Monthly Archive: March 2022

Ludwig von Mises (1881–1973)

One of the most notable economists and social philosophers of the twentieth century, Ludwig von Mises, in the course of a long and highly productive life, developed an integrated, deductive science of economics based on the fundamental axiom that individual human beings act purposively to achieve desired goals.

Read More »

Read More »

Honduras lässt Bitcoin links liegen und setzt auf CBDC

Die Crypto-Community hatte gehofft, dass Honduras dem Beispiel El Salvadors folgen würde. Doch nun hat die Zentralbank des Landes in Mittelamerika angekündigt, dass man nicht auf Bitcoin setzen wird, sondern stattdessen an einem staatlichen Cryptocoin arbeitet. Bitcoin News: Honduras lässt Bitcoin links liegen und setzt auf CBDCSchlechte Nachrichten für die Mass Adoption: Honduras setzt auf eine Central Bank Digital Currency (CBDC), die schon bald...

Read More »

Read More »

Switzerland sounds out Qatar over gas supplies

Switzerland plans to open negotiations with Qatar over the potential delivery of liquefied natural gas (LNG) supplies. The Alpine state is scouting for new energy suppliers, following the Russian invasion of Ukraine.

Read More »

Read More »

Will Biden Sanction Half the World to Isolate Russia?

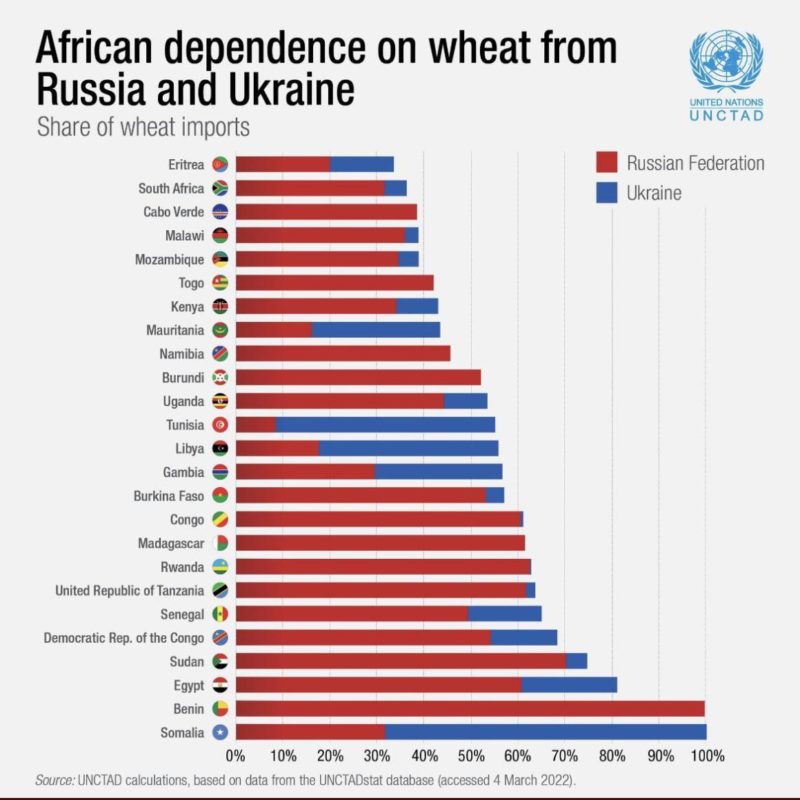

It is becoming increasingly apparent that isolating Russia and totally cutting it off from the global economy is not going to be easy. As I discussed last week, from Mexico to Brazil to China to India and much of Africa, the world is resisting Washington's call to treat Russia as a pariah nation.

Read More »

Read More »

Hat die ukrainische Krise eine Lösung, und wenn ja, welche könnte es sein? Welcher Vorschlag käme von Mises?

Hat die ukrainische Krise eine Lösung, und wenn ja, welche könnte es sein? Welcher Vorschlag käme von Mises?

Read More »

Read More »

Autocracy’s Fatal Weakness

This desire for compliance and consensus dooms the autocracy to failure and collapse because dissent is the essence of evolutionary churn and adaptation. The various flavors of autocracy (theocracy, kleptocracy, dictatorship, etc.) look remarkably successful at first blush but they all share a fatal flaw.

Read More »

Read More »

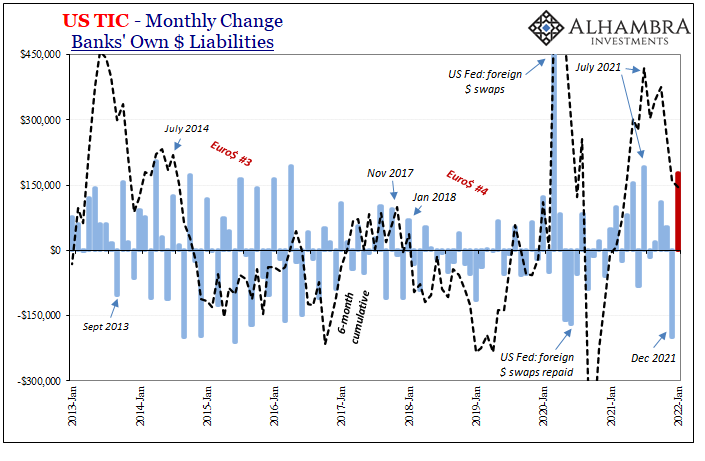

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

What the Ukraine war means for Switzerland’s energy policy

The war in Ukraine and consequent threat of energy insecurity is forcing many countries to reconsider their existing policies. The ripple effect has also reached Switzerland, which is already reassessing its gas supply for the coming winter.

Read More »

Read More »

Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that...

Read More »

Read More »

Der Markt erholt sich trotz fortschreitender Ukraine-Krise

Obwohl die Situation in der Ukraine keine Entspannung zeigt, konnte sich der Cryptomarkt wieder fangen. In der vergangenen Woche ging es für die meisten großen Cryptocoins deutlich nach oben – allein Bitcoin legte mehr als 10 Prozent zu.

Read More »

Read More »

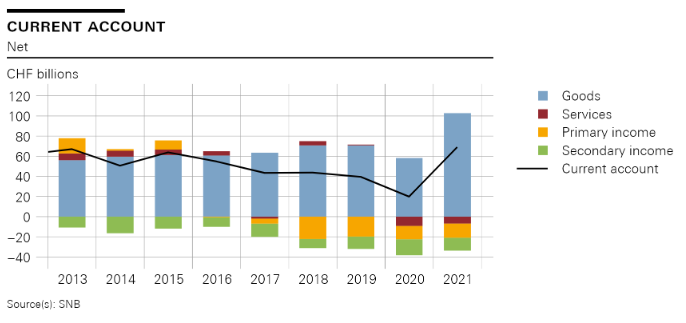

Swiss balance of payments and international investment position: 2021 and Q4 2021

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year....

Read More »

Read More »

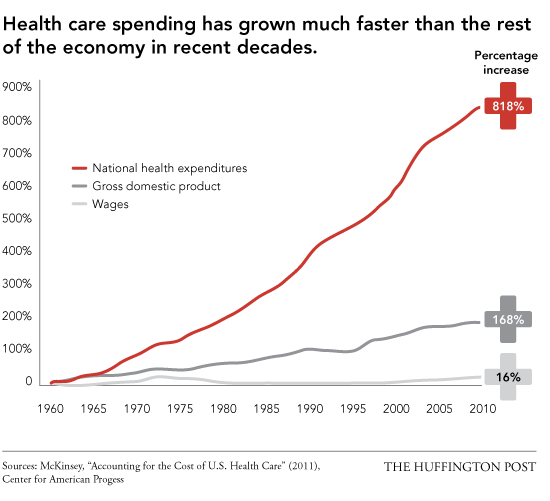

How Healthcare Became Sickcare

The financialization of healthcare started two generations ago and is now in a run-to-fail feedback loop of insolvency. Long-time readers know I have been critical of U.S. healthcare for over a decade. When I use the term sickcare this is not a reflection on the hard work of frontline caregivers--it is a reflection of the financialization incentives that have distorted the system's priorities and put it on a path to insolvency.

Read More »

Read More »

‘Next winter will be difficult in Europe without Russian gas’

The United States wants to cut its dependence on Russian fuels. But Switzerland and Europe cannot completely do without Russian gas, says René Bautz, the CEO of Gaznat, which supplies high-pressure gas to western Switzerland, and president of the Global Gas Centre platform for the natural gas sector.

Read More »

Read More »

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets.

Read More »

Read More »

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

Swiss exports reach all-time high

Data published on 17 March 2022 showed a 15.4% jump in Swiss exports in February 2022. The sharp rise in exports when combined with a 2.9% fall in imports led to a monthly trade balance of CHF 5.7 million. This is the first time in history that Switzerland’s monthly trade balance has exceeded CHF 5 million.

Read More »

Read More »

The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

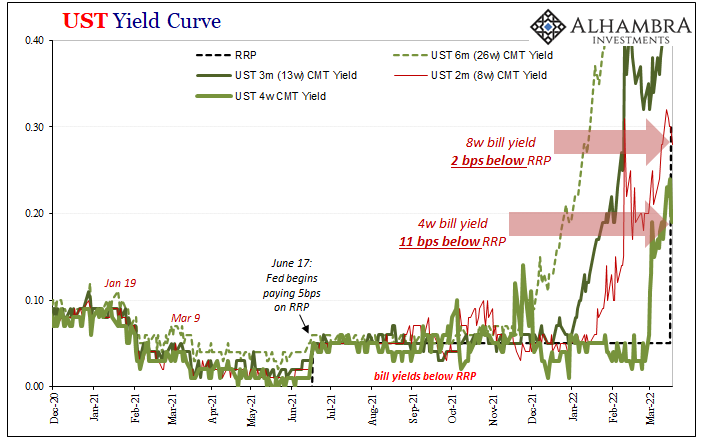

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps.

Read More »

Read More »

2022 Libertarian Scholars Conference

Join Joe Salerno, David Gordon, Jeff Deist, Patrick Newman, and many more at the 2022 Libertarian Scholars Conference on Saturday, September 10th! We'll meet at the Grand Hyatt in Nashville, Tennessee.

Read More »

Read More »

Gold Price Today – Gareth Soloway

2022-03-24

by Stephen Flood

2022-03-24

Read More »