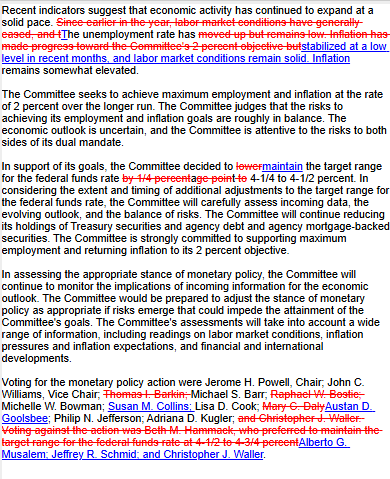

As expected, the Federal Reserve put further rate cuts on hold. After cutting rates three times in the latter half of 2024 for a total of 1%, the Fed is taking a break. While the Fed is still forecasting that inflation will trend lower by year-end, it is concerned that the trend has been stalling recently above its 2% target. The Fed hopes that its relatively high level of Fed Funds and the recent outbreak of higher long-term interest rates will put downward pressure on the economy, causing inflation to fall. As shown below, the Fed removed prior references that inflation is progressing toward its goal. Despite the language change, Powell alluded that the Fed remains upbeat that inflation is still heading lower. He called that change a "language cleanup." All members voted for no cuts in the Fed Funds rate.

At his press conference, Jerome Powell stressed that the labor market is "in balance." Accordingly, "it's not a source of inflationary pressure." He mentioned the Fed is not on a set course. They are willing to maintain the current policy but are willing to ease if the labor market weakens and or inflation declines further. The press tried to goad Powell into responding to Trump's demand for rate cuts and other proposed policies. He shed no light on the questions.

While removing the statement on progress on inflation may appear bearish for bonds, they were little changed on the day. Bond investors appear pleased the Fed is focusing on inflation.

What To Watch Today

Earnings

Economy

Market Trading Update

As discussed yesterday, the market has been rotating sharply over the last few days. The sharp selloff in some stocks on Monday was met by sharp buying on Tuesday, while Monday's winners were sold off the next day. This type of rapid rotation sometimes makes it difficult to navigate markets. Thus we suggested on Monday not to "do anything" and let the market calm down somewhat. One important facet is that despite Monday's selloff, money flows remain positive.

As shown in the chart below, money flows can reasonably signal when investors should consider increasing or reducing risk-based exposures. The vertical black lines denote when the MACD issues a "sell signal," relative strength is overbought, and money flows are declining or turning negative. This isn't meant to be used as a "timing" indicator to get all in or out of the market, but rather a warning signal that markets are likely to enter into a period of increased volatility.

The important point is that despite Monday's sharp selloff in some stocks, money flows remain positive, the "buy signal" is intact, and relative strength is not overbought yet. This suggests that the near-term risk is to the upside, and being overly defensive may impair performance. While this does not mean certain individual companies are immune to further risks, the broader market remains stable. When money flows turn negative, we will certainly apprise you.

Monday's AI Shock Was Very Unusual

Nvidia led AI-related stocks in a sharp decline on Monday, pulling the S&P 500 and Nasdaq lower as well. However, the Dow Jones Industrial Average was higher on the day. Moreover, the equal-weighted S&P 500 (RSP) was flat on the day. While some of the largest-cap stocks fell significantly, most others were fine. Stocks from the recently underperforming sectors had quite a good day.

The graph below, courtesy of SOFI, highlights the historical divergence. Despite the S&P 500 falling by about 1.5%, 199 more stocks closed higher than those that fell. Since 1996, we have only had three similar instances. All three occurred in the pre-dot-com bust surge. In hindsight, those three divergences were a warning of sorts. Might Monday's rare breadth be another?

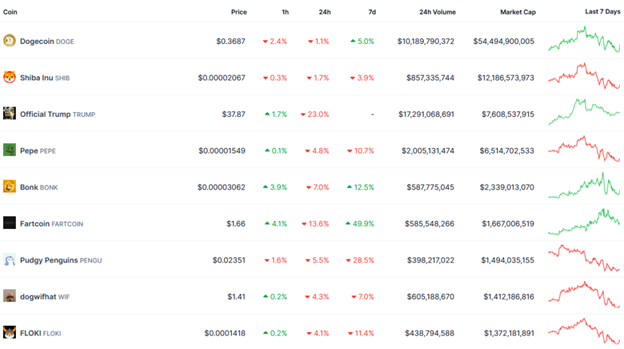

Meme Coins Do Not Create Wealth

The latest craze in cryptocurrency is the release of the $TRUMP and $MELANIA meme coins. Immediately upon issuance, the cryptocurrency coins surged in value, turning worthless 0s and 1s of computer code into tens of billions of dollars.

Many in the financial media, alongside crypto devotees, claim these meme coins, and others like Fart Coin, DOGE Coin, and the aptly named Shit Coin, create wealth. While they have made sizable profits for countless coin issuers and traders, the amount of dollars in the financial system remains unchanged. The coins do not create wealth; they transfer it from buyers to sellers.

More importantly and not advertised by the pro-crypto bandwagon, our potential national wealth suffers as the valuations of most cryptocurrencies grow. Instead of focusing on the glamor of instant millionaires that meme coins create, we take a different direction: their impact on the economy and the citizens’ aggregate wealth.

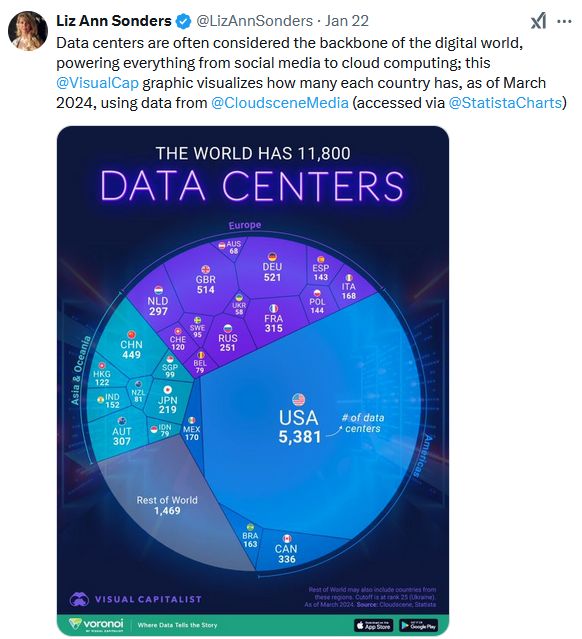

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Rate Cuts Put On Hold appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter