Monthly Archive: May 2023

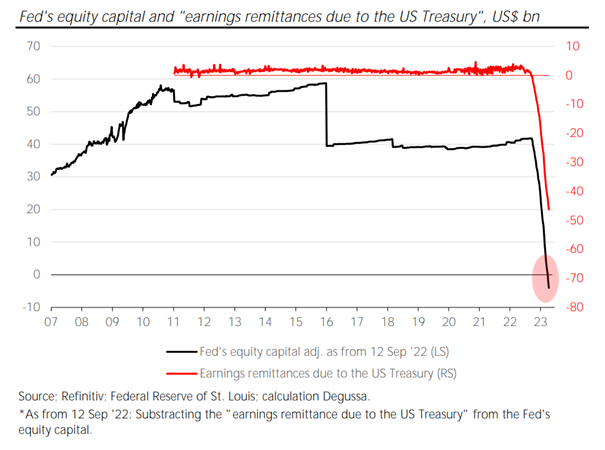

The Fed Is Overindebted, Isn’t It?

Behind closed doors, the report is already making the rounds in expert circles: if you follow the rules of sound commercial accounting, the United States Federal Reserve (Fed) has lost its equity and is, as common language would have it, bankrupt. What happened?

During spring 2020 (i.e., in a period of extremely low interest rates), the Fed purchased large amounts of government bonds and mortgage bonds to support the economy and financial markets...

Read More »

Read More »

The Income Tax: Lessons from the Sixteenth Amendment

The passage of an income tax in the early twentieth century was an enormous shift toward a far more centralized and powerful US state.

Original Article: "The Income Tax: Lessons from the Sixteenth Amendment"

Read More »

Read More »

Prevent Future Losses Like East Palestine by Reducing Regulation and Empowering Torts

To prevent rail accidents like the one in East Palestine, dial back government regulation and allow the tort system to work.

Original Article: "Prevent Future Losses Like East Palestine by Reducing Regulation and Empowering Torts"

Read More »

Read More »

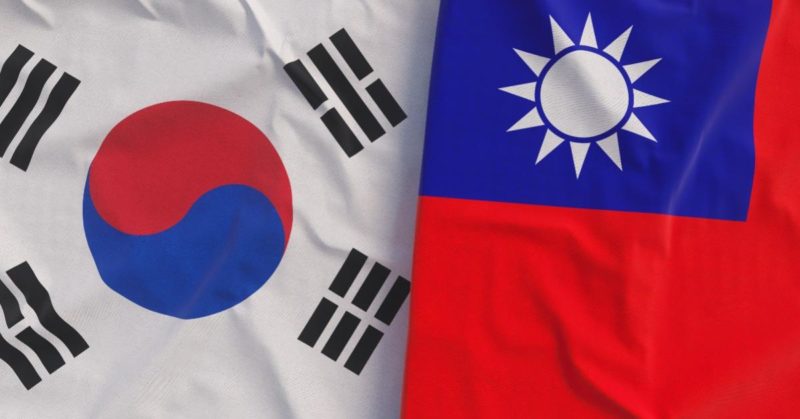

Was Japanese Colonialism the Engine of Later Prosperity for Korea and Taiwan? Probably Not

Mainstream historians attribute the postwar economic success of South Korea and Taiwan to the legacy of Japanese colonialism. The Japanese are credited with providing new technologies, critical infrastructure, and an efficient state that enabled industrial progress in South Korea and Taiwan. Both Taiwan and Korea benefitted from the successful adoption of Japanese technologies and recorded industrial growth under imperial rule.

Moreover, during...

Read More »

Read More »

The Greenback Continues to Struggle

Overview: There is a nervousness that hangs over the capital markets.

Although US banks shares recovered at the end of last week, many continue to

see the sector’s challenges as the harbinger of a dramatic reversal in the Fed’s

stance. America’s debt ceiling looms large and could be a few weeks away. China

led Asia Pacific bourses higher, and, ironically, its bank shares extended their

rally. Japan, returning from last week’s holiday was notable...

Read More »

Read More »

Financial Savvy Ways To Thrive In The Auto Market

The auto market can be challenging and unpredictable, but with the right strategies and insights, automotive business owners can thrive. This article will explore the financial savvy ways to succeed in the auto market, focusing on understanding the current landscape, saving money, using modern financial tools and AI, and navigating warranties and service contracts. …

Read More »

Read More »

Disinformation and the State: The Aptly Named RESTRICT Act

Federal laws with acronyms are usually bad news. (Think the USA PATRIOT Act.) The RESTRICT Act is yet another Orwellian proposal in which the federal government assumes ignorance is strength.

Original Article: "Disinformation and the State: The Aptly Named RESTRICT Act"

Read More »

Read More »

Lincoln’s Main Target Was “Anarchy” and Secession, Not Slavery

Once the Southern states accepted the Thirteenth Amendment, Lincoln was entirely content for the old Southern elites to resume their positions of power and for many blacks to continue in a condition little better than bondage.

Original Article: "Lincoln's Main Target Was "Anarchy" and Secession, Not Slavery"

Read More »

Read More »

A Pyrrhic End to 130 Years of Vicious Bad Money and Banking Crises

The current banking crises have deep roots in US financial history. Monetary authorities have engaged in inflationary behavior for more than a hundred years.

Original Article: "A Pyrrhic End to 130 Years of Vicious Bad Money and Banking Crises"

Read More »

Read More »

Week Ahead: Hawkish BOE, US and China CPI, but is the Fed Really Going to Cut Rates by 75-100 bp This Year?

The combination of the US bank stress, the approaching debt

ceiling, and the Fed's opening the door to a pause in rates weighed on risk

sentiment and dragged the greenback lower. KBW's indices for large and regional

bank shares bled 7.4%-8.0% lower last week to cut through March's lows like a hot

knife through butter. Still the price action was constructive ahead of the

weekend. US Treasury Secretary Yellen warned that the X-date when the...

Read More »

Read More »

Bank Reserves

Bank reserves are seldom mentioned except in cases of bank runs. The other possible mention is all the interest money the Fed pays to banks simply for holding reserves. Mark explains the role of bank reserves in the current "system" and gives a brief explanation of why the Austrian view is better and actually gets the job done.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

Argentina Sleepwalks into Hyperinflation (Yet Again)

The Argentine peso has lost half its value in one year. Both the official and parallel exchange rates with the US dollar and the Mexican peso have doubled in one year. Consumer prices have doubled in one year. The quantity of Argentine pesos has doubled in one year. All the rates at which these variables are increasing have also doubled in one year. Expecting everything to double again in half a year is now a conservative projection.

Argentina was...

Read More »

Read More »

The Progressive Era and the Family

[Originally from Joseph R. Peden and Fred R. Glahe, eds., The American Family and the State (San Francisco: Pacific Research Institute, 1986).]

While the "Progressive Era" used to be narrowly designated as the period 1900–1914, historians now realize that the period is really much broader, stretching from the latter decades of the nineteenth century into the early 1920s. The broader period marks an era in which the entire American...

Read More »

Read More »

A Credit Crunch Is Inevitable

Federal Reserve data shows $98 billion of deposits left the banking system in the week after the Silicon Valley Bank collapse. Most of the money went to money-market funds, as the Bloomberg data shows that assets in this class rose by $121 billion in the same period. The data shows the challenges of the banking system in the middle of a confidence crisis.

However, as many analysts point out, this is not necessarily the main factor that dictates the...

Read More »

Read More »

Washington Has No Moral Authority to Ban Guns

After the hate crime against Christians perpetrated by a transgender shooter in Nashville in March 2023, there was the usual outcry to ban firearms.

Days after the killing spree, activists staged an insurrection at the Tennessee State Capitol calling for tougher gun laws. This despite the fact that many in favor of gun control politicized the violence and called for more of it.

However, the most jarring of all the gun-ban reactions to the Nashville...

Read More »

Read More »

The Economics of Arts and Culture

Both artists and athletes perform for others. When governments get involved it either is for subsidies or censorship. Neither is satisfactory.

Original Article: "The Economics of Arts and Culture"

Read More »

Read More »

Can Supercomputers Make Socialism Work?

Jonathan Newman joins Bob to critique a recent Twitter argument where some were claiming that supercomputers solved the socialist calculation problem.

The Twitter thread on AI and Socialism: Mises.org/HAP394a

Bob on Socialism and calculation vs knowledge: Mises.org/HAP394b

Karras Lambert and Tate Fegley on economic calculation and AI: Mises.org/HAP394c

[embedded content]

Read More »

Read More »

Is Social Justice Just? A Review

Is Social Justice Just?Edited by Robert M. Whaples, Michael C. Munger, and Christopher J. CoyneIndependent Institute, 2023; xxiii + 348 pp.

Before one can answer the question posed by this excellent book’s title, one needs to ask what social justice is, and answering this proves to be no easy task. As Robert Whaples says, “For many, the term social justice is baffling and useless, with no real meaning. Most who use it argue that social justice is...

Read More »

Read More »

Austrian Economists and Empiricism

Austrian economics is defined by its adherence to the a priori methodology, not empiricism. That places it at odds with mainstream economics, which stresses the methodology of positivism.

Original Article: "Austrian Economists and Empiricism"

Read More »

Read More »

Shedding Light on the Law of Unintended Consequences

The US Department of Energy has recently announced two new rules banning the manufacture of incandescent light bulbs starting in July 2022 and phasing in standards across industries over the following months. The Biden administration claims that this ban is a cost-saving measure that will “save consumers about $3 billion annually when fully implemented.” However, the net impact of this policy is unclear since the substitution of incandescents for...

Read More »

Read More »