In the July 26 Financial Times article entitled “Is the Dollar about to Take a Turn?,” Barry Eichengreen writes that the US dollar has had a spectacular run, having risen more than 10 percent against other major currencies since the start of the year. According to Eichengreen, the key reason behind the spectacular strengthening in the US Dollar is that the Federal Reserve has been raising interest rates faster than other big central banks, drawing capital flows toward the US.

However, given the likelihood of a recession and a decline in inflation, Eichengreen believes that the Fed could start softening its stance, weakening the dollar in the coming months. Note that Eichengreen, while attempting to explain the exchange rate determination, does not make a distinction between fundamental factors and nonfundamental factors that drive the currency rate of exchange.

Fundamental versus Nonfundamental Causes

Various factors are perceived to be key drivers in determining an exchange rate. For instance, an increase in government foreign debt is regarded as a sign of a likely deterioration in economic fundamentals ahead, providing the rationale for the selling of the currency of concern.

Most economic commentators believe balance of trade is another key factor in the currency exchange rates. All other things being equal, an increase in imports, which leads to a trade deficit, gives rise to an increase in the demand for foreign currency. To obtain foreign currency, importers purchase it with domestic currency. As a result, this causes a strengthening in the exchange rate of the foreign currency against the domestic currency—i.e., more domestic money per unit of a foreign money.

Conversely, all other things being equal, an increase in exports leads to a trade surplus. Once exporters exchange their foreign currency earnings for domestic money this sets in motion a strengthening in the domestic money exchange rate against the foreign money. (Less domestic money per unit of a foreign money).

Alternatively, consider the case when the central bank tightens its interest rate stance. The increase in the domestic interest rate, all other things being equal, attracts foreigners demand for domestic money. Consequently, this lifts the price of the local currency in terms of foreign currency.

These factors including government debt, interest rate differential, the state of the economy and the balance of trade are important factors in exchange rate determination. We can also add to these various psychological factors that would appear to be important in the currency exchange rate determination. Thus, a change in individuals’ perceptions regarding the state of the economy is likely to influence exchange rates.

Rather than focusing on numerous factors, it would make more sense to identify the key or the essential factor that determines the currency rate of exchange. For example, the essence of individuals’ actions is conscious and purposeful conduct, and that money is a medium of exchange. Individuals exchange goods and services for money.

The Relative Purchasing Power of Money—the Essence of the Exchange Rate

Exchange rates are determined by the relative changes in the purchasing power of various monies. A price of a basket of goods is the amount of money paid for this basket. We can also say that the amount of money paid for a basket of goods is the purchasing power of money with respect to the basket. If in the US the price of a basket is one dollar and, in the eurozone, an identical basket of goods is sold for two euros then the rate of exchange between the US dollar and the euro is likely to be two euros per dollar.

An important factor in setting the purchasing power of money is the supply of money. If over time the growth rate in the US money supply exceeds the growth rate of European money supply, all other things being equal, this will put pressure on the US dollar.

Since a price of a good is the amount of money per good, it means that the prices of goods in dollar terms will increase faster than prices in euro terms, all other things being equal. As a result, an identical basket of goods is priced now let us say at two dollars against one dollar previously while in the eurozone it is now priced at 2.5 euros against 2 euros previously.

This would imply that the exchange rate between the US dollar and the euro should now be 1.25 euros per one dollar. Since changes in the domestic money supply affect its general purchasing power with a time lag, this means that changes in relative money supply affect exchange rates also with a time lag.

Deviation of the Exchange Rate from the Relative Purchasing Power Sets in Motion Arbitrage

Any deviation of the exchange rate from the relative purchasing power of money will likely create profit opportunities, which over time will undo that deviation. For instance, the deviation could emerge because of the market response to the trade account data or because of a change in the interest rate differential in the domestic economy versus other economies. Those deviations will set motion profit opportunities into motion, which ultimately will undo these differences.

Assume that the Fed raises its policy interest rate while the European Central Bank (ECB) keeps its policy rate unchanged. This increases the demand for dollars from the holders of the euros. Consequently, the holders of the euros are now exchanging more of them for dollars, and these dollars, in turn, are placed in the dollar deposits in order to earn higher interest rates.

If the price of a basket of goods in the US is one dollar and in eurozone the price of an identical basket is two euros, then according to the purchasing power framework the currency rate of exchange should be one dollar for two euros. Because of a widening in the interest rate differential between the US and the eurozone, an increase in the demand for dollars pushes the exchange rate in the market toward one dollar for three euros.

As a result, the dollar is now overvalued versus the exchange rate as dictated by the relative purchasing power of the dollar versus the euro (it should be two euro to one dollar and not three euro to one dollar). In this situation, it pays to sell the basket of goods for dollars then exchange dollars for euros and then buy the basket of goods with euros—thus making a clear arbitrage gain.

| For example, individuals could sell a basket of goods for one dollar, exchange the one dollar for three euros, and then exchange three euros for 1.5 basket, gaining an extra 0.5 of a basket of goods. (Please note that the price of the basket of goods in the eurozone is two euros.)

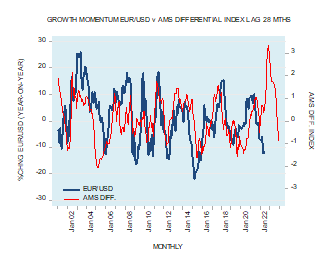

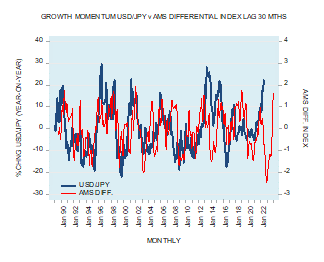

The fact that the holders of dollars increased their demand for euros in order to profit from the arbitrage will make euros more expensive in terms of dollars—pushing the exchange rate in the direction of one dollar for two euros. Arbitrage is always set in motion once the rate of exchange deviates, for whatever reasons, from the rate of exchange as dictated by the relative purchasing power of monies. Based on the lagged money growth differential, the yearly growth of the price of the euro in US dollar terms is likely to strengthen ahead. The yearly growth rate of the price of the dollar in yen terms is likely to weaken visibly (see chart). |

. |

| The driving factor behind the strengthening in the US dollar against the euro and the yen is the lagged money growth differential. Using this differential tells us that the US dollar is likely to weaken ahead against major currencies (see chart). Again, the weakening in the dollar is likely to occur because of the lagged money growth differential and not so much because of an emerging recession and an expected reversal in the Fed’s interest rate stance. |

. |

Summary and Conclusion

Contrary to the popular view, the state of the balance of payments does not determine exchange rates. Neither are the interest rate differential nor various psychological considerations the driving factors of the currency exchange rate, key factor, instead, being the relative purchasing power of money.

When market currency exchange rate deviate from the exchange rate, as dictated by the relative purchasing power of various monies, this activates an arbitrage, which works toward the convergence of the exchange rate toward the relative purchasing power of money. Furthermore, the relative purchasing power of money, all other things being equal, is set in motion by the lagged relative supply of various moneys. This in turn means that the currency exchange rate is driven by the lagged relative supply of various monies, all other things being equal.

Using the lagged money growth differential, we can suggest that the US dollar is likely to come under pressure against the euro and the yen.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter