Bitcoin and other cryptocurrencies are hitting record highs partly due to Donald Trump's pro-crypto policies. One such anticipated policy proposal was the establishment of a strategic crypto reserve. Presumably, this would be similar to currency strategic reserves the US holds but would hold cryptocurrencies. The plan, announced Thursday night, calls the strategic crypto holdings a stockpile, not a reserve. The stockpile will be comprised of crypto seized by law enforcement. Currently, the US is the second largest sovereign holder of Bitcoin, with nearly 200k coins. All of it was seized, not bought. Accordingly, as the policy reads today, the stockpile is the same policy the government has been running.

The change in direction from strategic crypto reserve to stockpile is an excellent example of the uncertainty regarding Trump's potential policies. Campaign rhetoric and actual policy often differ substantially. However, while Trump is no different than other Presidents in this regard, the amount of economic uncertainty is the most significant in 25 years, excluding the early days of the pandemic. Thus far, the bond market seems perturbed by the uncertainty. However, stock investors seem to think it is "no big deal" to quote Bloomberg. While forecasting stock or bond market direction based on policy is extremely difficult, we are confident that if policy uncertainty continues, we should expect volatility in all markets to run higher than usual.

What To Watch Today

Earnings

Economy

Market Trading Update

Last week, we noted that with the first five days of January making a positive return, such set the "January Barometer" in motion. If you missed our previous discussions, we reviewed the historical precedents of "So goes January, so goes the month."

“However, even with a failed Santa rally, the January barometer holds the key for the year. Historically, a positive January has been a bullish sign for stocks. The chart below highlights that the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns in 89% of these years. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results.”

The rally leading up to and following the inauguration pushed markets back to the December highs. While the month is not over yet, the return of bullish sentiment bodes well for the market to finish the month in positive territory. Furthermore, the current rally is being supported by positive earnings announcements, improvement in sentiment, and, most importantly, a return of share buybacks. Such was a previous point I made on “X.”

“Speaking of share buybacks, in today’s trading update I published the following two charts showing the correlation between the ebbs and flows of buybacks vs the market. Given we have been in a blackout period over the last few weeks, the market weakness was unsurprising. In 2025, the market is expected to set a record of $1 Trillion in repurchases.”

Technically speaking, the market has triggered a MACD 'buy signal,' which supports the current rally. However, the markets are back to decently overbought levels in the short term. Furthermore, the deviation from the 50-DMA is getting rather large, which may limit some near-term upside. Therefore, as always, do not negate managing risk and allocations accordingly.

The Week Ahead

Earnings, the FOMC meeting, GDP, and inflation data will set the market tone this week. The table below, courtesy of Earnings Whispers, shows that many large companies report earnings this week. To that end, Apple, Microsoft, Tesla, Meta, Visa, and Exxon lead the charge.

The Fed meets on Wednesday, and it's almost certain they will not cut rates. Moreover, they are not likely to hint at rate cuts in the next few meetings. Of interest will be the recent rent data which should push CPI expectations lower and Trump's demands for lower interest rates. This meeting has the potential to be relatively dull. In other words, the Fed may repeat much of what they said at the last meeting.

PCE price data on Friday and GDP on Thursday will be closely followed. The current market expectation is for PCE prices to rise by .3% and GDP to grow by 3%. The Atlanta Fed also forecasts 3% GDP growth.

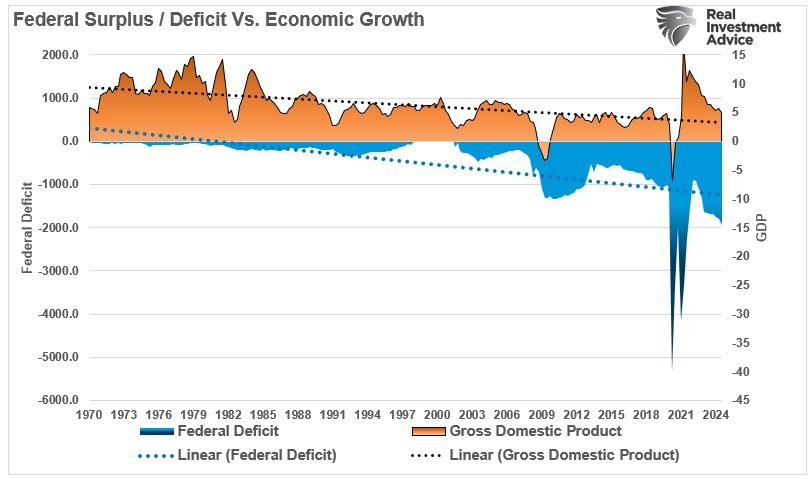

Do Money Supply, Deficit, and QE Create Inflation?

The reality is that despite mainstream thinking that inflation will resurge due to rising debts, deficits, or Federal Reserve interventions, the historical evidence does not support such claims. The negative impact of debt on the economy is evident. Furthermore, the negative correlation between the size of the government and economic growth suggests the most likely outcome in the future is deflation.

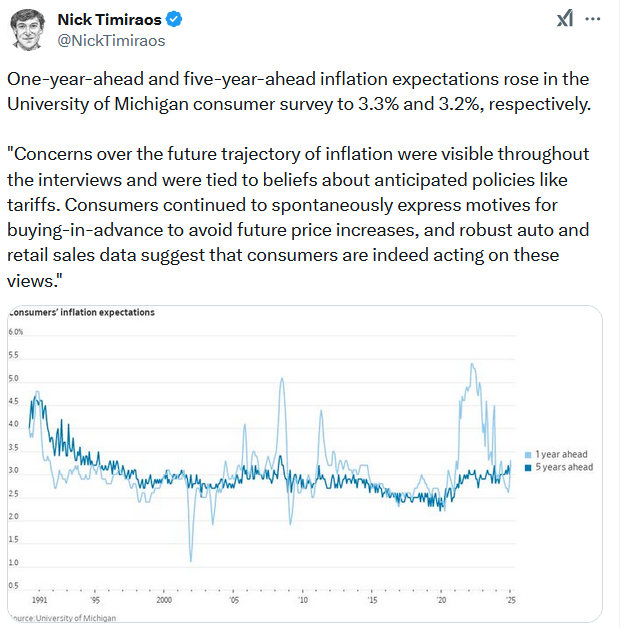

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Strategic Crypto Stockpile And Political Uncertainty appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter