Behind closed doors, the report is already making the rounds in expert circles: if you follow the rules of sound commercial accounting, the United States Federal Reserve (Fed) has lost its equity and is, as common language would have it, bankrupt. What happened?

During spring 2020 (i.e., in a period of extremely low interest rates), the Fed purchased large amounts of government bonds and mortgage bonds to support the economy and financial markets during the covid crisis.

The Fed paid for the purchases by issuing vast amounts of new central bank money. This has created an enormous “money surplus” in the US interbank market, where banks lend money to one another. It is exactly in this market where the interest rates for all other credit markets are determined.

However, the excess money supply now exerts strong downward pressure on the interbank interest rates. Since this is not desirable from a monetary policy point of view—after all, the Fed is raising the key interest rate with the intention of making interbank credit more expensive, slowing down economic growth, and lowering inflation—the Fed’s Open Market Committee has decided to pay interest on the excess balances that the banks hold at the Fed.

This interest rate is currently 5.15 percent. This is close to the Fed’s official key interest rate, which is currently between 5.00 and 5.25 percent. In doing so, the Fed has set an interest rate limit in the interbank money market: no bank can lend its excess money supply for less than 5.15 percent if it gets this rate from the Fed.

In addition, the Fed grants “privileged nonbanks” the opportunity to conclude so-called reverse repurchase agreements with the Fed—this select group includes asset managers, investment companies, pension funds, and others. This agreement allows them to transfer the balances they and their customers do not need to the Fed “overnight” in exchange for interest-bearing securities. In return, they earn an interest rate of 5.05 percent, slightly below, but still close to, the minimum interest rate on the interbank market.

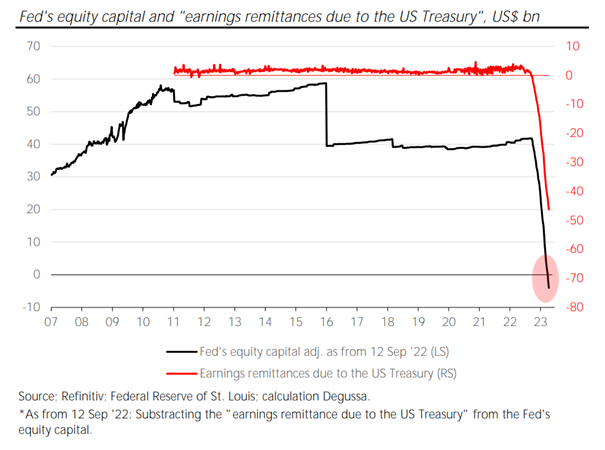

While this means that the Fed has full control over the interest rates in the money market, it is committed to making interest payments that are higher than the interest payments it receives on its securities portfolio. Since the Fed has been paying more interest than it collects for some time now, a massive negative interest result has built up on the Fed’s balance sheet. It is recorded as a balance sheet liability. The usual US Treasury retained earnings, which are positive under normal circumstances, were negative $54.5 billion as of April 12, 2023 (or negative $44.2 billion on a consolidated basis).

If, however, a book entry that the Fed shows on the liability side of its balance sheet (i.e., under its liabilities) has a negative sign, this means nothing other than that it reduces the overall debt. One can rightly become suspicious here: this accounting practice is hardly compatible with truth and clarity when it comes to balance sheet accounting. Rather, it obscures the fact that the Fed’s debt has effectively eaten away its reported equity, which was just $42.2 billion at the time. In other words, the Fed’s liabilities are greater than its assets; in commercial accounting terms, this means “overindebtedness.”

It is worth noting that the Fed’s book loss would be much larger if it were to report on its balance sheet the debt securities it purchases at market values (“mark-to-market”) rather than at historical cost. By the way, it is the Fed’s interest-rate-hiking spree that has security prices plummeting.

The Fed currently holds around $8.5 trillion in debt securities on its balance sheet. A price drop of just, let’s say, 5 percent on this debt portfolio would result in an accounting loss (an “unrealized loss”) of $425 billion, reducing the Fed’s equity capital by the same amount. (It should be noted here that if the Fed held the securities to maturity and the borrowers repaid them in full, the accounting loss would disappear by maturity.)

Any conventional company would be in dire straits under these circumstances. (By the way, failing to report a loss would be a punishable offense in many countries.) However, the Fed, like any other central bank, is not a conventional company. Rather, it has the state monopoly of money production, which makes it truly special.

The central bank can produce the money with which it needs to pay off its liabilities at any time and in any amount. However, a central bank cannot become insolvent like a traditional company. In fact, it could continue to operate even if its equity were depleted (i.e., if it were zero or negative, which is recorded on the assets side of its balance sheet).

Of course, the Fed’s lack of equity could be remedied. This would be the case, for instance, if the US Treasury transferred newly issued government bonds to the Fed for free. The Fed’s assets would increase, so the Fed’s equity would increase if and when its liabilities remained the same.

The gold reserves on the Fed’s balance sheet could also be revalued. Since the early 1970s, the Fed’s 261.5 million gold troy ounces have been valued at $42.22 per troy ounce, equivalent to $11.04 billion. At current prices, however, the gold on the Fed’s balance sheet has a market value of approximately $520 billion. That said, the revaluation of the Fed’s gold could produce a revaluation gain of around $510 billion—and bolster Fed equity accordingly.

While such a “cooking the books” could indeed “save” the Fed’s balance sheet, it doesn’t mean investors wouldn’t become concerned and have doubts about the whole US dollar construct. If the Fed has already run out of equity, what must the situation be like in the commercial banking sector? Also, if its balance sheet is already overstretched, will the Fed still be in a position to function as a “lender of last resort” in the next crisis?

The Fed’s balance sheet, in which liabilities exceed assets, is a red flag. Investors could lose confidence in the reliability and value of the US dollar and all currencies based on it. Who could blame investors if that eventually happened? In fact, the Fed’s negative equity is just another sign of the growing trouble in the world’s fiat money regime dominated by the US dollar.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter