Decades of central bank distortions and regulatory / market-share capture by cartels and monopolies have completely gutted “markets,” destroying their self-correcting dynamics.

Decades of central bank distortions and regulatory / market-share capture by cartels and monopolies have completely gutted “markets,” destroying their self-correcting dynamics.

Unintended consequences introduce unexpected problems that may not have easy solutions. An entirely different set of problems are unleashed as unintended consequenceshave their own unintended consequences. This is the problem with complex emergent systemssuch as economies, societies and global supply chains: the system’s feedback, leverage points and phase-change thresholds are not necessarily visible or predictable, yet these dynamics have the potential to cascade small failures into systemic collapse.

The unintended consequences of unintended consequences are called second-order effects: consequences have their own consequences.

So for example, you juice your economy with massive stimulus after a lockdown that upended consumers and global supply chains, crushing both demand and supply, and suddenly you have rip-roaring inflation as demand comes back while supply chains remain tangled.

Shifting critical industrial production to frenemies so corporations could maximize profits while reducing the quality of goods and services seemed like a good idea until the potential costs of that dependence on frenemies become apparent.

Assuming oil and natural gas would always be in abundance made sense when they were abundant, but geopolitical forces kicked that assumption into the gutter. All the reassuring economic stories we told ourselves–energy is only 3.5% of the economy and the household spending budget, so cost really doesn’t matter–fall off the cliff when availability and supply become the paramount issues setting price.

That 3.5% loses meaning when there’s not enough to supply demand and somebody loses the game of musical chairs.

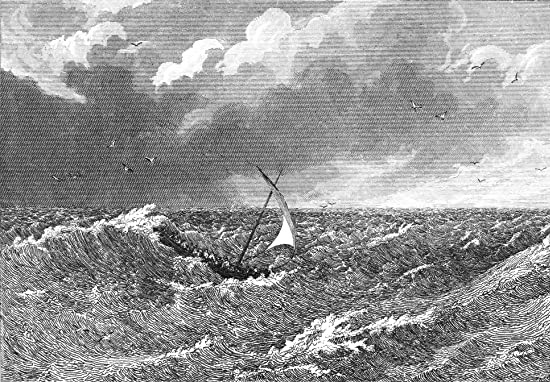

Then there’s the fantasy that monetary policy imposed by central banks control inflation. The inconvenient reality is central bank monetary policy is akin to building sand castles on the beach: when the tide is ebbing, the castles look magnificent. When the tide is rising, the sand castles are quickly washed away.

Inflation is actually a consequence of much larger forces that central banks don’t control: demographics (labor supply), social changes (quiet quitting, laying flat, let it rot), supply of essential minerals/materials, flows of private-sector capital, and most profoundly, the real-world productivity of capital, labor and state policies.

The tide of inflation has reversed and is now rising. This tide is gradual and will temporarily be reversed by the gluts of supply that inevitably follow artificial scarcities and the deflationary impact of credit-asset bubbles popping. But these reversals will be temporary and misleading: inflation has reversed for structural reasons unrelated to credit-asset bubbles and temporary gluts.

Another fantasy is that “markets are self-correcting” and will sort themselves out. The inconvenient reality is sometimes markets sort themselves out by crashing, as a good cleaning is the only cure for decades of distortion, manipulation, fraud, embezzlement and the dead hand of cartels and monopolies, whose sole reason to exit is to strangle market forces to enable unfettered profiteering and control of what’s passed off as “markets.”

Decades of central bank distortions and regulatory / market-share capture by cartels and monopolies have completely gutted “markets,” destroying their self-correcting dynamics. This is why Crash Is King.

This is the ultimate irony of the Unintended Consequences of Unintended Consequences: the more insiders and elites attempt to “fix” the cascade of second-order Unintended Consequences, the more Unintended Consequences they unleash.

Tweaking existing distortions and profiteering won’t work. Clearing the mess requires a collapse of all the distortions and profiteering skims / scams of cartels and monopolies, which is why I say Crash Is King.

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter