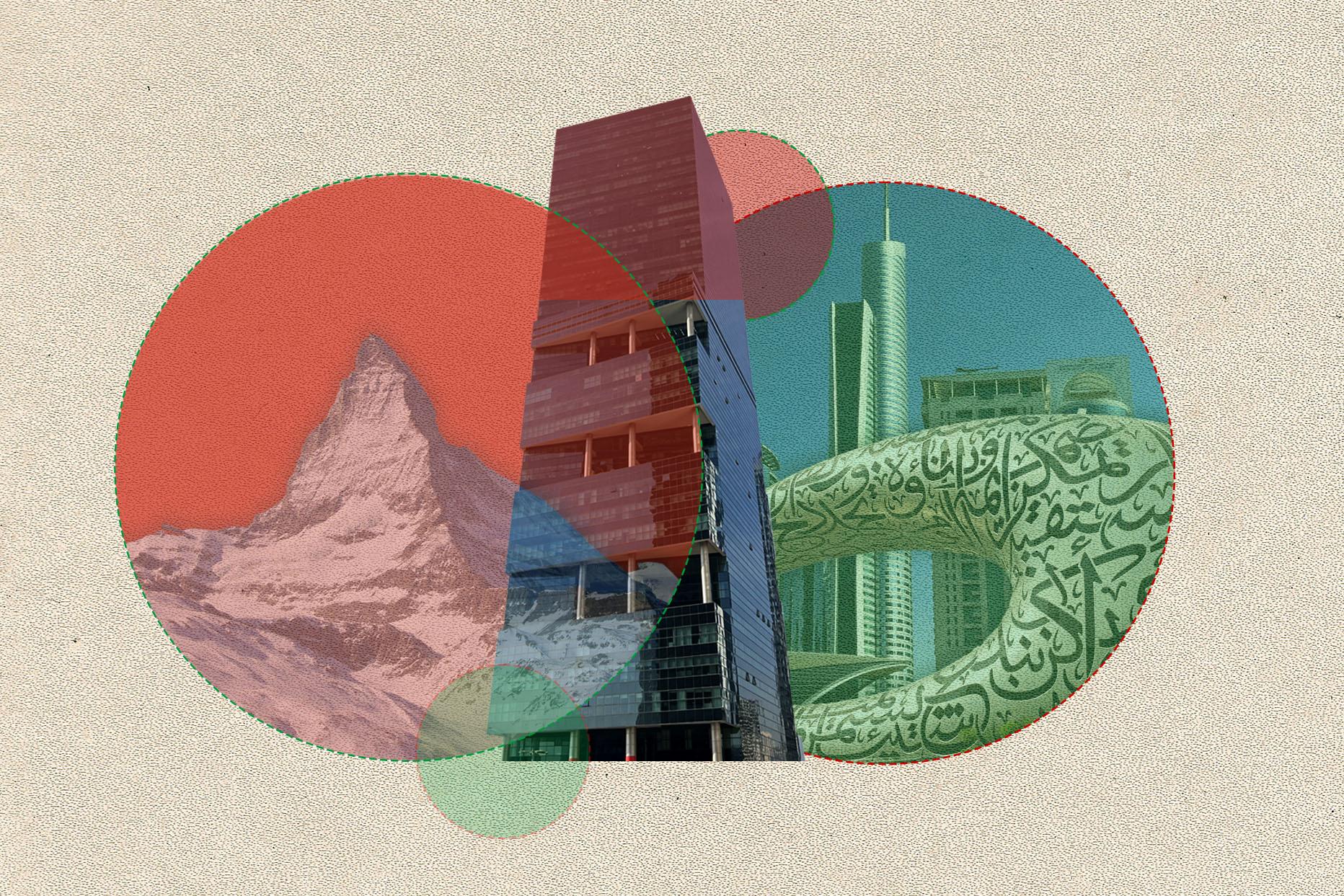

Dubai has positioned itself as a key commodities hub. But that’s not necessarily at the expense of Switzerland.

The Matterhorn-inspired Swiss Tower is nestled among the many imposing skyscrapers in part of Dubai’s vast central business district. It is one tile in the evolving mosaic of business connections between Switzerland and the Middle East.

Inaugurated in 2013, the 40-floor building was one of the early arrivals in the tax-free Dubai Multi Commodities Centre, which quickly became a jungle of shimmering skyscrapers. The Swiss Tower houses various businesses benefiting from the district’s one-stop-shop character for commodities trading and related services.

Under surveillance cameras, the electronic directory in the building’s lobby reveals a mix of energy traders, drilling and shipping companies, consultants and beauty salons. The Swiss Group Advisory DMCC, a corporate services provider, has offices on the 15th floor. Its managing director, Roberto Delorenzi, says in an email exchange that the United Arab Emirates (UAE) is “the place to be”.

Delorenzi explains that the Gulf nation became a key commodity trading hub over the past decade by capitalising on its potential as a transit link between East and West, offering easy access to the Far East, Europe, and Africa. “Two billion people live within a flight range of four to five hours; this figure alone highlights the potential of this market,” he notes.

“Investors in the UAE or the region, or even from India, are also an important source of finance for trading companies,” points out Giacomo Luciani, professor at the University of Geneva.

The UAE’s rise as a global commodities hub makes it a potential rival to Switzerland, which is home to global energy trading heavyweights Glencore, Gunvor, Trafigura, Vitol and Mercuria – with combined net profits of more than $50 billion (CHF44 billion) in the past two years, according to Bloomberg.

But so far, trade dynamics appear to work out to the favour of both. Bilateral trade topped $22.3 billion in 2023, an increase of 41.2% over 2022. The Swiss foreign ministry points to this growth as evidence of the “synergy between our economies”. In the Middle East region, Saudi Arabia comes second with $6.8 billion in bilateral trade in 2023.

According to DMCC chief executive Ahmed Bin Sulayem, between 2021 and 2023, there was a 30% rise in Swiss businesses settling in Dubai, bringing the total to more than 400. It is unclear whether this trend continued or stabilised in 2024, as the DMCC did not provide updated figures.

This comes on the back of a commodity trade boom that saw increased trade regionalisation and supply chain restructuring amid rising geopolitical tensions. Some Russian oil buyers pivoted to the UAE after Western countries enforced sanctions on Russian oil.

Early start

Since the introduction of a Double Tax Treaty in 2012, updated in 2022, Switzerland has become one of the top investors in Dubai, contributing the equivalent of 4% of foreign direct investment in the nation, notes Delorenzi. The 2014 Free Trade Agreement between the European Free Trade Association (EFTA) and the Gulf Cooperation Council further solidified these economic connections between Switzerland and the United Arab Emirates.

Out of the seven emirates that make up the UAE, Dubai draws in the most foreign business, according to Delorenzi. It offers three major free zones: DIFC, Jafza and the DMCC. The latter is the largest with 25,000 registered companies and is testament to the government’s effort to position Dubai, with its state-of-the art ports and warehouses, as a major commodity trading hub.

The three zones allow complete foreign ownership with 0% tax. Dubai also has two major commodity exchanges: the Dubai Gold and Commodities Exchange, and the Dubai Mercantile Exchange. The emirate of Abu Dhabi, just over an hour’s drive from Dubai’s trading centre, draws firms from the global financial sector, including from Switzerland. Sharjah in the east is popular with start-ups.

Large multinationals have opened a branch or subsidiary in the UAE, Delorenzi says, while entrepreneurs looking to expand and grow their business have relocated their entire business operations and families for a total life change. Delorenzi, a Swiss himself, moved to Dubai in 2009.

“The ease of doing business and variety of opportunities meant that setting foot in the country is not only afforded by multinationals with deep pockets, but family businesses and entrepreneurs alike,” he says.

The Swiss Business Council (SBC), which hosts regular networking and social events for its 405 members, is also located in the Swiss Tower. “There are quite a few Swiss people coming here,” an SBC employee told SWI swissinfo.ch. “Some are interested in setting up a business here but don’t know how to start and are testing the waters to try to get more contacts.”

A further draw for individuals and companies is the UAE’s competitive tax framework. There is no income tax on individuals, and the Corporate Tax Law that came into force in June 2023 levies a single rate of 9% on income exceeding AED375,000 (CHF90,000). In comparison, the average corporate tax rate in Switzerland is around 14.6%, with commodity trading hubs canton Zug and canton Geneva offering lower rates of 11.6% and 14%, respectively.

Fabio Belloni, managing director of International Business Advisors, acknowledges that low taxes put the UAE on the map as an attractive business location. But that is not the only factor. Bureaucratic processes are easier than in Switzerland, he says, and many services are fully digitised, including the application process to open a business.

“It’s a safe country for families. They have a good infrastructure and quality of life is very high,” says Belloni about the high surveillance and segregation in the police state by the sea. Civil society organisations, including Human Rights WatchExternal link, have criticised labour abuses for migrant workers, who represent nearly 90% of the population.

The Russian oil pivot

Dubai as a trading centre got an extra boost when Western countries-imposed sanctions on Russia – a major commodities producer – after Moscow launched a full-scale war on Ukraine in 2022. Many Russians relocated to the UAE to do business at a time when they felt less welcome in many parts of the world.

Until 2022, Geneva was the nerve centre for trading crude oil from Russia, the world’s third-largest producer. Following Russia’s invasion of Ukraine, Europe imposed an embargo on seaborne crude oil and a $60-per-barrel price cap was set. The goal was to reduce Russian oil revenues without completely disrupting the global market.

With the new restrictions in place, many Swiss traders looked to Dubai as an alternative. Litasco, the international trading company of Russia’s Lukoil, had inaugurated headquarters with 300 desks in Geneva in 2020 before reportedlyExternal link shifting some of its trade operations to Dubai to avoid sanctions. Russian oil trading firms Gazprom and Rosneft did the same.

Public Eye, a Swiss NGO, reportedExternal link that Dubai replaced Geneva as the primary trading hub for Russian crude after February 2022 and flagged that new players in the opaque market included subsidiaries of Swiss companies. “Dubai chose not to impose sanctions or align with the price cap. That’s made it a critical hub for Russian crude trading,” it said.

The shift in Russian trading activity to Dubai sparked controversy. In the DMCC, some 20,000 companies were created in the first two years following Russia’s war on Ukraine, notes Florence Schurch, general secretary of Suissenégoce, the Swiss association of commodities traders. By comparison, the commodities trading sector in Switzerland, which contributes to about 3.8% of Swiss GDP, comprises 900 trading companies.

Unnecessary risks

Schurch says that although that boom was certainly not driven by Swiss citizens or businesses, it “raises significant ethical and reputational risks, not just for Dubai but also for Switzerland”.

Some traders created separate legal entities to distance themselves from their Swiss operations. “They’re agile,” says a former Geneva trader. “They set up a company, complete a few trades, and then dissolve it. It’s a risk-reward calculation. If you can make $20 million on a few trades, spending a million on setting up a temporary structure is nothing.”

Switzerland came under pressure from the European Union when it failed to sanction Geneva-based Paramount Energy and Commodities for transferring its trading of Russian oil – at rates above the price cap – to Dubai. In late 2024, Switzerland instead rejected a round of EU sanctions that would have required Swiss-based traders to make their “best efforts” to ensure that subsidiaries in third countries do not skirt sanctions.

The Swiss oil majors say they are doing everything by the book and that they are committed to Switzerland. Geneva-based trading performed in Dubai by Gunvor, whose co-founder Gennady Timchenko was among those hit by US sanctions in 2014 after Russia first hit Ukraine, mostly comprises non-Russian oil and gas, according to a spokesperson. Timchenko sold his majority stake in the company one day before the punitive actions took effect.

‘By the book’

Trafigura’s spokesperson says the company terminated its long-term offtake contracts for crude oil and petroleum products with state-owned Russian producers in advance of European sanctions coming into effect in May 2022.

Litasco did not respond to a request for comment, but its corporate communications suggest it has reorganised and rebranded to focus more on Europe since sanctions took effect.

In February 2024, the UAE was removed from the Financial Action Task Force (FATF) grey list, on which it landed in 2022 due to “strategic deficiencies” in its money-laundering oversight. “It’s not like anyone can move a company into Dubai to do business with Russia, bypassing sanctions,” says Belloni, rejecting the idea that legal requirements in the Gulf state were less than robust.

Two-way street

Geneva is still a key centre for oil trading and trade finance. Experts credit Switzerland’s longstanding political neutrality and expertise in handling complex international transactions for this. These assets appear to be recognised by UAE businesses that are becoming increasingly global and opening branches in Switzerland, the US and UK.

Since 2022, a few UAE companies have set up in the Swiss commodity trading hub of Geneva, according to the cantonal registry. Oilmar DMCC, an oil trading and chartering company, was registered shortly after Russia invaded Ukraine. Other newcomers in 2023 include Tamal Trading and Logistics and Mahsul Trading & Services.

“Geneva has always been perceived as an international and open city which offers financial and communication services for traders,” says Luciani of the University of Geneva. “There are alternatives, London for instance, but Geneva remains a central commodities centre in Europe. Trading companies have posted record profits.”

Trafigura and Gunvor, each with offices in Dubai, say their presence in the UAE reflects a global economy in which the Middle East plays a prominent role. Trafigura, which has over 12,000 employees globally, notes it has only 35 employees in the Dubai without specifying their roles. Gunvor’s staff of 15 in Dubai is small relative to over 280 in Switzerland.

“The reason why Gunvor came to Geneva in the first place, back in 2003, was talent and access to financing,” says Seth Pietras, Gunvor Group’s spokesperson, justifying its ongoing headquarters in a lower-rise lakeside cityscape. “People want to live here. They want to be educated here. Although trade finance has gone global, its heritage remains here.”

Virginie Mangin contributed reporting.

Edited by Virginie Mangin/ts

Picture research by Helen James and graphics by Pauline Turuban

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter