Fed rate cuts, tariffs, deficits, California wildfires, and other narratives bolster a growing concern that inflation will surge again. While those narratives are concerning, and some may have merit, market and survey-based inflation expectations do not confirm them.

The Fed and almost all economists use two types of gauges to measure inflation expectations: surveys and market-based measures. The graph below shows eight well-followed inflation expectation measures spanning expected inflation rates for the next year to ten years. Nothing in the eight graphs warns us that inflation expectations are starting to trend higher.

The table below the graph provides details on the inflation gauges since 2021. Only two have increased since June 2024. Those two, 5- and 10-year inflation expectations, are up a mere 15bps and 4bps, respectively. All other inflation expectation gauges have declined since June. The data show that the inflation narrative is a fear that is not grounded in reality. That can certainly change, but market and survey data argue that the term bond premium is misguided.

What To Watch Today

Earnings

Economy

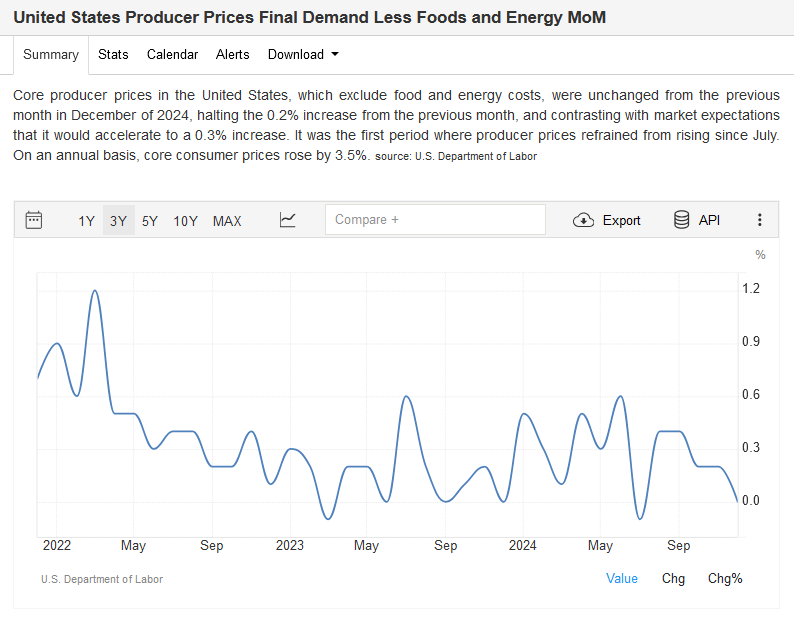

Market Trading Update

As noted yesterday, today is the all-important CPI (inflation) number that the markets are glued to regarding their expectations for the Fed's next move. While the bond market has traded off, along with stocks, on expectations for a "hotter-than-expected" print, there is a decent possibility the number could be weaker given the Producer Price Index (PPI) number yesterday. Given the market's short-term oversold condition and a sharp drop in sentiment, an inline or softer CPI print this morning could lead to a rather sharp rebound in market prices.

We will see what happens and trade the market accordingly. However, TODAY also kicks off earnings season. As we have discussed recently, earnings growth in Q4 is expected to be around $209/share, but analysts expect nearly $250/share by the end of 2025. Notably, those expectations have declined since the beginning of 2024 as economic growth continues to slow.

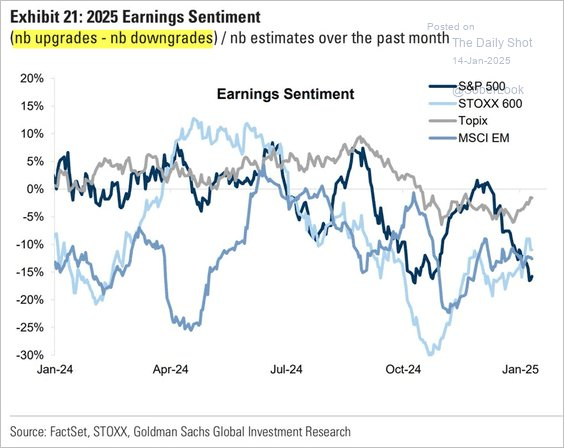

The most significant risk to earnings is slowing international growth. While the U.S. is still growing rather strongly, the rest of the world is on the verge of slipping into a recession. This is important because 41% of corporate revenue is derived from international markets. When you combine weak economic growth with a strong dollar, which increases the costs of products bought from the U.S., the risk to earnings is notable.

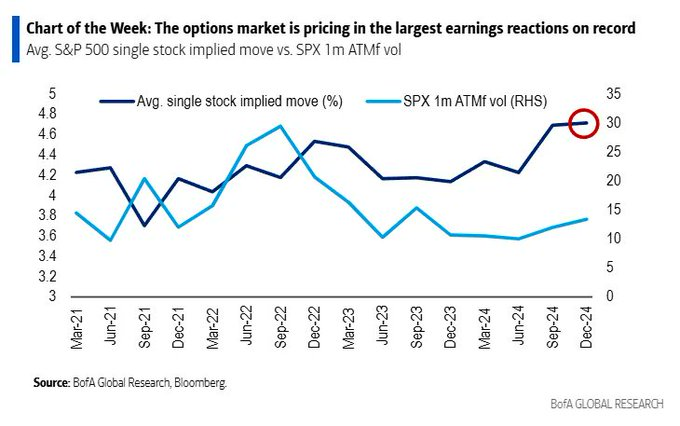

In other words, there is more than a small risk that we could see an increase in missed earnings and more significant price swings based on disappointing results. Bloomberg made this point yesterday.

"Traders are bracing for one of the most volatile earnings periods in stock market history. At least, that’s what they are positioning for two days before big banks kick off the reporting cycle in the US. Options traders expect individual stocks in the S&P 500 Index to move 4.7% on average in either direction after reporting their results, the largest earnings-day moves on record, according to Bank of America Corp strategists"

Since analysts expect earnings to grow by 7.5% in Q4, the risk of disappointment is high. Furthermore, equity selection will separate portfolio performance over the next month. Manage risk and exposures, particularly given the recent stretch of market weakness.

Does A Weak PPI Imply A Weak CPI?

PPI was weaker than expected, coming in at +0.2% versus expectations of +0.3%. Core PPI, excluding food and energy, was flat at 0%. Expectations were calling for a +0.2% increase. PPI has a decent impact on PCE, which will be reported later this month. Moreover, when the PPI comes out before CPI, as it is this month, a weaker-than-expected PPI often leads a weaker CPI.

The following review by Brent Donnelly of Spectra Markets is courtesy of Walter Bloomberg (@DeItaone):

Weak PPI means weak CPI, not always but often, writes Brent Donnelly of Spectra Markets. Recently, it's somewhat rare for the Labor Department to publish PPI data before CPI data in a given month, but before 2018, it was the norm. Looking back at 10 years of history: When headline and core PPI both fall short of expectations--as they did in this morning's release of December data--CPI for the same month has come in hot only 21% of the time. In such cases, it meets expectations 39% of the time and it too is softer than expected 39% of the time, Donnelly finds. That suggests that Wednesday's December CPI is now less likely to come it higher than Wall Street expects. Economists had been forecasting a 0.3% rise in consumer prices.

Tactically Bearish As Risks Increase

Could a “crash” happen? Yes. However, bear markets rarely happen all at once. In most bear markets, the market showed plenty of warning signs well before the “bear” came out of hibernation. Such gave investors ample time to exit the market, reduce risks, and raise cash to minimize the eventual reversion to capital. Even a simple technical signal, such as when the market violates the 48-week simple moving average, allowed investors to exit risk well before the rest of the correction occurred. Did you get out right at the top? No. Did you get back in at the exact bottom? No. Did you participate in most of the advance and avoid most declines? Yes.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post The Inflation Narrative Versus Reality appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter