Monthly Archive: April 2022

Ethereum Miner verdienen mehr als Bitcoin Miner

Auch im März war es lukrativer Ethereum zu minen als Bitcoin. Insgesamt verdienten die Miner mit dem ETH 1,34 Milliarden US-Dollar, damit sahen die Miner gegenüber Februar einen Anstieg von 7 Prozent. Bitcoin Miner verdienten im selben Zeitraum nur 1,21 Milliarden. Ethereum News: Ethereum Miner verdienen mehr als Bitcoin MinerRelativ betrachtet gab es im Bitcoin Markt jedoch 14 Prozent mehr als im vorherigen Monat.

Read More »

Read More »

New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe's Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish.

Read More »

Read More »

Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular.

Read More »

Read More »

Switzerland misses greenhouse gas reduction target

Switzerland has narrowly missed its target of reducing greenhouse gas emissions by 2020 despite coronavirus lockdowns and an unusually warm winter.

Read More »

Read More »

The Ukraine War Shows Nukes Mean Safety from US-Led Regime Change

Some journalists like Steve Portnoy of CBS seem unable to grasp that escalations that might lead to nuclear war are a bad thing. The journalist seemed incredulous last week when asking White House spokeswoman Jen Psaki why the United States has not started a full-on war with Moscow. Psaki’s position—with which any reasonable person could agree—was that it is not in the interest of Americans “to be in a war with Russia.”

Read More »

Read More »

Global Blockchain Sector Surged in 2021

2021 was a blockbuster year for the global blockchain sector, which saw funding activity surge, trading volumes balloon and further growth in key segments including custodians, exchanges, decentralized finance (DeFi), as well as non-fungible tokens (NFTs) and the metaverse, a new report by Swiss blockchain-focused investment company CV VC, in collaboration with PwC Switzerland, says.

Read More »

Read More »

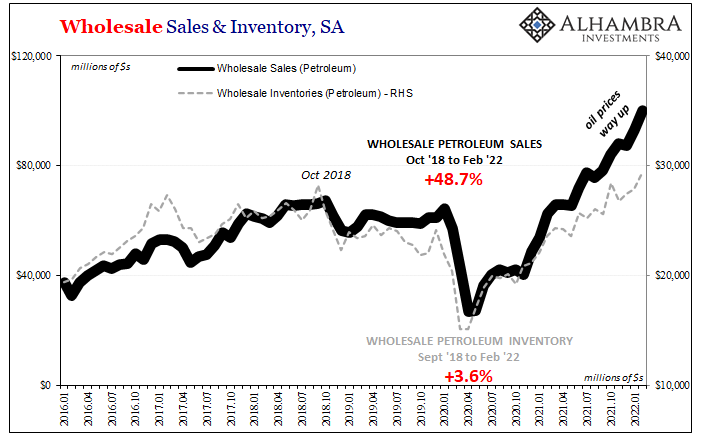

Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast.

Read More »

Read More »

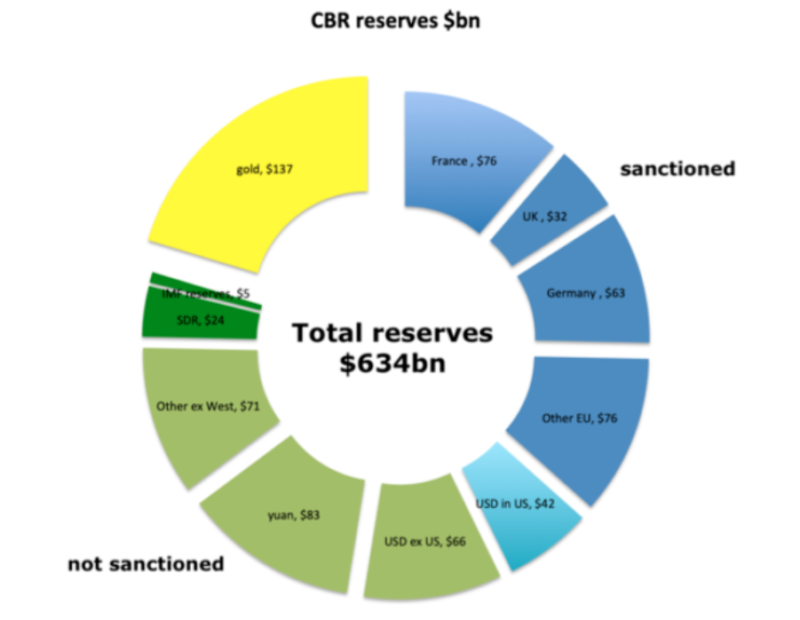

Heavy Sanctions against Russia Could Usher in a Wider Economic War

Vladimir Putin’s invasion of Ukraine was met with unprecedented economic sanctions by the United States and its allies in order to cripple Russia’s capacity to wage war. Never before in post–World War II history has an economy of Russia’s size been reprimanded with such force. Moreover, the sanctions could remain in place after the war ends and reach other major economies too, in particular China. In this case, current sanctions could be the...

Read More »

Read More »

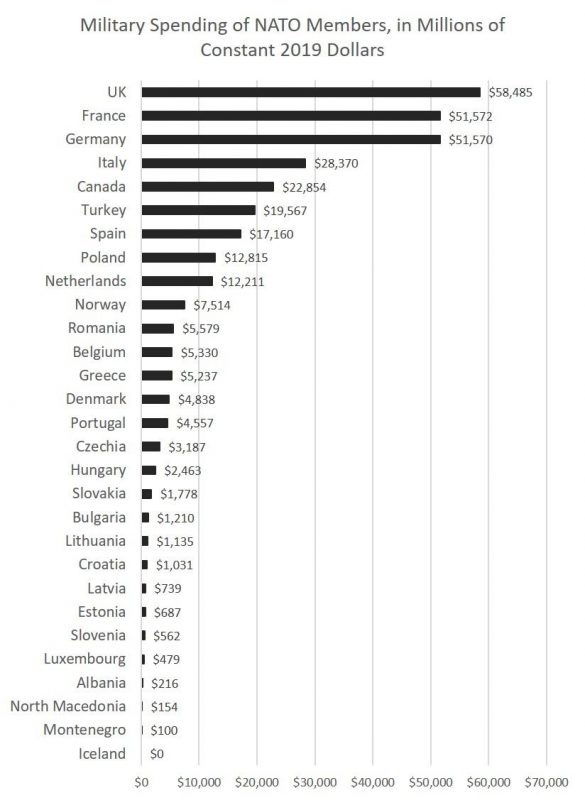

NATO: Our International Welfare Queens

The states of Europe have more than enough wealth and military potential to deal with a second-rate power like Russia. The American taxpayers, on the other hand, deserve a break from Europe's grifting.

Original Article: "NATO: Our International Welfare Queens"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Swiss health insurance could jump by 9 percent next year

According to the newspaper Le Matin Swiss health insurance premiums could rise by 7% to 9%, reported RTS. The future rise in the cost of health insurance is estimated based on data on the rising healthcare costs being passed on to health insurance companies. According to the data, costs rose during the second half of 2021. Across all of 2021 costs were up by 5.1% and the trend appears to have continued.

Read More »

Read More »

It Was the Lockdowns, Not the Pandemic That Created the Havoc

It may be years before we fully realize the ramifications of the lockdown policies governments around the world have imposed on their citizens in response to covid-19, but evidence of the costs is starting to trickle in.

A recent study conducted by the Centers for Disease Control and Prevention (CDC) surveyed thousands of high school students on the effects of the pandemic.

Read More »

Read More »

Honduras akzeptiert Bitcoin als legales Zahlungsmittel

Noch wurde Bitcoin nicht im ganzen Land als legales Zahlungsmittel akzeptiert, doch auf einer Insel vor der Küste Honduras hat nun ein lokales Gericht diese Deklarierung bekanntgegeben. Damit stellt sich das lokale Gericht sogar gegen die Zentralbank das Landes. Bitcoin News: Honduras akzeptiert Bitcoin als legales ZahlungsmittelDie Insel ist Teil einer sogenannten „Economic Zone“, die als „Honduras Prospera“ bezeichnet wird. Erst 2020 gegründet,...

Read More »

Read More »

Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over.

Read More »

Read More »

Do “Inflationary Expectations” Cause Inflation? Contra Krugman, the Answer Is No

In the New York Times article “How High Inflation Will Come Down,” Paul Krugman suggests that the key for future inflation is inflation expectations. Krugman does not think that currently inflation expectations are comparable to the 1980s.

Read More »

Read More »

Hazlitt, Hayek and How the Fed Made Itself into the World’s Biggest Savings & Loan

The Henry Hazlitt Memorial Lecture, March 18, 20221. Many thanks to the Mises Institute and to sponsor Yousif Almoayyed for this opportunity to be with you all today as we consider one of the truly remarkable developments in the history of American central banking, money printing, and credit inflation.

Read More »

Read More »

New Swiss bank pitches itself as digital, but not robotic

Switzerland’s shrinking banking universe has been bolstered by a new wealth management entrant, Alpian, which is aiming for the sweet spot between digital and human-centric services. Alpian has just secured a Swiss banking license along with a CHF19 million ($20.5 million) capital boost from the Italian banking group Intesa Sanpaolo.

Read More »

Read More »

Switzerland has frozen CHF7.5bn in assets under Russia sanctions

Switzerland has so far frozen some CHF7.5 billion ($8 billion) in funds and assets under sanctions against Russians to punish Moscow’s invasion of Ukraine.

Read More »

Read More »

For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn't too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it's like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man's Curve.

Read More »

Read More »

Swiss consumers spend big on organic products

The organic food market in Switzerland experienced slower growth in 2021 than the previous year. However, consumers are spending more than ever on organic products.

Read More »

Read More »