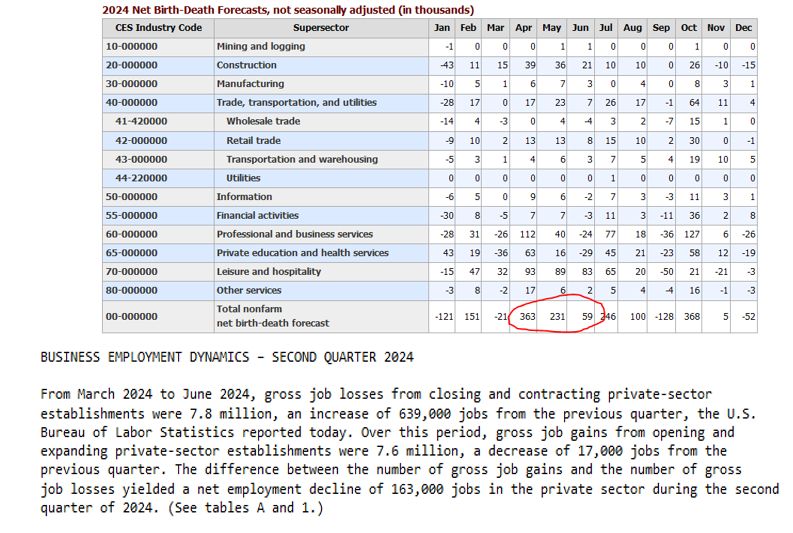

When formulating its monthly employment data, the BLS includes an adjustment for the net number of new jobs coming from new businesses and those lost by companies that have shut down. This adjustment is logical, as neither new nor closing firms are included in their surveys. While the so-called birth death adjustment is rational, the number of net jobs added due to the estimate can be incredibly flawed. The latest example is in the latest BLS Business Employment Dynamics Summary.

Within the summary covering March through June 2024, the BLS reports the following regarding its birth death adjustment: "The difference between the number of gross job gains and the number of gross job losses yields a net employment decline of 163,000 jobs in the private sector during the second quarter of 2024." Interestingly, during that same period, the total birth death adjustment in the BLS reports added 683,000 jobs.

The BLS presumes that the growing economy means the number of new businesses exceeds that of failing companies. Thus, the number of net jobs due to the birth and death of companies adds to the employment number. This has been wrong on numerous occasions. We bring this up because Friday's employment data will have a big adjustment for the birth death rate. The markets will potentially be volatile if the number of jobs is well above or below forecasts. The birth death adjustment will be wrong and possibly by over 100,000 jobs. Such introduces the idiocy of the markets when it trades off one month of the initial employment data that will inevitably be changed, possibly significantly.

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the history of "tariffs" and their impact on the market and volatility. Notably, when it comes to investing, the markets factor in the economic and earnings impacts from tariffs very quickly. Estimates are reduced, and expectations are adjusted, which allows markets to adapt to the current environment and continue to move higher based on the change in "future" expectations.

Such is why "sentiment" is critical to assessing future market outcomes. While extremely "bearish" or "bullish" headlines will get clicks and views, it is often much better to step back and look at the fundamental drivers of the market in the short term, which are sentiment and liquidity. Both remain firmly intact despite "tariff" headlines or missed earnings by Google and AMD. As shown, money flows remain robust, with the markets holding support and the 20 and 50-DMA. Notably, the market also triggered a bullish cross of the 20-DMA above the 50, suggesting buyers are coming into the market (bullish sentiment). Lastly, money flows (liquidity) remain broadly positive.

The only issue of concern is the short-term MACD "sell signal," which is approaching with money flows at decently high levels. Such suggests that the current rally may be nearing a short-term exhaustion level, and more consolidation may be likely. As noted yesterday, we suggest taking small steps to rebalance portfolios, reduce risk as needed, and diversify across sectors and factors to mitigate increased volatility.

However, for now, the bullish trend remains firmly intact, keeping equity exposures near full allocations.

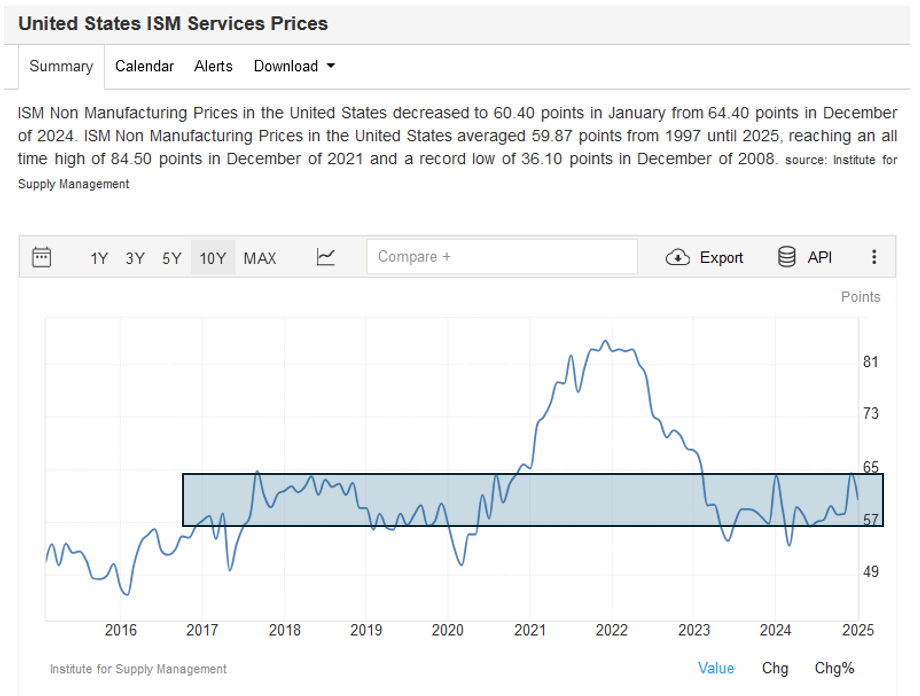

ISM Services

Yesterday, we discussed the improvement in the ISM manufacturing survey. Today, we learned that the services sector survey moved in the opposite direction. This survey is more important as it represents about 80% of economic activity. The headline number was 52.8, below expectations of 54.4. More importantly, ISM prices fell from 64.4 to 60.4. Moreover, new orders, a good indicator of future activity, fell from 54.4 to 51.3.

The graph below, courtesy of Trading Economics, shows that ISM service prices spiked last month. The increase fed concerns that inflation was starting to increase. The most recent data shows inflation is back in the range it oscillated in during the two years before the pandemic. Bond yields fell sharply on the report as it lessens fears of a spike in inflation.

Where Does Money Come From?

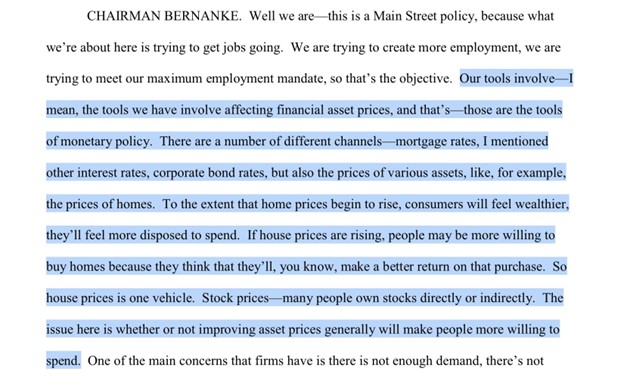

All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does money come from? Furthermore, knowing who does and doesn’t print money and the incentives and disincentives that change the money supply are critical to inflation forecasting.

Some so-called bond vigilantes are running around like Chicken Little, warning that the Fed’s recent rate cuts will increase inflation. They fail to understand the two lead facts. Moreover, and somewhat ironic, the Fed’s shift to a dovish monetary policy has been hawkish and disinflationary on the margin.

A dovish-hawkish policy description may sound crazy, but read on. With a better appreciation of how money is created, you will see that inflation fears driven by Fed actions may be misplaced. Furthermore, inflation concerns are significantly impacting bond yields. Opportunity may lay in wait for those who appreciate how the money supply impacts inflation.

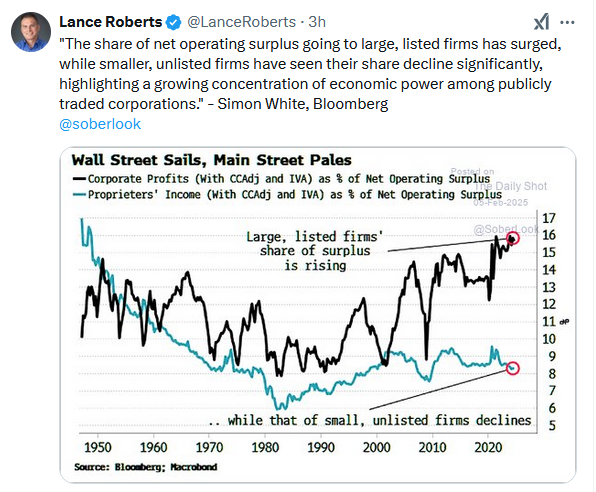

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Birth Death Adjustment: Trade With Caution appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter