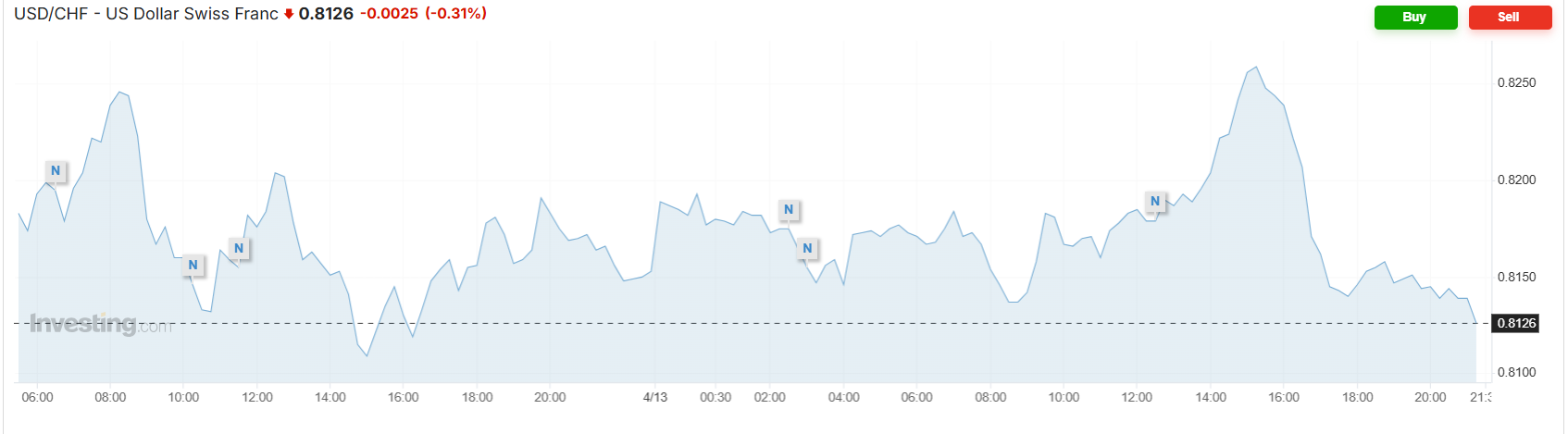

On Monday, April 14, 2025, during the European afternoon, the U.S. dollar experienced a notable decline against the Swiss franc, reversing earlier gains. This shift was primarily influenced by escalating trade tensions between the United States and China.

Specifically, the U.S. administration announced the immediate implementation of tariffs on a range of Chinese imports, including electronics and semiconductors. This abrupt policy shift heightened investor concerns about potential retaliatory measures from China and the broader implications for global trade. As a result, market participants sought refuge in safe-haven assets, notably the Swiss franc, which is traditionally viewed as a stable currency during periods of geopolitical uncertainty.

The Swiss franc’s appeal was further bolstered by Switzerland’s political neutrality and robust fiscal health, making it an attractive alternative to the U.S. dollar amid the prevailing market volatility (see .Invezz)

In summary, the dollar’s afternoon decline against the Swiss franc was driven by renewed U.S.-China trade tensions, prompting a shift in investor sentiment towards safer assets (see .FXStreet).

Background:

Several factors contributed to this downturn:

-

Tariff Policy Uncertainty: Recent inconsistent announcements regarding U.S. tariffs, particularly on electronics and semiconductors, have created confusion among investors. The administration’s abrupt imposition and subsequent postponement of tariffs have undermined confidence in the dollar .Reuters

-

Shift Towards Safe-Haven Assets: The Swiss franc, traditionally viewed as a safe-haven currency, has gained appeal amid global economic uncertainties. Switzerland’s political neutrality and strong fiscal position make it an attractive alternative to the U.S. dollar during times of market volatility .Invezz

-

Concerns Over U.S. Fiscal Health: The U.S. faces a substantial public debt burden, with projections indicating continued growth. This fiscal outlook has prompted investors to reassess the dollar’s status as the world’s primary reserve currency, leading to a trend of “de-dollarization” .Reuters

-

Technical Market Factors: From a technical analysis perspective, the USD/CHF pair has broken below key support levels, indicating a strong bearish trend. This has led to increased selling pressure, further driving down the dollar’s value against the Swiss franc .

In summary, a combination of policy uncertainty, a shift towards safer assets, fiscal concerns, and technical market dynamics have contributed to the dollar’s decline against the Swiss franc.

Are you the author? Previous post See more for

Tags: