The initial reaction to Friday's BLS jobs report was a yield surge and a sharp stock decline. Stock investors are finally noticing higher yields. While sentiment can certainly cause stocks and bonds to deviate from fundamentals, at the end of the day, they both have fundamental roots in economic activity. Over the past couple of Commentaries, we have shared data showing that the recent increase in bond yields is due to poor sentiment. Before this past week, the stock market didn't seem concerned about higher interest rates resulting from the negative bond sentiment, aka higher term premiums.

The stock market's negative reaction to the jobs data and higher yields is not necessarily a reaction to how the Fed might react. Sure, if the Fed were to raise rates, that, on the margin, might portend stock weakness. Instead, however, we think the adverse reaction directly relates to the expected economic impact of higher rates. The graph below, courtesy of Pictet Asset Management, shows the lagged correlation between the Citi Economic Surprise index and yields and the dollar. It portends that economic data will likely fall below forecasts for the next few months. In other words, it takes a few months for higher rates and a stronger dollar to impact economic data negatively. And stocks seem to acknowledge that.

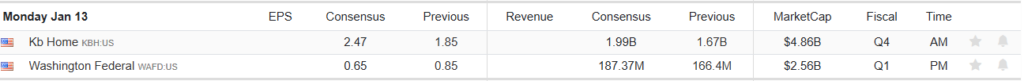

What To Watch Today

Earnings

Economy

One Week Left To Get Your Tickets

Don't miss the opportunity to get your tickets for the 2025 Economic and Investing Summit. Seating is extremely limited, and this year's event is almost sold out. We have set aside time to visit with attendees one-on-one to answer your burning questions about 2025.

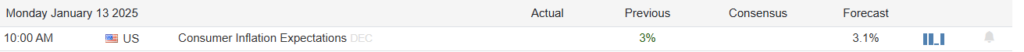

Market Trading Update

Last week, we addressed the inability to sugarcoat the market's poor performance heading into year-end. Furthermore, we discussed the "January Barometer," which sets the year's tone. To wit:

"However, even with a failed Santa rally, the January barometer holds the key for the year. Historically, a positive January has been a bullish sign for stocks. The chart below highlights that the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns in 89% of these years. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results."

However, before we reach the full month of January, the market must pass the first five days. As of Wednesday, which concluded the first five trading days of January, that market did generate a positive return, rising about 0.62%.

As we noted last week, this is the first of two "January Indicators" that have historically, on average, set the tone for the year. Since 1950, the S&P 500 has logged net gains during the first five days of the year 47 times. Of those 47 instances, the index ended the year up in 39 of them. That's an 83% success rate for the first five-day theory. However, don't get too excited. Of the 74 completed years since 1950, the S&P 500 has logged a full-year gain 73% of the time. That is likely because stocks are rising as the growth of the global economy continues despite the occasional stumble.

The last point is most notable, and most investors often ignore it. The first five days of January and the "January Barometer" are certainly statistically notable, but its failure rate as an indicator for bearish outcomes is also noteworthy. In the 27 years where stocks lost ground during the first five days of the new calendar year, the S&P 500 logged full-year gains in 15 of them anyway. In other words, the indicator only boasts a 45% success rate when predicting full-year losses.

It's also worth noting that some of the market's very best years since 1950 got started on a bearish foot. For example, the S&P 500 rallied 21% in 1991 despite losing 4.6% of its value during the first five days of that year. Conversely, despite rising 1.1% over the first five days of 2002, the S&P 500 lost more than 22% that year. When the theory is wrong, it can be very wrong.

As investors, these calendar-based time frames can give us some psychological comfort. However, the outcomes are likely not as closely tethered to reality as investors want to believe. As we discussed recently, the success rate as a bullish indicator is mainly rooted in that stocks rise more often than they fall.

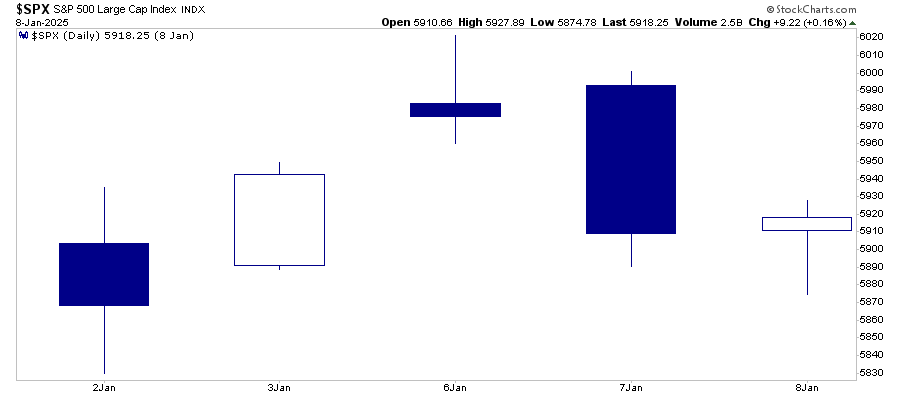

Since 1900, the stock market has “averaged” an 8% annualized rate of return. However, this does NOT mean the market returns 8% every year. As we discussed recently, several key facts about markets should be understood. Stocks rise more often than they fall: Historically, the stock market increases about 73% of the time. The other 27% of the time, market corrections reverse the excesses of previous advances. The table below shows the dispersion of returns over time.”

In other words, while the first five trading days have been fruitful, investors should remain focused on the risks that could derail the markets.

The Week Ahead

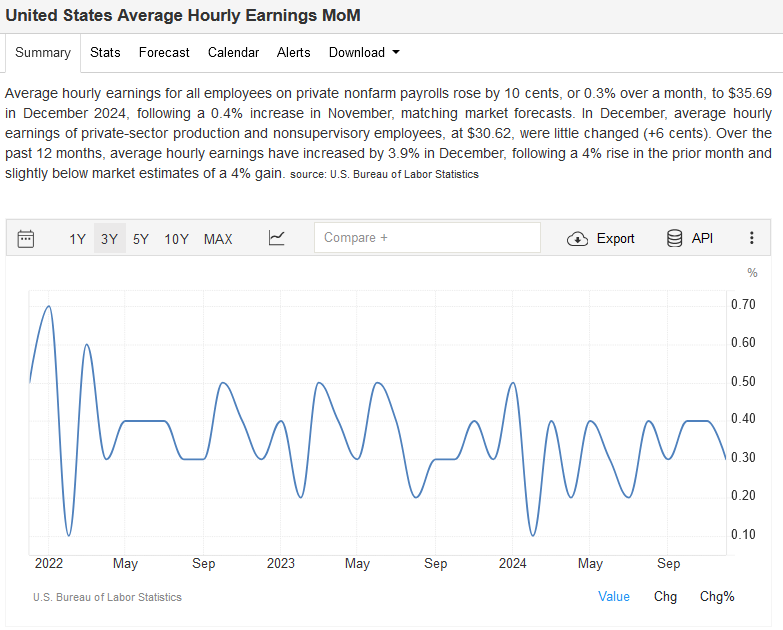

With the strong jobs report behind us, the stock and bond markets will focus on inflation to better gauge the Fed's next steps. While the jobs number was strong, the earnings component aligned with expectations. As we share below, the monthly increase in average hourly earnings has been stable. In 2021 and 2022, wages were rising rapidly, and the Fed was concerned about a price-wage spiral, whereby higher wages drive inflation. Despite the recent BLS data, there is no indication that wage growth is increasing. Thus, the inflation data coming this week will help gauge monetary policy.

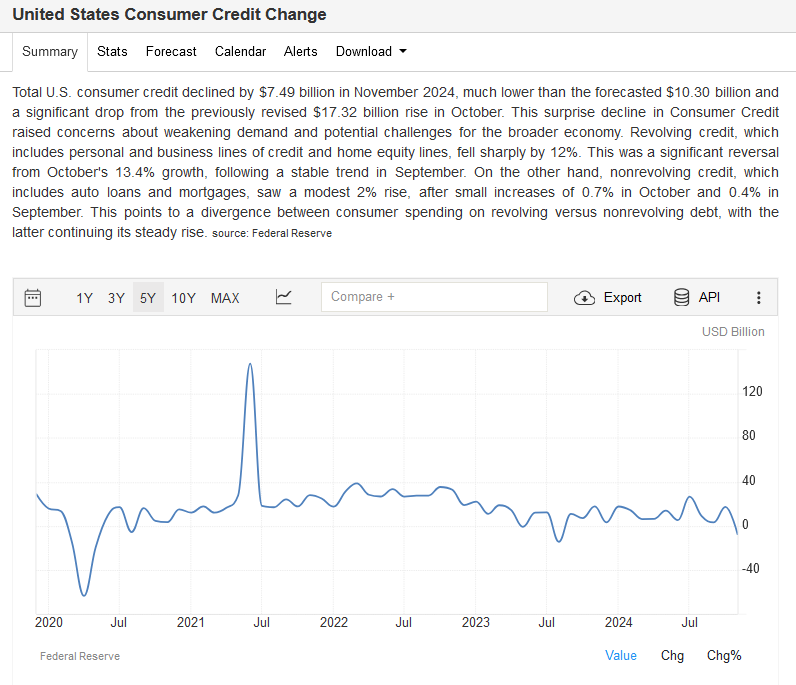

PPI on Tuesday and CPI on Wednesday are both expected to increase by .3%. Retail sales on Thursday are expected to grow by 0.5%. The second graph shows that consumer credit fell by $7.5 billion in November, much lower than forecasts of a $10 billion increase. The surprising decline raises questions about consumer spending. If it is indicative, the retail sales data will be weaker than expected.

Investor Resolutions For 2025

I publish an updated version of my New Year “investor” resolutions yearly. The purpose of the process is to take an annual inventory of what I did and did not do over the last year to improve my portfolio management practices. As with all resolutions made at the beginning of a new year, it is not uncommon to fall short of my goals.

Here is a good example of the importance of keeping resolutions. Early in my career, I built health and fitness facilities. But have you ever wondered why you couldn’t just go into a gym and pay a fee to use it? It’s because the fitness industry gets built around a simple premise – you will sign up for a membership and never use it. So, the membership fee continues to hit your credit card every month. Yet, you don’t cancel the membership because you feel guilty about not starting your diet and workout program.

But you promise yourself you will start tomorrow.

Fitness facilities can continually oversell their gym capacity because many members sign up but never show up. Like going to the gym, resolutions to eat better, sleep more, work out, etc., all sound great. However, while we know we should do them, we don’t.

Such is why America is the most obese country on the planet.

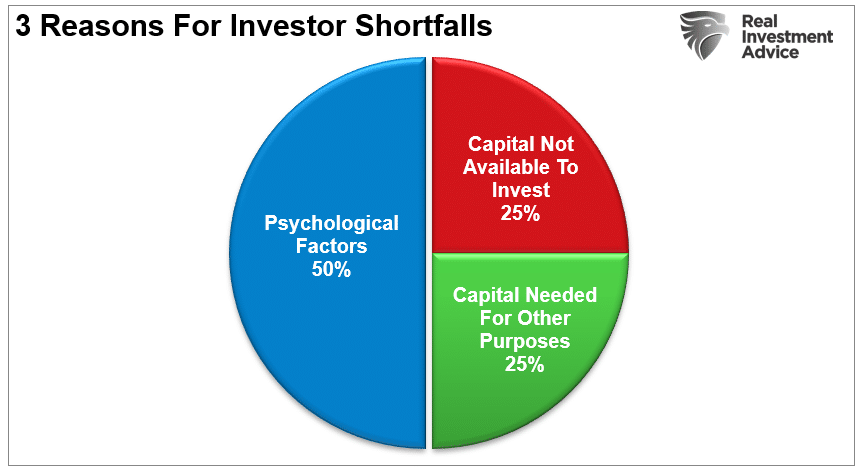

Why am I telling you this? Because investor resolutions are just as hard to follow.

We know we should, but there are many psychological reasons we don’t.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Jobs, Stocks, And Bonds Oh My! appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter