| With the Consumer Price Index (CPI) hitting a forty-year high of 9.1 percent, the Bank of England has responded by raising interest rates to 1.25 percent, up by 0.25 from the previous period. This, alongside ex-chancellor and PM hopeful Rishi Sunak planning to “tackle inflation before tax cuts,” signals a poor plan for combating the rising effects of inflation.

First, inflation must be defined by its cause rather than its effect for the monetary authorities to enact a sound recovery policy. Inflation in the truest sense is an excess increase in the money supply over the real demand for money (MS > MD). MD, which is an inverse of velocity, is measured by the quantity of nominal pounds sterling economic actors hold over a period of time in order to acquire a higher purchasing power for future consumption. This means individuals are withholding current consumption in preference of future consumption. This time preference is an important concept, as it is what makes interest possible. Other variables may affect interest rates, such as risk or time until final settlement, but the time preference for future/current consumption lays the foundation. Despite Milton Friedman’s wise words, inflation is not simply a monetary phenomenon but a monetary and time phenomenon. The time lapse between production and consumption, alongside the furlough scheme during the 2020 covid outbreak, can help us better understand the financial cost and tradeoffs people now face and what the monetary authorities should do. |

|

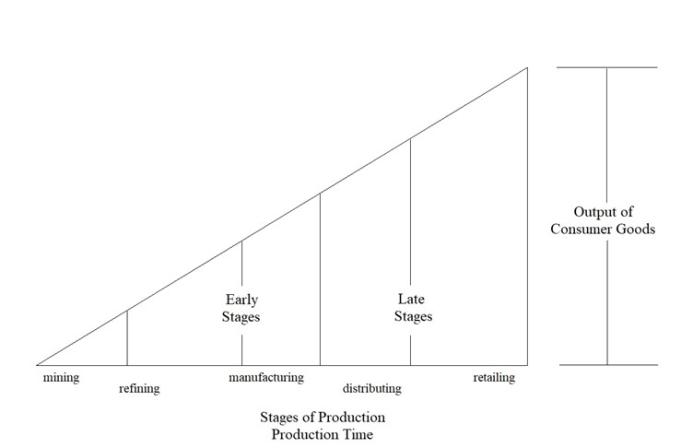

| The Hayekian triangle above, where the production process is hypothesized as an input-output process, denotes the stages and time process of production; “the horizontal leg is representative of the production time, and the vertical leg is a measurement of the value of consumable outputs.”

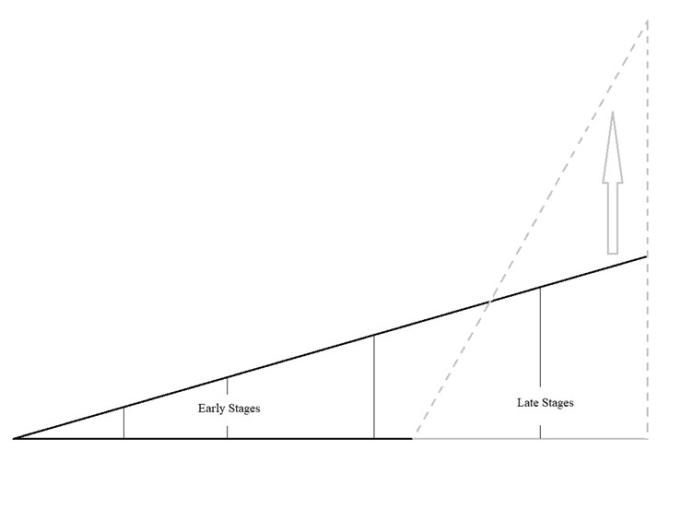

As economic actors restrict their current consumption in favor of future consumption, social savings pool. This changes the structure of the multiperiod production process: the later stages of production contract and the early stages expand. This allows the interest rate to fall, as there are more financial resources available for loans, investment, and expansion. By refraining from current consumption, people expand earlier stages of production so that future consumers will be able to consume more goods they value at a lower price. This is what occurs under “normal” circumstances. Due to lockdowns and the furlough scheme, however, the money and time markets have been distorted. Another way of looking at the nature of the high inflation rate is that excess money has entered the economy faster than goods and services have been produced. This can be observed by returning to an adjusted Hayekian triangle: Here the darker triangle represents the production process during the covid outbreak and lockdown, and the scattered gray triangle represents current consumption. With production processes in many stages halted and with furlough payments going to businesses and workers who were not being productive, the money supply was increasing faster than production during the lockdown. |

|

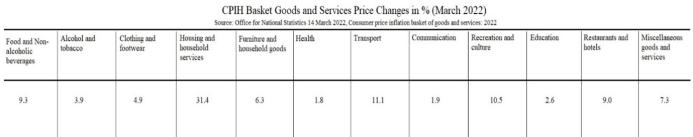

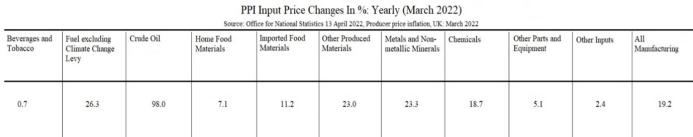

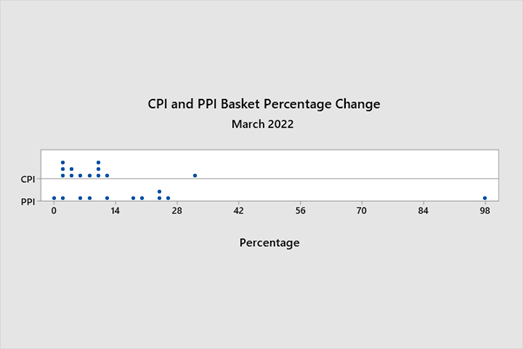

So Why Are We Only Now Feeling Inflation’s Effects?The distorting effects of inflation are not felt instantaneously because money circulates through the economy at differing velocities for different sectors. This is why it is important to look not only at the average rate, but at all the price changes for the goods within the CPI basket; this helps to identify where the excess money is circulating and how much. Therefore, not all price distortions will be the same: some prices will rise faster than others, some much slower; others may increase by larger percentages, while goods valued less may increase by lower percentages. This is seen by looking at the CPI basket of goods and Produce Price Index (PPI) input goods in the March 2022 reports: |

|

|

As shown above, the most extreme changes in the CPI and PPI reports were a 31.4 percent increase for housing and household services and a 98.0 percent increase for crude oil. Furthermore, we can visualize the spread of the price distortions by using a dot plot: |

|

|

Getting back to the matter, the Bank of England’s low-rate policy and the remaining high tax rates are not effective policy measures for curbing the rising inflation. The high tax rates leave consumers with less expendable income, forcing up their cost of living and discouraging them from saving. Moreover, government spending contributes to the circulation of excess money and simply changes the makeup of our gross domestic product. Instead of the goods they want, consumers get more of what government wants; instead of more houses and petrol, we get more ditches being dug up to be refilled. Additionally, the Bank of England’s low-rate policy fails to address the reality that the excess money is being spent faster than it is being saved; a low rate of interest fails to reflect not only people’s expectation of higher inflation to come, but also economic actors’ present preference for current consumption. |

So What Should the Monetary Authorities Do?

With the nominal interest rate being 1.25 percent, the real rate is negative, adjusting for inflation:

The Bank of England should aim to raise interest rates to a minimum of 13.50 percent, so as to ensure that after adjusting for inflation, the real rate would not be negative but would sit at 4.4 percent. This would help to properly signal that now is an appropriate time to save and would assist in incentivizing the private sector to take such actions. This would also, in principle, help curb incentives for banks to take high-risk loans.

By increasing the interest rate to a nominal level of 13.5 percent, savers and investors will see there is a high demand to allow earlier stages of production to expand, allowing for high future output.

Additionally, the government should temporarily freeze value-added taxes and sales taxes in order to reduce the tax burden on consumers during the cost-of-living crisis. Finally, the government should temporarily freeze the capital gains tax until inflation falls to its target rate of 2 percent. This would ensure that investors receive 100 percent of their returns, further incentivizing large-scale investments to expand production processes and creating new, value-inducing jobs.

The inflation and cost-of-living crises were created by large injections of money into the economy, and it is saving and investment that will help fix the distortions, by allowing for growth and deflation. Despite the Keynesian “paradox of thrift,” increased saving is not a decrease in economic activity, but a dynamic process that invests in a wider, more affordable future consumption.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter