Retail investors are showing distinct behavioral patterns when trading cryptocurrencies compared to traditional assets such as gold and stocks. Traditionally, investors tend to sell their stocks and gold when prices rise.

In contrast, when cryptocurrency prices increase, retail investors are more likely to hold or buy more. This aligns with a “momentum-like” strategy, reflecting the belief that rising prices signal greater future adoption and value, a new research found.

The research, published in September by finance academics from the US and the UK, analyzed trading behaviors for cryptocurrencies and traditional assets, using a dataset of trades from 200,000 individual retail accounts on brokerage eToro between 2015 and 2019.

The analysis used the 200 most traded stocks on eToro, which account for over 91% of stock trading on the platform during the sample period. Similarly, it focused on the three most traded cryptocurrencies, namely bitcoin, ether, and ripple, which constitute over 78% of cryptocurrency trading during the sample period.

For stocks and gold, the research found contrarian tendencies, where retail investors actively rebalanced their portfolios when prices went up, and put money into stocks when the prices went down.

An analysis for the full set of traders in the dataset found that a 1% increase in stock prices was associated with a 1.2% decrease in the portfolio share due to rebalancing, translating to a 0.28% decrease in total portfolio share of stocks.

Similarly, in gold trading, a 1% increase in gold prices was associated with a 38.1% decrease in the portfolio share due to rebalancing, translating to a 37.3% decrease in total portfolio share of gold. This strong contrarian behavior is explained in part by gold returns having much lower volatility than other asset classes as well as the high leverage used by retail investors when trading gold.

Buy and Hold and Double Down on Surges

In contrast, cryptocurrency investors tend to hold onto their assets after large price movements. Some even double down on cryptocurrencies during price surges. An analysis of trading activity found that a 1% increase in prices is associated with a 0.67% increase in the total portfolio share of cryptocurrencies, reflecting this trend.

According to the report, these results are not the outcome of inattention, differential preferences for lottery-like assets, differences in fees, or the lack of cash flow information about cryptocurrencies. Instead, they reveal that retail investors are applying a model of cryptocurrency pricing in which positive returns increase the likelihood of future widespread adoption, which in turn leads them to update their price expectations in the direction of the price change.

Unlike traditional assets, where adoption is already well-established, cryptocurrencies are a nascent industry, with their value tied to expectations of future growth. This explains the contrarian behavior when trading cryptocurrencies compared to more established assets like stocks and commodities, and the momentum-like tendencies.

Booming crypto trading activity

Crypto trading has undergone drastic evolution over the past decade, shifting from being a niche market among tech enthusiasts to becoming a mainstream financial phenomenon influencing global markets.

Despite criticism on their speculative nature, extreme volatility, and lack of regulatory oversight, cryptocurrencies have gained significant traction among supporters.

The State of Cryptocurrency Ownership Worldwide in 2024 report estimates that the number of digital currency users reached 562 million people this year, up 34% increase from 420 million in 2023. This figure implies that 6.8% of the world’s population are now crypto owners, with crypto ownership rising by a compound annual growth rate (CAGR) of 99% between 2018 and 2023.

Institutional interest has also surged. A study by EY-Parthenon found that 94% of the 277 institutional investor decision-makers surveyed believe in the long-term value of blockchain and digital assets, with 79% considering them crucial for portfolio diversification.

38% of respondents said they had already committed between 1%-5% of funds to digital assets or crypto-related investments, and in the case of family offices, nearly half are in that allocation range. Traditional hedge funds are reaching for digital assets gains even more aggressively than their peers, with 22% allocating greater than 5% of funds.

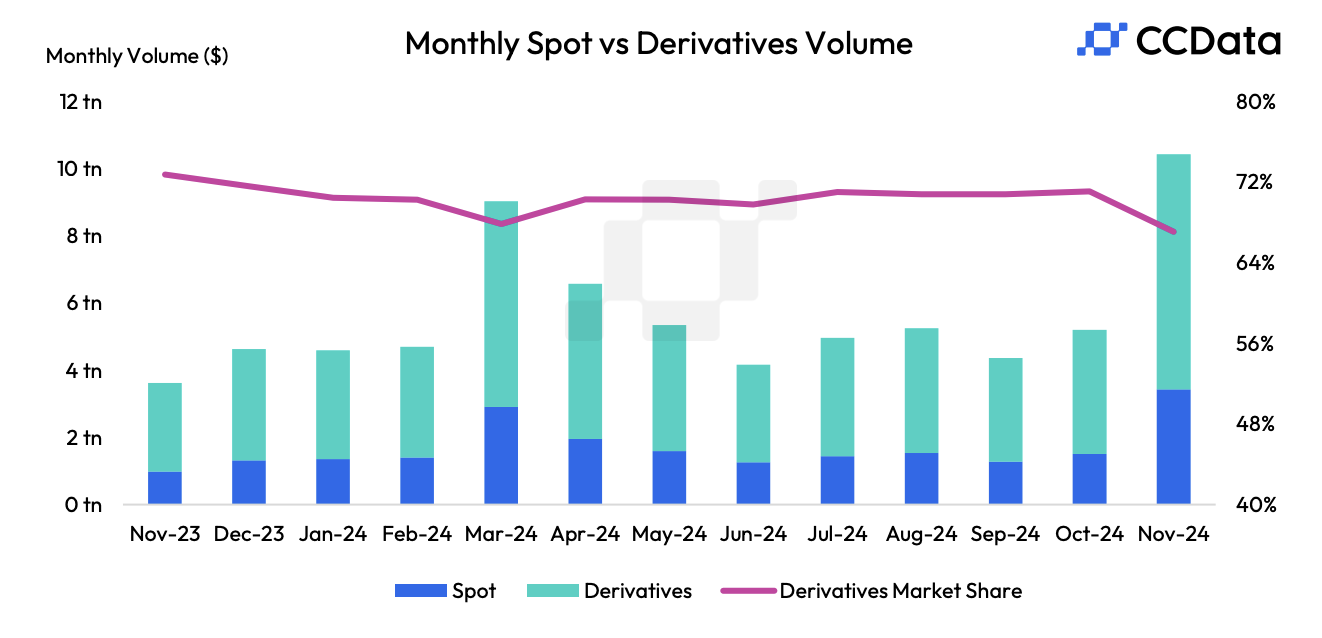

Last month, crypto trading hit a new milestone, exceeding US$10 trillion across spot and derivatives markets for the first time in November, according to CCData, a data and index solutions provider specializing in the digital asset market.

Spot trading volume rose 128% month-on-month (MoM) to US$3.43 billion, marking the second-highest monthly total since the previous peak in May 2021. Derivatives trading volumes, meanwhile, surged 89.4% to US$6.99 trillion, surpassing the previous all-time high set in March 2024.

This surge was fueled by significant events including Donald Trump’s election victory, which spurred expectations of a pro-crypto regulatory shift. Since election day on November 05, the price of bitcoin climbed more than 40%, crossing the US$100,000 mark on December 06.

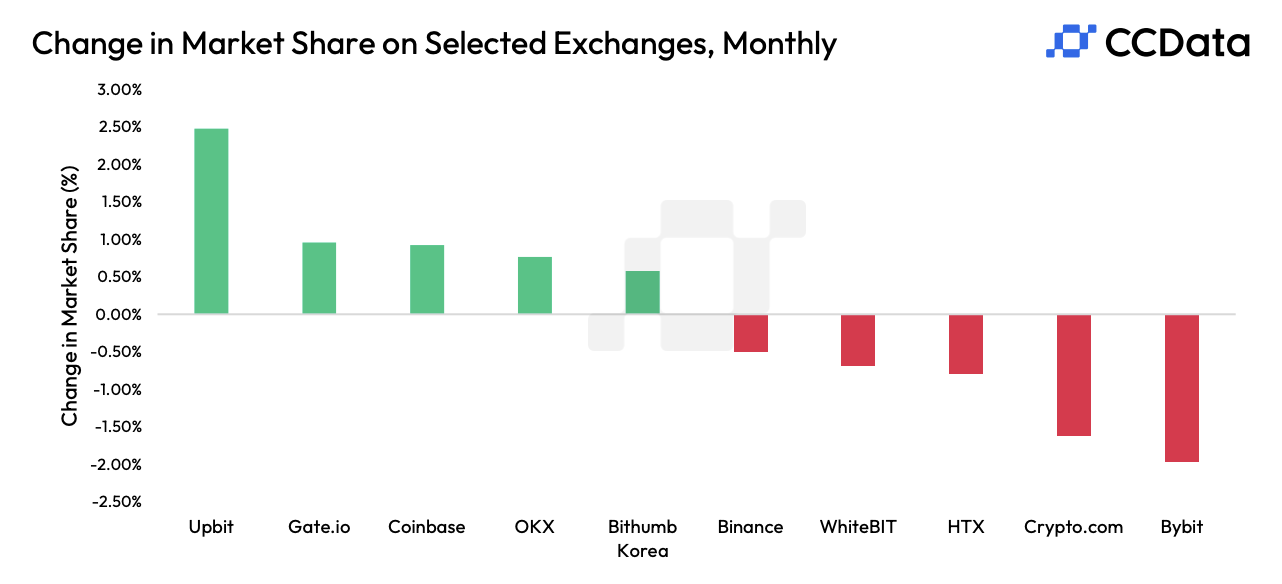

South Korea also played a key role in the global trading surge, driven by an altcoin frenzy. Aggregate trading volumes across major South Korean exchanges, including Upbit and Bithumb Korea, reached a record of US$254 billion, representing a 294% MoM increase. South Korea now accounts for 7.38% of the total spot trading volumes on centralized exchanges.

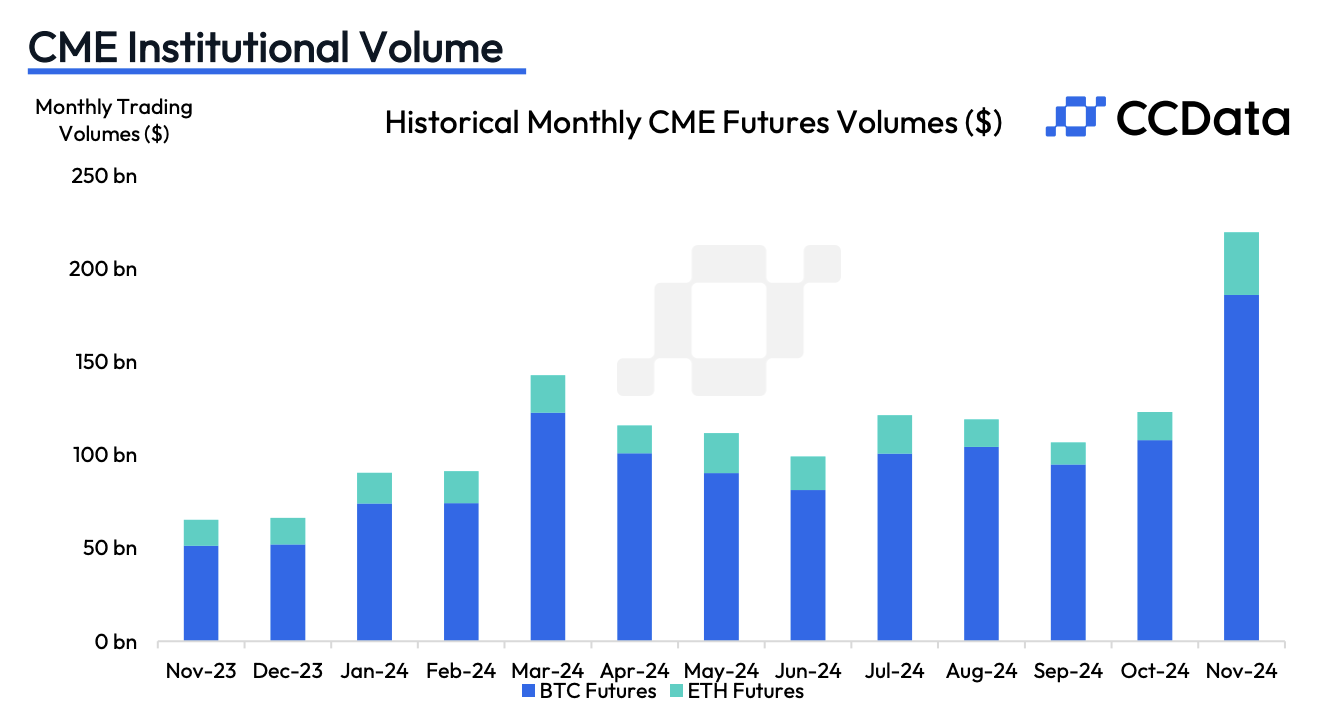

Institutional trading also soared, with CME’s aggregate trading volume hitting US$245 billion in November. Bitcoin futures volume rose by 72.2% to US$186 billion while ether futures volume increased by 122% to US$33.6 billion, a new all-time high for both the instruments.

Featured image credit: edited from freepik

The post Retail Investors Show Divergent Behaviors in Crypto versus Traditional Assets appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain,Cryptocurrencies,Featured,newsletter