. That’s double what they spent in the prior decade, and those costs are typically passed through to customers over time.

For consumers, electricity is already the second-largest energy expense after gasoline. For investors, persistently rising power costs risk becoming a more durable source of inflation than policymakers anticipate. Even if headline inflation cools, higher utility bills could continue to pressure household budgets, complicate the Fed’s disinflation narrative, and weigh on consumer-driven growth.

What To Watch Today

Earnings

- No earnings releases today.

Economy

Market Trading Update

Yesterday, we covered the technical backdrop of the market as we wrap up the year. On Monday, precious metals slid, and according to Zerohedge, there was no apparent reason. However, therein lies the risk of speculative assets, particularly when they are in a frantic meltup. As is always the case, prices are driven by the balance of supply and demand between buyers and sellers. As prices rise, buyers must offer a high bid to entice sellers to enter the market. However, as that price escalates, the number of buyers thins to the point where willing sellers outweigh the number of willing buyers. When that occurs, prices will slump quickly, as we saw on Monday.

Very quickly, I saw several posts saying yes, Silver prices are down 8% today, but they were up 10% on Monday, so you are still "winning." However, such claims demonstrate a lack of understanding of mathematics. Notably, a 10% increase and a 10% decrease are two VERY different things. For example:

The price of commodity A rises from 1000 to 1100. That is indeed a 10% increase. However, a decline of 10% brings the cost of commodity A to just $990. In other words, losses are significantly worse in reality. That is also why a 50% decline entirely erases a 100% increase in the price of an asset. The chart below is a monthly chart of Silver, and shows various retracement levels.

First, let me state that I am NOT MAKING ANY PREDICTIONS.

However, the chart shows previous retracements where the price of Silver as 3-4 standard deviations above its 4-year moving average. You will note that all previous retracements have historically ranged from 40% to 90%. If we assume a retracement to the 4-year moving average, that would entail a 65% decline from current levels, with Silver still being in a strong bullish uptrend. While such a decline would likely present a good buying opportunity, there will most likely be a "panic to sell" during such a fall. That panic to sell positions would then push Silver to the following logical support levels, which range from a 77% to a near 90% decline.

Again, I am not making any predictions or suggestions that such will happen. Perhaps this time is different, and Silver could reach 5, 6, or 7 standard deviations above its long-term mean. That is a possibility, as manias can last longer and extend further than logic would suggest. However, the eventual mean reversion will come, and as the old saying goes, the "bigger they are, the harder they fall."

As such, there are only two things that I want you to take away from today's commentary.

- Don't forget the basics of math.

- Don't forget to manage your risk.

Do those two things, and you can survive and profit from whatever happens.

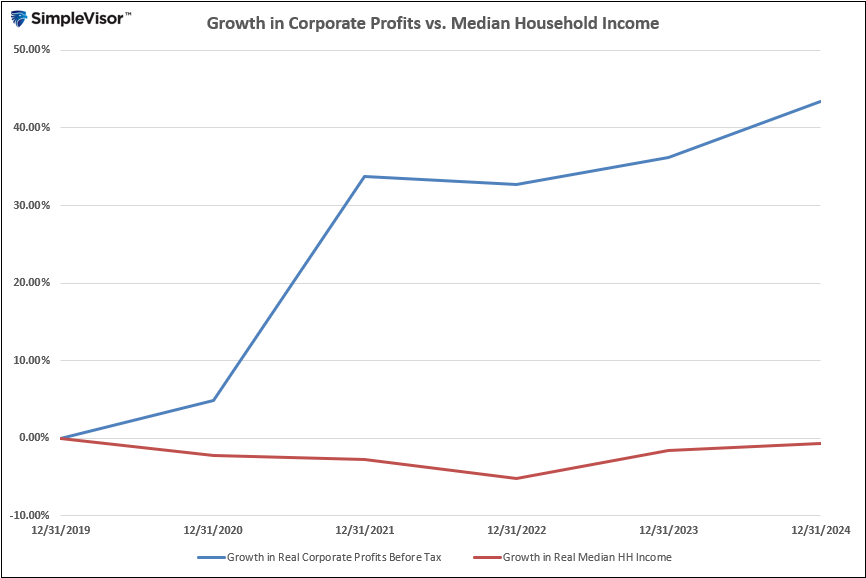

The Disconnect Behind Weak Consumer Sentiment

Yesterday’s market commentary addressed the “consumption conundrum”. The phenomenon where GDP growth and consumer spending were larger than expected last quarter, while consumer sentiment remains at historically low levels. We examined the reasons underlying continued consumption despite the prevailing consumer sentiment. Today, we look from another perspective. Why is consumer sentiment so poor in the face of an economy that’s humming along? Many people are quick to point out the prevalence of political polarization and geopolitical tensions in today's world. Those are valid drivers of sentiment, but we’ll look past them to focus on the trend in median household income and corporate profits since 2019.

As shown below, real (inflation-adjusted) growth in corporate profits has far outpaced the growth of the median household income in the US since 2019. In fact, real corporate profits have increased by 43.4% (or 7.47% annually). Meanwhile, the real median household income has remained essentially flat over that period. In other words, the average American family is no better off despite solid economic growth and a tight labor market for many years. However, corporations are in a much better position than they were in 2019. If consumers are catching on to the trend depicted below, that surely could dampen sentiment.

The Market Risk in 2026 If Growth Projections Fail

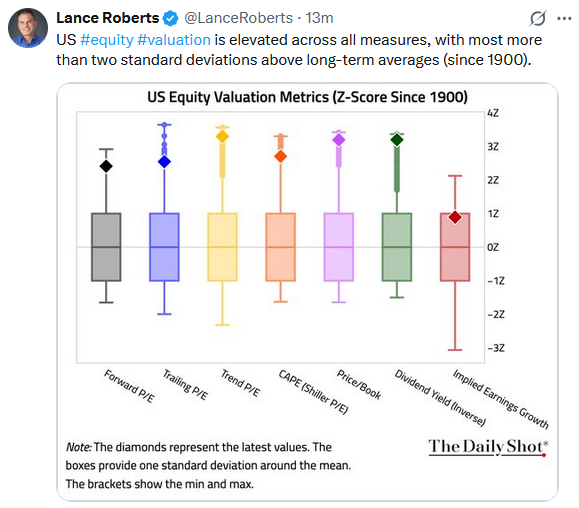

There is nothing wrong with having an optimistic outlook when it comes to investing; however, “outlooks can change rapidly,” which is a significant market risk, particularly when expectations and valuations are elevated.

Notably, these forecasts rest on an assumption that the economy will not only avoid recession but reaccelerate in the face of waning inflation. As noted, equity markets have responded by pushing valuations higher across major indexes, with price-to-earnings ratios well above historical medians. Simultaneously, investors have rewarded narratives built on the idea of a soft landing and a return to pre-pandemic trends.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Electricity Prices Could Become a Structural Inflation Problem appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter