In our bureaucratically-managed economy, financial prosperity increasingly depends on how close one can position himself to the dissemination of newly-created money. Understanding this critically means identifying the link between this “prosperity” and newly-created money. Since creating money from nothing can’t possibly be productive, or enhance wealth in any real way, there is no direct link to prosperity. The connection must be indirect, and indeed it is.

The federal government’s persistent deficit and the Federal Reserve’s inflation policy necessitate continuous money creation. This new money enters the economy unevenly, benefiting early recipients who can spend or invest at current prices. As this money flows into specific sectors or assets, prices rise. Those with early access gain significantly, while others face relative wealth decline. Although wages may eventually increase, they do so to a lesser degree and lag behind price increases, cementing the economic disadvantage for those without early access.

As a result of the above process, which describes how the US economy functions today, there are many whose primary aim is to gain proximity to the source of new money creation and dissemination. These rent-seekers benefit, not from merit and productive achievement, but from political maneuvering into the right positions, so as to be among the early recipients of the new money.

When the Federal Reserve lowers interest rates, they are de facto creating new money. This is generally done through open market operations, wherein the Fed purchases securities—using newly-created dollars—from a select group of banks, thus increasing reserves and subsequently increasing credit in the economy through lending and other mechanisms. Therefore, forcing down interest rates is akin to creating new money from nothing and it is used to the same effect by the beneficiaries thereof.

Financial Distortion

Economic bureaucrats, including those at the Federal Reserve, are well aware that there is a direct relationship between interest rates and the value of capital assets.

For these assets, prevailing and future interest rates are key inputs for calculating their value. Consider the Dividend Discount Model, an equation used in investing and corporate finance to derive the present value of an income-producing asset. The equation is simple enough:

P = D/k-g

Where:

- P is the price, or value, of the asset.

- D is the first year’s dividend, or cash flow.

- k is the discount rate, essentially the prevailing cost of capital.

- g is the growth rate of D.

If the discount rate is 10% and the growth rate is 2%, a perpetual stream of annual cash flows starting at $100 is worth $1,250 today. Assume this cash flow comes from the profits of a business, the details of which don’t matter.

Assume further that, the day after our initial calculation, everything about this business—the management team, product line, technology, etc.—remains the same, but the Federal Reserve surprises markets by cutting interest rates such that the discount rate drops from 10% to 7%. Recalculating with this new information, the business is now worth $2,000, a 67% increase from the prior day.

Importantly, the pace of increases in asset valuations (i.e., the second derivative of asset prices) accelerates as benchmark rates get lower. In the prior example, the asset value increased by 67% overnight when the discount rate dropped by 3%—from 10% to 7%.

What if it drops by 3% again, from 7% to 4%? In that case, the asset value would increase from $2,000 to $5,000—a further 150% increase based on no change in business fundamentals. It’s this dynamic that characterizes parabolic asset prices including the recent bubble peaks during the ZIRP era.

Note that rates themselves need not even change to affect asset values. Increases in asset prices can come about from expectations of lower interest rates, hence the Federal Reserve’s constant jawboning in favor of lower rates so as to stimulate asset prices and transaction volume. This latter point is a further consideration when bureaucrats blow asset bubbles using artificially-low interest rates. Wall Streeters, and similarly situated middlemen, earn fees every time money moves, and few things move money like low interest rates.

Artificially-Low Rates are the “DEI” of Capital Markets

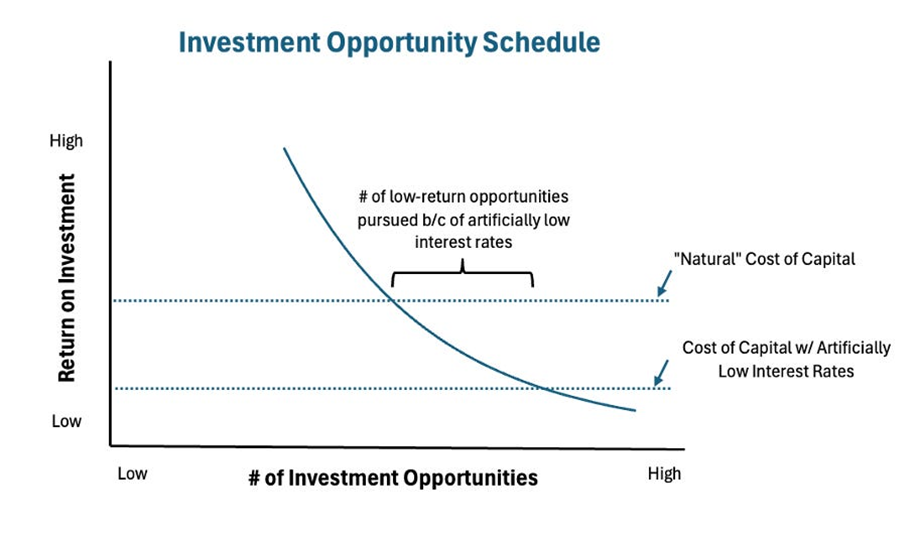

In a free market, one of the primary challenges for business operators is capital allocation—where and how to invest. In order to utilize capital efficiently, it must be deployed into areas that provide returns greater than the prevailing cost of capital. This must be done repeatedly, over long timeframes. Therefore, a keen business sense must be combined with a low time-preference in order to succeed. As a byproduct of this dynamic, the most productive areas of an economy receive an appropriate amount of capital and the least productive are shunned.

Artificially-low interest rates, on the other hand, reduce the cost of capital such that the challenge of capital allocation is warped. Previously unprofitable areas become marginally profitable by virtue of low rates and receive capital they wouldn’t otherwise receive. Naturally, areas that are marginally profitable only because of low rates are not inherently productive enterprises and therefore attract those of lower ability rather than skilled entrepreneurs. Put simply, artificially low rates subsidize incompetence.

(Source: Adapted by author from https://www.forbes.com/sites/greatspeculations/2010/11/17/artificially-low-interest-rates-do-permanent-economic-damage/?sh=5a6102787c73)

For evidence of this phenomenon in action, one need look no further than the market for apartment investments over the last few years, but many such cases exist including electric vehicles, serially-unprofitable tech, and various cryptocurrency scams.

“The Four Horsemen of Cheap Money”

Artificially-low interest rates lead to malinvestment, asset bubbles, excess financialization, and zombie companies—all of which are prevalent in spades today. Nevertheless, the Federal Reserve and our political class are hell-bent on more of the same, loudly signaling imminent rate cuts despite asset prices at or near-record highs in many categories including stocks, bonds, and housing.

To those without political access, who don’t reap the primary benefits of artificially-low rates, understand that the destruction of your wealth leads directly to the enhancement of wealth for those with such access. For money bureaucrats and the crony class, this is a highly sought-after feature of fiat money. As Michael Burry once pointed out,

“The zero interest-rate policy broke the social contract for generations of hardworking Americans who saved for retirement, only to find their savings are not nearly enough.”

Thrift, hard work, and personal responsibility used to be enough to secure a decent life for oneself and family. That’s no longer the case. Artificially-lowering interest rates, creating money ex nihilo in the process, can’t produce wealth, but it can and does redistribute it—directly from your pockets to those of the crony class.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter