Monthly Archive: February 2023

Biden versus Bastiat

Whether well-intentioned or otherwise, a “Made in China” ban for construction materials on federally funded infrastructure projects will benefit a chosen political class to the detriment of all else.

“This rival, which is none other than the sun, is waging war on us so mercilessly . . . We ask you to be so good as to pass a law requiring the closing of all windows, dormers, skylights.”

Frédéric Bastiat’s scathing satire of the absurdity of...

Read More »

Read More »

Fed Tightening Seen Extending into Q3

Overview: The prospect that the Federal Reserve tightening

cycle continues into early Q3 is underpinning the greenback today against

most of the G10 currencies. The dollar bloc is the notable exception, and they

are posting minor gains, perhaps encouraged by the firmer equity markets. The

minutes of this month’s FOMC meeting appear to show wide support for quarter

point hikes going forward and there did not seem to be much discussion of the...

Read More »

Read More »

Vermont Seeks to Become 44th State to Roll Back Sales Tax on Sound Money

(Montpelier, Vermont) – On the heels of overwhelming votes to remove all taxes from purchases of precious metals in Mississippi, legislators in Vermont have introduced a measure to curtail the controversial tax in their own state.

Introduced yesterday by Rep.

Read More »

Read More »

Ludwig von Mises’s Monetary Theory in Light of Modern Monetary Thought

Ludwig von Mises's contributions to the development of the technical methods and apparatus of monetary theory continue to be neglected today, despite the fact that Mises succeeded exactly eight decades ago, while barely out of his twenties, in a task that still admittedly defies the best efforts of the most eminent of modern monetary theorists, viz., integrating monetary and value theory. Such a unified and truly "general theory" is...

Read More »

Read More »

SNB dumps FANGS. Should You?

John Rubino and Patrick Highsmith of Firefox Gold return as guests on this week’s program.

The Swiss National Bank (SNB) loaded up on some of the largest cap stocks in the world like MSFT, GOOG, AMZN, TSLA, XOM and many more in order to weaken the Swiss francs vis-a-vis the Euro and the Dollar.

Read More »

Read More »

Money versus Monetary Policy

Money is simple. The political program of monetary "policy" is not.

Original Article: "Money versus Monetary Policy"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Power of Woke: How Leftist Ideology Is Undermining Our Society and Economy

“It’s an important part of society whether you like it or not,” lexicologist Tony Thorne, referring to “wokeness,” told The New Yorker’s David Remnick in January. That’s an understatement.

Wokeness is poisoning the Western workplace and constraining small and family businesses, midsized banks, and entrepreneurs while enriching powerful corporations and billionaires. It’s eating away at the capitalist ethos and killing the bottom-up modes of...

Read More »

Read More »

Supporters Summit 2023

Save the date!

Join us for our 2023 Supporters Summit, October 12–14, at the Mises Institute in Auburn, Alabama.

Lew Rockwell and Jeff Deist will host a weekend filled with engaging discussion and social time with other Mises members and speakers. We'll open Thursday evening, October 12 with a reception in Auburn. Friday, October 13, we'll have discussions and lunch at the Institute and close with a dinner at the new and unique Botanic in...

Read More »

Read More »

Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

We're still living with the consequences of the massive monetary inflation by Trump and Biden. Prices are stubbornly high, and falling real wages are driving Americans to say things are getting worse.

Original Article: "Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Joe Biden and Protectionism: Continuing to Make America “Grate”

Nobel Prize–winning economist George Stigler once wrote of economists as preachers, which he described as involving offering “a clear and reasoned recommendation (or, more often, denunciation) of a policy or form of behavior by men or societies of men,” particularly with respect to the ethics of market competition. With regard to defending those ethics (i.e., defending mutually voluntary arrangements that individuals make with one another versus...

Read More »

Read More »

Investors Shaken by Rising Rates

Overview: The surge in US interest rates and sharp

losses in US stocks sent the dollar broadly higher in North America yesterday. The

$42 bln of two-year notes auctioned by the US Treasury saw the highest yield in

more than a quarter-of-a-century (4.67%) and it still produced a small tail.

Sterling, helped by its own surprisingly strong data, was the only G10 currency

to have gained against the surging dollar. Still, no important technical levels...

Read More »

Read More »

Secession: Should the American Revolutionaries Have Quit to Appease the Loyalists?

When advocates of secession in the United States bring up “national divorce,” a common objection we hear is that secession can’t be allowed because it would make some people worse off. For example, we’re told that if, say, a majority of Floridians voted to secede, that still can’t be allowed because there would still be a minority that opposes secession. We especially hear this in the context of so-called red states—where, presumably, a majority of...

Read More »

Read More »

The Price-Gouging State

Politicians and the media are blaming businesses for inflation when, in fact, the skyrocketing prices of nearly everything have a government stamp on them.

Original Article: "The Price-Gouging State"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don't control, you stop paying attention to it.

Read More »

Read More »

A Student Loan Fable

A student goes into a bank. He tells the personal loan banker, “I want to borrow $7,500 per year for the next four or five years.”

“That’s at least $30,000 over time,” the banker says. “Personal loans have a 10 percent interest factor.”

“For my loan,” says the student, “I need an interest rate close to a home mortgage, like 6 percent. Also, I don’t want to be charged interest for the first four or five years of the loan.”

The banker asks, “How long...

Read More »

Read More »

Lipton Matthews: A 5-Way Global Perspective on Innovation and Entrepreneurship in the USA

Entrepreneurship and innovation are the keys to economic growth and higher standards of living. The USA has long enjoyed leadership status on these dimensions — people see the USA as the land of entrepreneurs and the source of new ideas and advances in business. Is the reputation still deserved? Or is it being eclipsed as part of the general decline in standards and capabilities that we observe? Lipton Matthews is a global economic and...

Read More »

Read More »

Yes, the US Government Has Defaulted Before

While the 1979 default was relatively small, the 1934 default affected millions of Americans who had bought Liberty Bonds mistakenly thinking the government would make good on its promises.

Original Article: "Yes, the US Government Has Defaulted Before"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Forget the Liquidity Trap—Loose Monetary Policies Cause Recessions

Advocates of Keynesian economics believe the Federal Reserve should pursue policies that will prevent the possible decline of the economy into a liquidity trap. But what is a liquidity trap?

Economic activity often is presented in terms of a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and spending by another individual becomes part of the first individual’s earnings. Recessions, by this...

Read More »

Read More »

Upside Surprise in UK’s Flash PMI and Better-than-Expected January Public Finances Lift Sterling

Overview: Rising interest rates are weighing on risk

appetites and the dollar is broadly stronger. Sterling is a notable exception

after a stronger than expected flash PMI and better than expected public

finances. The correlation between higher US rates and a weaker yen is

increasing and the greenback looks poised to rechallenge the JPY135 area. A

slightly better than expected preliminary PMI and hawkish minutes from the

recent RBA meeting has done...

Read More »

Read More »

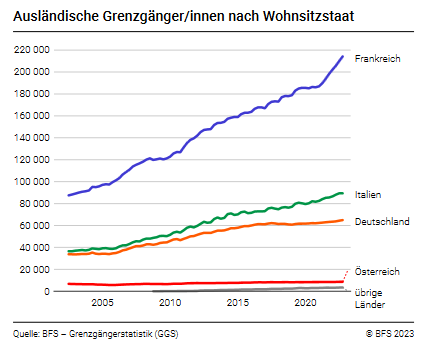

The number of cross-border commuters rose by 6.1% in 4th quarter 2022 over a one-year period

The number of workers holding a cross-border commuter permit (G permit) increased by 6.1% between the 4th quarters of 2021 and 2022 with 380 000 persons. Their share in the employed population was 7.3% (+0.4 percentage points).

Read More »

Read More »