Within the headline retail sales figure is a lesser-followed data point called the retail sales control group. Following the trend of both figures is important because although the headline figure receives more attention, the control group is the measure that feeds into the GDP calculation. While retail sales increased by only 0.2% MoM on Monday, the retail sales control group increased by 1% MoM. Furthermore, headline retail sales have declined by 0.5% over the first two months of 2025, while the control group is flat at 0%. We outline the difference between the two measures below.

Headline retail sales include all retail categories, such as motor vehicle and parts dealers, gasoline stations, food and beverage stores, clothing, electronics, and more. The headline figure provides a comprehensive snapshot of consumer spending across the economy. However, it can be heavily influenced by volatile components like auto sales, gasoline prices, or big-ticket purchases. Thus, the retail sales control group better measures consumer consumption trends.

The retail sales control group is a narrower subset of retail sales that provides a picture of core consumer demand. It excludes the most volatile components from the headline number including:

- Building materials and garden equipment (tied to construction activity rather than everyday spending).

- Motor vehicle and parts dealers (affected by large, infrequent purchases).

- Gas stations (more sensitive to price swings than consumption volume).

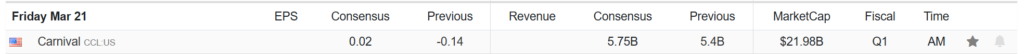

What To Watch Today

Earnings

Economy

Market Trading Update

In yesterday's note, we discussed the dollar's impact on international and emerging market investments and why investors should consider taking some profits. Today, the next opportunity may be a rotation back into U.S. stocks, particularly following the Federal Reserve's more "dovish" stance. The reduction in Quantitative Tightening and additional rate cuts is a reversal toward monetary accommodation. That reversal, while minor, was a tailwind for stocks on Wednesday and Thursday, but even more notable was the rally in the bond market as the Fed returned to being a potential buyer. That support gave buyers a reason to return to the market.

As noted previously, the market has been on a vital momentum "sell signal" since late February. Since then, the decline has worked off the previous overbought conditions, and now we are closing in on a reversal of that "risk off" period. As shown, the market's momentum is improving and close to triggering a "buy signal," with relative strength improving as well. Furthermore, the market completed a very normal 23.6% retracements of the rally from last year's lows. The market needs to conquer resistance at the 200-DMA, but with recent improvement, a break above that resistance should trigger a round of "short-covering," pushing asset prices higher. If that occurs, retail and professional investors will likely start chasing the rally, providing further support for the rally back to the 50-DMA. Given current market dynamics, we suggest using any such rally to reduce risk and rebalance portfolios.

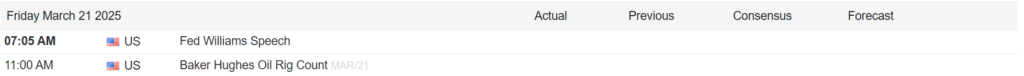

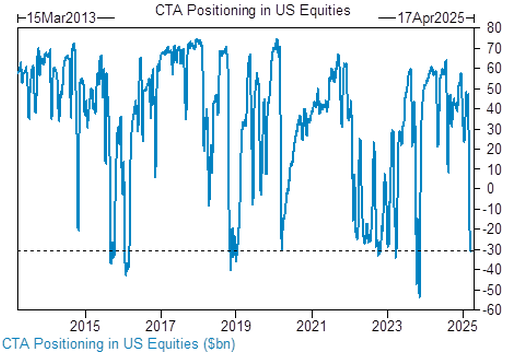

Goldman Analysis: US Equity Risk is to the Upside

Goldman Sachs trader Brian Garrett estimates that equity risk over the next month is significantly skewed to the upside. His outlook stems from systematic CTA positioning in US equities following the de-risking over the past few weeks. The first chart below shows that CTA positioning flipped rapidly from ~$50 billion net long to $30 billion net short. Given current positioning, the Goldman models predict a limited downside in US equities over the next month.

Garrett estimates systematic CTAs need to sell just $3 billion of SPX in a down market. In comparison, CTAs would need to buy $45 billion given a two-sigma rally over the period. He noted that this is the largest one-month forward demand seen since 2023 and the third-largest since COVID. If the market gets a bid following today’s options expiration, look out for a reflexive rally that can be used to reduce portfolio risk.

The Role of Dividend Investing in Generating Passive Income for Retirement

Building a secure retirement requires a reliable stream of income that can support your lifestyle without depleting your savings too quickly. A dividend investing strategy offers a way to generate passive income in retirement, providing consistent cash flow while preserving capital.

In this article, we’ll explore how dividend-paying stocks can help retirees create sustainable income, how to build a diversified dividend portfolio, and strategies for reinvesting dividends for long-term growth.

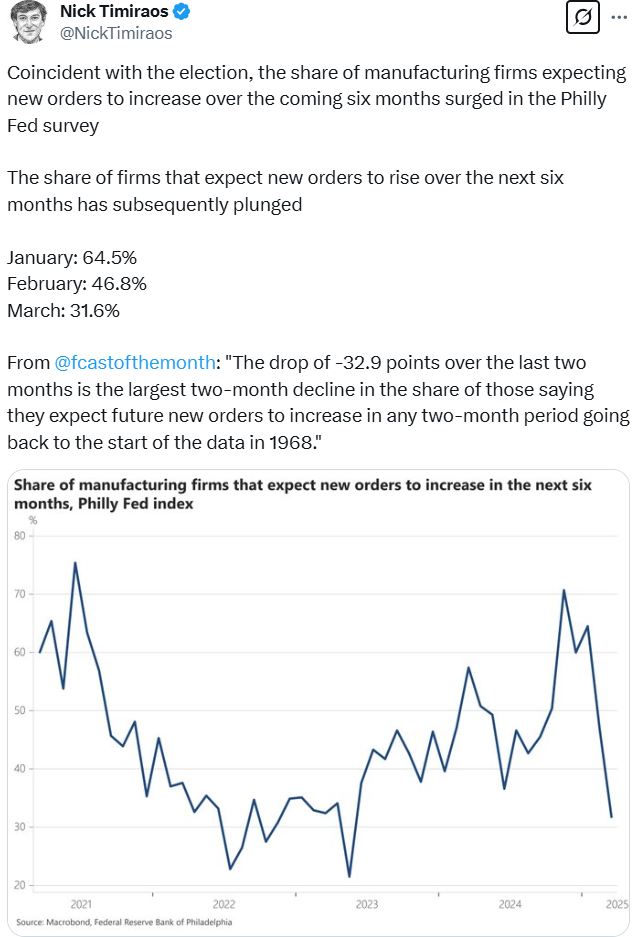

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Retail Sales Are Better Than Advertised appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter