The global cryptocurrency market saw some volatility in the first half of 2025, marked by major hacks but also an increase in bitcoin millionaires and wider adoption of bitcoin ATMs, according to a new report by Finbold, a finance and crypto news and data platform.

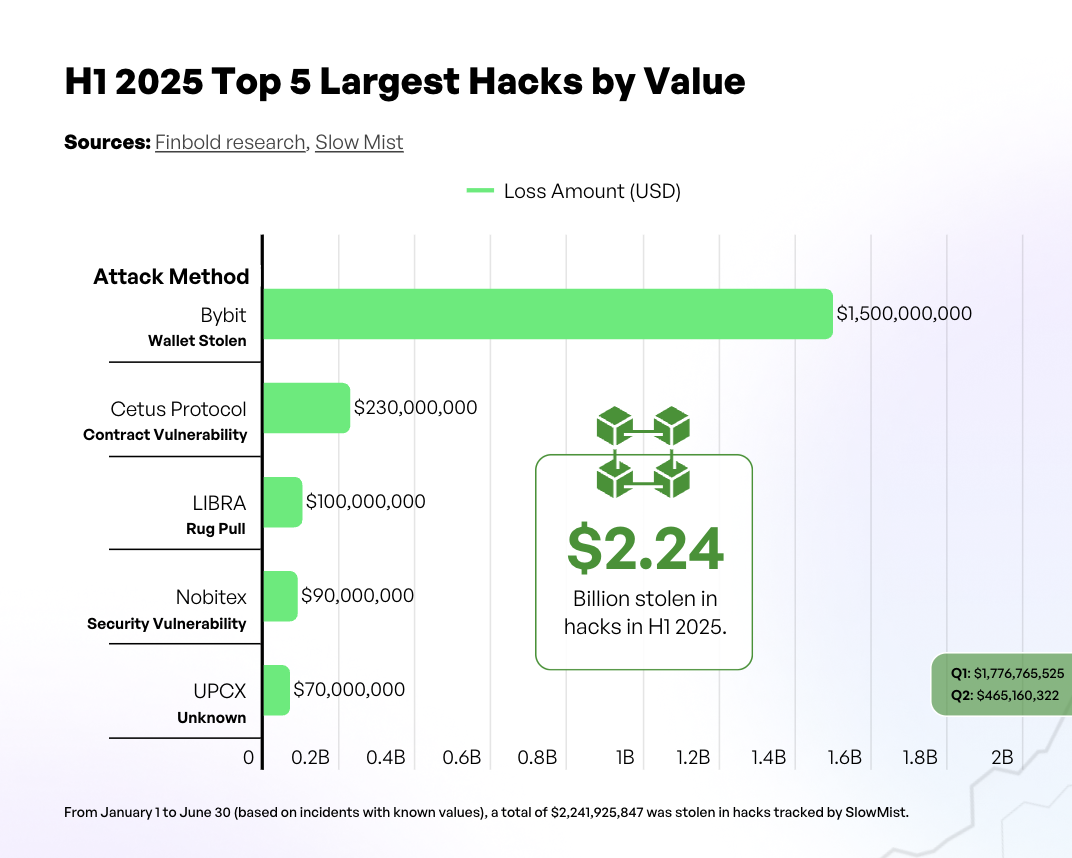

A total of US$2.24 billion was stolen in crypto hacks in H1 2025, driven by major incidents at Bybit, Cetus Protocol, and Libra:

- Crypto exchange Bybit lost US$1.5 billion to North Korean hackers. The funds were taken from a “cold wallet” stored offline used for ether tokens. The FBI links this attack to North Korea’s “TraderTraitor” cyber operations.

- Decentralized exchange (DEX) Cetus Protocol lost about US$230 million due to a contract vulnerability. The Cetus Protocol, which operates on the Sui and Aptos blockchains, is offering a US$5 million bounty to anyone providing relevant information leading to the identification and arrest of the attacker.

- Libra, a meme coin, became one of the biggest rug pulls in crypto history. In February, Argentine President Javier Milei promoted the little-known token on X, claiming it would boost Argentina’s economy by funding small businesses. Within minutes, Libra surged from essentially US$0 to around US$5, reaching a US$4.5 billion market cap. Three hours later, insiders withdrew about US$100 million, draining liquidity and triggering a collapse of over 90% of the cryptocurrency.

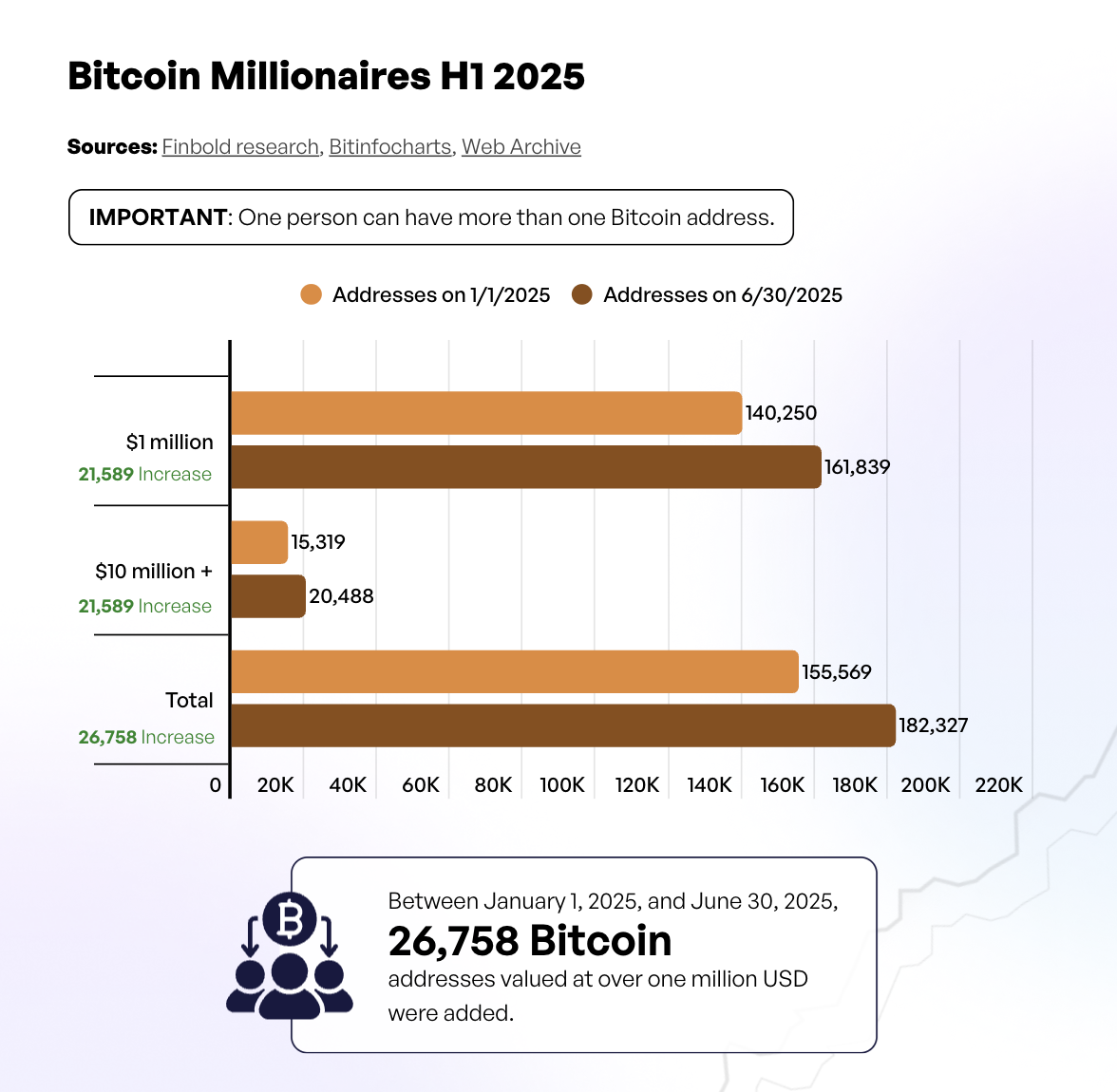

Bitcoin millionaires hit new high

Despite these setbacks, the sector also saw positive trends. Bitcoin’s price rose from US$93,693 at the start of the year to over US$107,000, marking a 14% increase. On-chain wealth concentration also grew, with the number of millionaire-status bitcoin addresses rising by 26,758 to 182,327, representing a 17.2% jump.

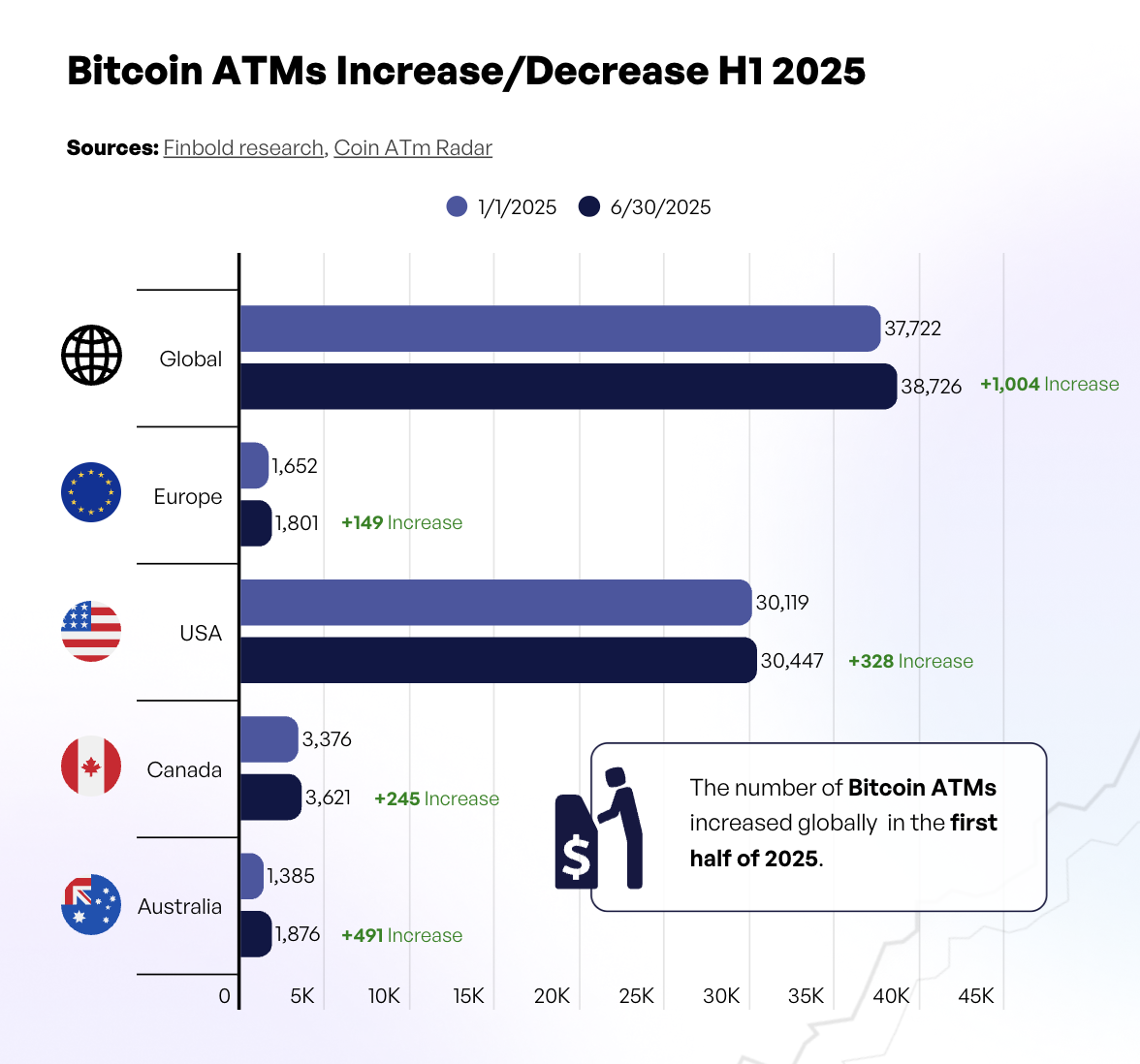

Bitcoin ATM network expands

Another positive development in H1 2025 was the growing number of bitcoin ATMs, which increased from nearly 3% from 37,722 at the beginning of the year to 38,726 by the end of the period. The US remained the world leader in the number of bitcoin ATMs deployed with 30,447 devices, followed by Canada with 3,621, and Australia with 1,876. Europe lagged with 1,801 ATMs in H1 2025.

The rise of DeFi

In H1 2025, decentralized finance (DeFi) continued to gain ground. According to an analysis by Swiss bank AMINA Bank, the DeFi sector has been on a strong run over the past three months, with Aave’s AAVE token recording an impressive 74%, while Uniswap’s UNI climbed 38%. The total market capitalization of leading DeFi tokens has swelled to US$11.41 billion, marking a 25.4% increase in just 90 days.

This surge has been fueled by regulatory clarity starting to take shape in the US and renewed investor confidence. A June 2025 SEC roundtable by the US Securities and Exchange Commission (SEC) hinted at possible regulatory exemptions for DeFi projects, sparking cautious optimism.

Meme drives crypto adoption

Memecoins are another emerging trend in the cryptocurrency sphere. These cryptocurrencies, which are based on Internet memes and viral culture, are helping drive wider adoption of cryptocurrencies by attracting new investors into the market.

According to a H1 2025 survey commissioned by Gemini, many people’s first experience with crypto is through memecoins like Dogecoin, Shiba Inu, or Pepe. After buying memecoins, these investors usually expand into more established cryptocurrencies like bitcoin or ether.

For example, in the US, about 31% of people who own both memecoins and mainstream cryptocurrencies say they bought the memecoins first. Similar patterns are seen in Australia (28%), the UK (28%), Singapore (23%), Italy (22%), and France (19%).

Europe drives crypto ownership growth

The Gemini report also found Europe leading crypto ownership growth in H1 2025. In the UK, crypto ownership rose 6 points year-over-year (YoY), reaching 25% in 2025. France also recorded a significant gain of 3 points YoY, climbing to 21%.

Growth was more modest in Singapore and the US, with increases of 2 and 1 points, respectively.

Traditional finance and crypto converge

Another major trend this year is the growing overlap between crypto and traditional finance. On June 05, Circle, a stablecoin issuer, debuted on the New York Stock Exchange (NYSE). The company raised almost US$1.1 billion at US$31 per share, with the stock soaring 168% on day one. The surge was a clear sign of institutional appetite for compliant, crypto-native infrastructure.

Just days earlier, on June 02, online brokerage platform Robinhood completed its US$200 million acquisition of Bitstamp, gaining access to over 50 regulatory licenses and positioning itself to serve both retail and institutional crypto clients globally.

Finally, on June 11, American payment service provider Stripe deepened its crypto presence by acquiring Privy, a Web3 wallet infrastructure provider. The move aims to strengthen Stripe’s ability to offer seamless blockchain integration across mainstream applications.

Featured image: Edited by Fintech News Switzerland, based on image by thanyakij-12 via Freepik

The post Despite Major Thefts, Crypto Adoption and Wealth Hit New Highs appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Cryptocurrencies,Featured,newsletter