For this week’s episode, I wanted to find something familiar in the form of a “saying” to try and convey my thoughts about the economy as it stands today. I even thought about nursery rhymes like “ring around the Rosie” and “musical chairs,” but those did not exactly fit and did not stand up to historical or logical scrutiny the way I hoped.

I settled on “When Everyone Runs for the Exit.” This is a play off the legal doctrine limiting free speech of “You can’t yell “fire” in a crowded theater, unless there is a fire.” The more modern, market-orientated version of this might be: Take your money and run!

This is also the title of a paper by economist Lasse H. Pedersen, then with New York University and also affiliated with the right-wing National Bureau of Economic Research and the left-wing Center for Economic Policy Research. The so-called “Dane with a Brain” is now back in the homeland at the Copenhagen Business School. The paper,

It is this idea of “everyone running for the exits” in financial markets that caught my eye, because I see both a general nervous tension in markets centered on a great deal of unrealized uncertainty—things that people are uncertain about, over an extended period of time, without either resolution or new direction. Tops on this list is the Fed and its command policies on interest rates.

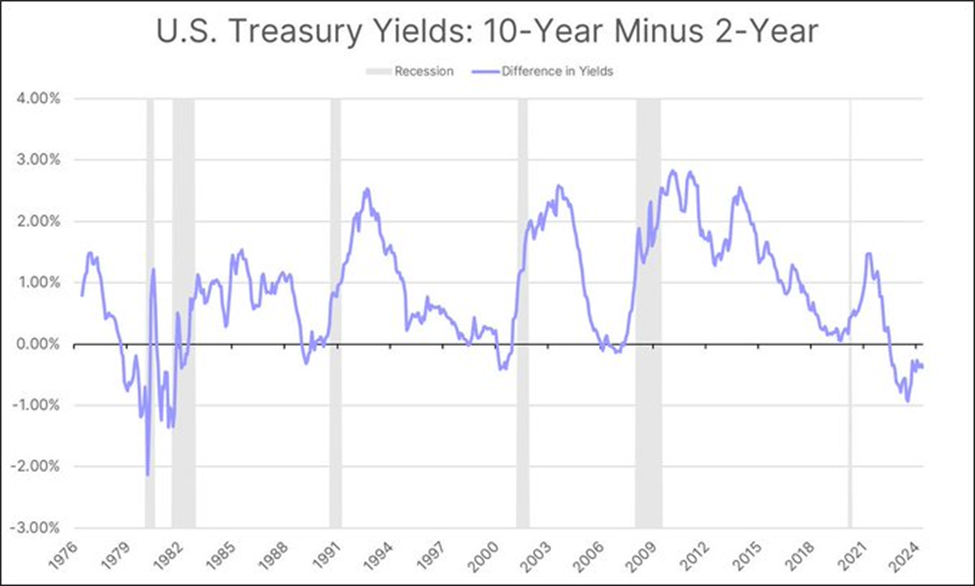

The Fed has been walking a policy tightrope. Rates are not high enough to crash the economy and bring down price inflation in the economy. Also, they are low enough to keep financial investors subdued and to prevent a job market collapse. However, we are also experiencing the longest inverted yield curve in modern history—a traditional signal of recession. They have also reduced their sales of government bonds and MBSs, a reduction in their so-called “Quantitative Tightening” policy and they have disgorged most of their Overnight Reverse Repurchase Agreements flooding the market with about $2 Trillion of credit over the last year. We have also seen financial regulators coddling and cajoling the commercial mortgage market to keep it from collapsing. https://fred.stlouisfed.org/series/RRPONTSYD

While the Fed has achieved some sort of macro or economywide stability, we have also seen three large banks fail, thus draining the FDIC insurance fund, a bubble in AI-Tech stocks, an upside-down mortgage market and housing market distortion, and a stall or even reversal in its disinflationary agenda. On the other hand, the news—as it is typically presented—appears to most people to be good news in the commercial real estate market and the labor market.

The two overriding and unaddressed uncertainties out there are 1.) The Fed’s interest rate policy. The Fed’s talk has been both dovish and hawkish and opinion on its direction has vacillated between extreme optimism (6 to 8 cuts) to extreme pessimism (no cuts) and now back to some middle ground (a few cuts). And 2.) The national election for President between Trump and Biden, which if you believe in the opinion polls, the Electoral College vote is even, a tossup, or too close to call. Adding to the uncertainty here is that neither party had a normal primary season so we have no reliable revealed data about the views of voters. Also, both major party candidates will be lame ducks, unable to run in the subsequent election, not to mention they are both old enough to be statistically dead even before the election takes place, so that creates even more uncertainty.

Another wildcard is that the Fed has been revealed as having a distinctly pro-Biden and anti-Trump bias and agenda. What do we make of that? Does it mean they will rush in and try to save Biden with politically motivated interest rate cuts before election day? Or does it mean they will try to engineer a huge economic disaster for an incoming President Trump? The safest bet I can see is that they will sit tight and allow the next crisis to play itself out and then come to the rescue in order to be seen in their preferred light. They are the ones who cause economic crises, but they want to be seen as economic saviors—the white knight riding in to save the day.

I felt I had to lay out these factors to see if you agree with them and if that makes for a situation where uncertainty, largely politically generated, can create an economic environment of instability. Whether that uncertainty and/or instability is significant enough to cause everyone to run to the exits of financial markets all at once is another question.

To address that question Professor Pederson’s paper investigated the Great Financial Crisis that ensued in the aftermath of the Fed’s Housing Bubble. Here is the abstract of the paper:

The dangers of shouting “fire” in a crowded theater are well understood, but the dangers of rushing to the exit in the financial markets are more complex. Yet, the two events share several features, and I analyze why people crowd into theaters and trades, why they run, what determines the risk, whether to return to the theater or trade when the dust settles, and how much to pay for assets (or tickets) in light of this risk. These theoretical considerations shed light on the recent global liquidity crisis and, in particular, the quant event of 2007.

Professor Pederson’s paper mentions that markets face both the possibility of liquidity crises as well as fundamental-based crises. However, the paper really only discusses the liquidity version of crises where there is not enough credit forthcoming from markets to fully finance the structure of assets. Yes, markets and regulators could do a better job of things, and some people can make money trading the crisis, but he concludes that the Fed’s willingness to provide collateralized loans to fill the liquidity gap saved the day.

Pederson only addresses the issue of liquidity crises, not fundamental crises. Of course, also left unsaid, is that the Fed is who crowded the theater with patrons and tinderboxes full of flammable debts in the first place.

Moreover, from an objective perspective we are not that concerned about liquidity crises. An economywide liquidity crisis is extremely unlikely in a world of a gold monetary system, full reserve deposit banking, and no lender of last resort, such as the Fed. In this environment, liquidity crises would likely only be a company specific event, rather than industrywide or economywide events. The value of the company or possibly its ownership might change, but it would have little impact on overall production, employment, or income.

Also, we should go back to the situation in the theater. Yes, yelling fire in a crowded theater is dangerous in terms of unnecessary injuries and deaths, but only if there is no fire! In the absence of the Fed, or even in its presence, we are more concerned with the theater actually burning down and killing all the patrons. In the market, this is the fundamental crisis problem, which can also be engineered by the Fed, and can lead to all the theaters in town burn down at once.

Do we have financial market situation primed for a situation for when everyone heads for the exits, including banks, bonds, stocks and real estate? What would ignite such a problem? We can’t know the answers to those questions for certain. However, we do know what would cause it on a fundamental level and we will be vigilant about placing the proper blame.

Conclusion

Longest Recorded Yield Curve Inversion: The yield curve has been inverted since July 2022. This is the longest period of inversion on record. We’ve produced a brief write-up explaining this measurement, which has historically been a leading indicator for recessions.

Types of Yield Curves: A normal yield curve shows low yields for shorter-maturity bonds and then increases for bonds with longer maturities, sloping upwards. A normal yield curve implies stable economic conditions and a normal economic cycle. A steep yield curve implies strong economic growth, with conditions often accompanied by higher inflation and higher interest rates. An inverted yield curve slopes downward, with short-term interest rates exceeding long-term rates. Such a yield curve corresponds to periods of economic recession, where investors expect yields on longer-maturity bonds to trend lower in the future. In an economic downturn, investors seeking safe investments tend to purchase longer-dated bonds over short-dated bonds, bidding up the price of longer bonds and driving down their yield. The chart below displays the difference between the 10-year U.S. Treasury yield and the 2-year U.S. Treasury yield. We charted this because it’s the most prominent comparison and is frequently discussed, but you could create a different comparison.

Importance of Yield Curve Inversion: A persistent negative spread between 2-year and 10-year U.S. Treasury yields is a key input into many analysts’ models as a reliable predictor of recession, having been observed in the lead-up to nearly all recessions since 1955, per Reuters. During the aforementioned period, it offered a false signal just once. There has been a growing discussion as to whether the yield curve is a reliable indicator. Nearly two-thirds of strategists in a March 6-12 Reuters poll of bond market experts, 22 of 34, said the yield curve’s predictive power is not what it once was. It remains to be seen whether the inversion will pre-empt a recession. We’d be interested in hearing your opinion on the matter!

This is the transcript of Mark Thornton’s podcast, Minor Issues, 6/29/2024.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter