During his 2024 presidential campaign Donald Trump repeatedly and in grave terms highlighted the possibility of the US dollar losing its world reserve currency status. This occurred at summits with business leaders at the New York and Chicago Economic Clubs.

Trump occupies a rather unique position in this debate since he recognizes the real possibility of the dollar losing its world currency status, he opposes this change and wishes to prevent it, and yet he is not a paradigmatic member of the ruling class. However mainstream he is—today or in the past—he doesn’t possess the establishment credentials of a Ben Bernanke, for instance.

Since Trump doesn’t want the dollar to lose reserve currency status, his acknowledgment that this is a real possibility should at least serve as ammunition against those who are oblivious to this change, or who claim that it isn’t happening. Typically, when dollar defenders argue that the loss of reserve currency status is an impossibility, they are arguing against those who wish for this change to happen. When Trump says that the dollar could lose its reserve status—even though he opposes this change—it at least undercuts the factual basis of those dollar defenders who claim its status is secure.

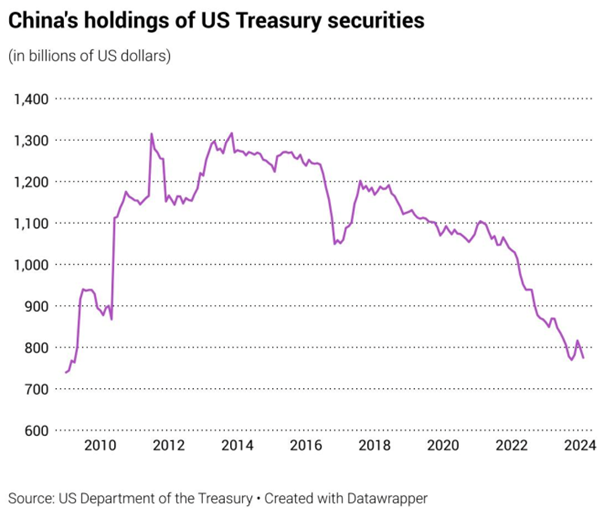

Admittedly, the possible loss of reserve currency status is not a short-term trend. Anyone claiming the demise of the dollar is imminent—and particularly anyone trying to sell you a financial package on this basis—should be treated with skepticism. But there is a bizarre school of thought which downplays all blows to the dollar’s position, and claims that these events are insignificant. There are, in fact, many significant events occurring, and they are stacking up to present a real threat to the dollar’s position. Events such as Saudi Arabia trading oil in other currencies, BRICs countries developing a new payment system, and China rapidly decreasing its holdings of US treasuries. How can these events not mean anything?

If the dollar is in jeopardy, and Trump wants to save it, the question then becomes: can he save it? One approach to achieving this goal would be to manage the dollar more competently. This would involve less creation of new money (inflation), since many national economies were severely destabilized by the massive inflation of recent years. It would also involve a judicious, non-ideological use of dollar-based power, as opposed to weaponizing the dollar over conflicts where a nation perceives its fundamental interests are at stake, and the US interest is peripheral at best, and unjustified at worst. The other approach would be to get tough; to threaten countries who move away from holding the dollar for forex purposes with either economic or military power.

Trump has made noise about both approaches, though he seems to lean most heavily towards the use of tariffs to prevent nations from breaking away. In my view, the aggressive approach would only accelerate current trends, since this was the path taken from Russia’s invasion of Ukraine in 2022 up until now, and it created the situation in the first place. A Trump administration managing the dollar the way it used to be managed could placate other nations and slow down current trends, but I think that is all it could do, rather than permanently halt and reverse these developments. A fundamental rupture has occurred and too many important nations perceive it as a fundamental interest to break the power of the dollar as the world reserve currency in the long term. They may be happier if this process is managed slowly and without disruption, but they are committed to it.

In my view, it is impossible for Trump to stop the process of de-dollarization. Regardless of how much success he is able to achieve, we should also ask whether this is the right goal in the first place. Undoubtedly the dollar losing global reserve currency status would cause significant short-term economic pain for the American people. Trump seems to have the noble intention of avoiding this pain, but we also know that markets can respond to these events and get the economy working again rather quickly when left alone. Beyond markets, there is also the calculation, by which the government could adjust the ratio of its gold holdings to the dollar (assuming implementation of a hard gold standard). This is explained by Murray Rothbard in the final chapter of The Case Against the Fed. In the event that the dollar loses its reserve status, this plan could very quickly restore the currency to a sound position.

It may seem noble to attempt to reinforce the reserve status of the dollar, but defending the Fed, the fiat dollar, and global reserve currency status are the economic equivalent of defending death by strangulation just because it’s slow. This currency system supports the bloated welfare-warfare functions of the government. It has hollowed out American industry by financialization and the fact that dollars can be created out of thin air to pay for goods and services domestically and abroad. This tremendously undercuts genuine production and wealth generation.

Because this system creates such an unnatural and unproductive economy, and though this economy has such pernicious effects on society, collapse is inherent in the system sooner or later. The longer the system lasts, the more rot sets in, and the worse the eventual collapse will be.

This discussion brings us to the subject of institutionalism. There is a powerful tendency in politics to regard an institution as one’s own, long after one’s own faction has lost it, or even where the institution never belonged to one’s own faction in the first place. Accompanying this is the tendency to want to reform institutions recognized as not aligned with one’s own faction, rather than destroy them.

Being unable to recognize when an institution is opposed to one’s political goals, and being unable to recognize when an opposing institution is irredeemably opposed to these goals and, therefore, not subject to reform, can prevent a faction from achieving its desired political goals. In these cases, all energy—by the fact of being directed into these institutions—is then redirected against the goals the political faction wishes to achieve.

According to Trump’s stated goals of wishing to revitalize the American economy on behalf of the American people—and not government or corporate special interests—the Federal Reserve and the fiat dollar it supports are irredeemable institutions. Trying to reform and reinforce the status of the dollar as global reserve currency will never achieve these goals. People may be able to point to this or that improvement in economic conditions over the next few years, but I am talking about systemic change and a lasting victory. It is hard to argue that these aren’t necessary over and above small improvements.

Between the Biden administration inadvertently and obliviously endangering the global reserve currency status of the dollar through its own incompetence, and Trump’s intention to undo this damage, there is a better path. Any future American administration should create a plan to manage the transition away from the fiat dollar as global reserve currency towards a national gold dollar, that is, a national policy of a 100 percent gold-backed dollar, where other countries are free to set their own monetary policy. This would vastly improve the American economy as well as international relations.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter