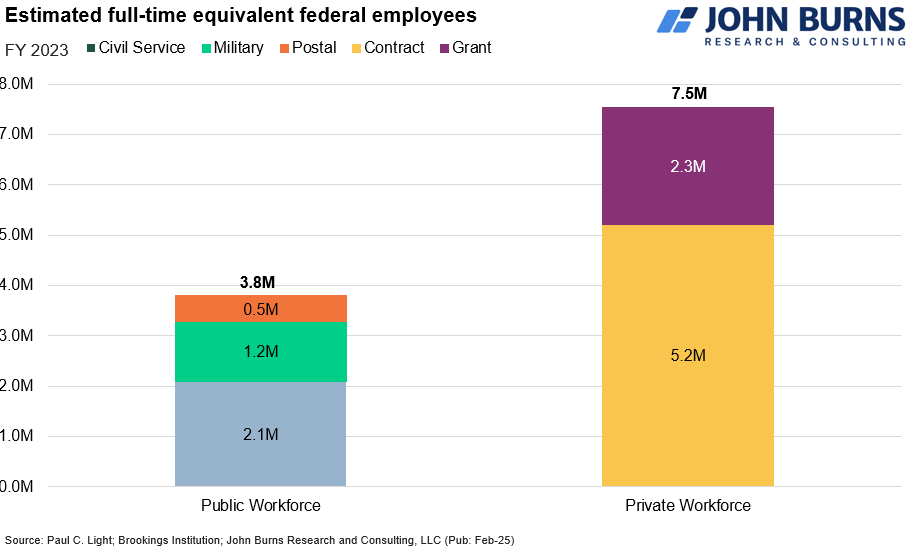

The coming unprecedented government job cuts will undoubtedly impact the job market. Given the labor market's importance to Fed policy and the economy, it's worth fully appreciating the size of the government workforce and other employees whose jobs might be affected. The following graph, courtesy of John Burns Research & Consulting, shows that 3.8 million employees work directly for the government. Moreover, almost twice as many employees indirectly receive some or all of their wages from the government.

The graph's direct and indirect job categories comprise over 11 million workers, about 8% of the total U.S. workforce (134 million). However, the impact will be far more significant than those jobs. To better appreciate the chain effect of government layoffs, let's presume the government needs to buy 1 million fewer computers this year than last. In this case, those working for computer manufacturing and chip companies could be let go. Furthermore, for all of those laid off, whether they are government or otherwise, their spending habits will likely be curtailed. Accordingly, the impact will ripple throughout the economy. The bottom line is the 3.8 million government jobs are just the tip of the iceberg.

What To Watch Today

Earnings

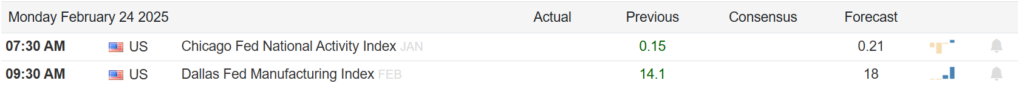

Economy

Market Trading Update

Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. As we noted then, introducing an unexpected, exogenous event can soon lead to a price decline if investors begin to reprice forward expectations. On Friday, that unexpected event presented itself when China, and most notoriously, the Wuhan Lab, reported the discovery of a new coronavirus in bats. To wit:

"Another coronavirus feared to be powerful enough to spread through humans has been discovered in China. In scenes eerily reminiscent of the beginnings of Covid, researchers at the infamous Wuhan Institute of Virology detected the new strain living within bats.

HKU5-CoV-2 is strikingly similar to the pandemic virus, sparking fears that history could repeat itself just two years after the worst was declared over. The new virus is even closer related to MERS, a deadlier type of coronavirus that kills up to a third of people it infects. Virologist Shi Zhengli, known as 'Batwoman' for her work on coronaviruses, led the discovery, published in a top scientific journal."

While this may or may not be an issue, it doesn't take much to cause a market reversal when markets are elevated and highly bullish. As discussed last week, the market broke out of the bullish consolidation and set new record highs. However, that breakout was brief, and the news on Friday led to a retest of the 50-DMA and the triggering of the MACD "sell signal." Such indeed suggests there could be more price pressure next week.

However, we want to give the market a few days to review the news. First, Friday was also an "options expiration" event, which added to the selling pressure in the market when the "virus" news hit. Secondly, the virus news will be thoroughly digested over the weekend and, by Monday, should be discounted in the markets. However, if the virus begins to replicate and spread, markets will have to evaluate further the risk to economic growth and earnings.

For now, we suspect markets will likely stabilize between the 50 and 100 DMA, reducing the bullish exuberance in the market. This will provide a better base on which to build as we enter the last three months of the seasonally strong period of the year. As noted previously, while there are certainly market risks, like sharp increases in leverage and speculation, there are currently no signs of that breaking—at least not yet.

Friday's sell-off is precisely why we continue reiterating the need to rebalance risk and manage allocations.

The Week Ahead

Once again, there is little economic data or earnings release on the docket for the week. However, one critical piece of data that the markets will closely follow is PCE Prices on Friday. The bond market handled higher-than-expected CPI and PPI data well primarily because similar increases are believed to be less prevalent in PCE prices. Analysts expect the index to increase by 0.3%, reducing the year-over-year rate from 2.8% to 2.7%. The risk to the bond market is a stronger-than-expected set of numbers. The table below shows the PPI components that feed PCE. Moreover, we highlight that six of the seven categories fell in January.

Jobless claims will also become more important to markets. Investors will want to see how much government layoffs and other jobs dependent on government spending impact the job market.

A host of Fed members will be speaking this week. Accordingly, be on the lookout for any discussions of reducing or ending QT due to the debt ceiling.

The Tariff Risk Isn't In Inflation (Part 2)

As always, the problem facing investors is the timing of when the impacts of economic, political, or regulatory changes occur. Sometimes, those impacts can be immediate, such as a reduction in corporate tax rates; other times, the effect of a political or regulatory change can take much longer to manifest.

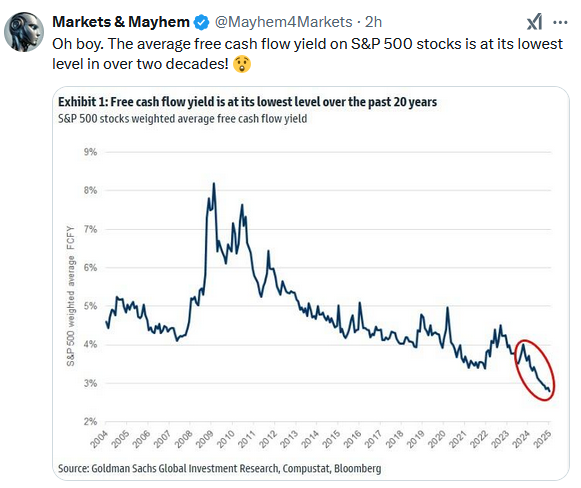

However, given the exceptionally high-profit margin levels in an environment where employment growth is declining, tariff risks are increasing, and economic growth is slowing, being somewhat cautious about specific market exposures may make sense. The chart below shows the long-term relationship between employment growth (where wages and economic demand come from) and corporate profitability as a percentage of the economy.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Government Job Cuts May Be The Tip Of The Iceberg appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter