Paul Krugman has a very prominent perch from the editorial page at the New York Times and he has used his influence, among other things, to shill for two things that are anathema to a strong economy: inflation and organized labor. My analysis examines what Krugman says about labor unions and explains why once again his economic prognostications are off base.

In a recent column, Krugman declares that the present political climate may reverse the long trend in private sector unionism—and that is a good thing:

The political environment that gave anti-union employers a free hand may be changing—the decline of unionization was, above all, political, not a necessary consequence of a changing economy. And America needs a union revival if we’re to have any hope of reversing spiraling inequality.

As he often does, Krugman presents a scenario of a prosperous America in which organized labor helped create a productive and happy society, although one might question his knowledge of history. He writes:

America used to have a powerful labor movement. Union membership soared between 1934 and the end of World War II. During the 1950s roughly a third of nonagricultural workers were union members. As late as 1980 unions still represented around a quarter of the work force. And strong unions had a big impact even on nonunion workers, setting pay norms and putting nonunion employers on notice that they had to treat their workers relatively well lest they face an organizing drive.

While he is partly correct in his statement, Krugman then paints an alternate picture of history, claiming, in effect, that the source of economic growth is high factor prices.

And this decline in unionization has had dire consequences. In their heyday, unions were a powerful force for equality; their influence reduced the overall inequality of wages and also reduced wage disparities associated with different levels of education and even race. Surging union membership appears to have been a key factor in the “Great Compression,” the rapid reduction in inequality that took place between the mid-1930s and 1945, turning America into a middle-class nation.

First, and most important (and maybe most shocking), the 1930s constituted the Great Depression, when unemployment was in double digits and living standards for many Americans fell from their levels a decade before. The notion that the Roosevelt administration “created” a middle class by putting people out of work is preposterous on its face.

Second, Robert Higgs forcefully destroyed the lie that the US economy during World War II brought prosperity and helped turn the country into a “middle-class nation.” Such thinking only can reflect a mindset that sees the US economy as being “managed” by the state, and that middle-class incomes are solely a function of state power to confiscate income from some and turn it over to others. To take a time when the nation was in an economic crisis and later involved in the most destructive war in history and then present it as a permanent model for society is perverse beyond words.

To better understand why Krugman would write such things, we need to understand his view of the economy, a view shared, apparently, by most political, academic, and social elites in this country. In the Krugman view—and I will try to keep from veering into presenting a caricature of his beliefs—private enterprise rests on a tenuous foundation. Like J.M. Keynes, he believes that the economy is circular in nature.

More than a decade ago, I wrote that Krugman and others see the economy as being like a “perpetual motion machine” in which individual savings actually work against economic prosperity:

If I can put the whole Keynesian set of fallacies into one statement, it would be this: the modern Keynesians believe that the economy operates like a perpetual motion machine, with government spending being the “grease” that keeps it from slowing down. The “friction” in this economic machine, according to the pundits, is private saving. Eliminate it, and the economy goes on forever, adding energy and expanding indefinitely.

I continue:

f consumers save or “hoard” some of their money, then there will be a “leakage” from the system, which means that households cannot “buy back” the products they have produced. The unpurchased goods then pile up in the inventories, so businesses must then cut back production and lay off workers. This further triggers consumer uncertainty, which means they save even more money, and we are off to the downward races. Krugman has used this analysis to explain every economic downturn, including the Great Depression, and since he left the Princeton University faculty to dedicate his academic work to examining what he calls income inequality, he has doubled down on his rhetoric. In his view, business firms create goods which people purchase, and the income ultimately flows back to business owners, making them wealthy.

As long as these wealthy business owners continue to spend all of their income either on consumption goods or new capital, the economy can move along. The likelihood of that chain of events happening, however, is near zero and, instead, the wealthy often will save (read: hoard) much of their income. Instead of buying cars, yachts, jewelry, and whatever else the rich like to purchase, and instead of putting back the rest of their income to purchase new capital or replenish existing capital, they stuff the money into nonproductive accounts and don’t spend at all.

On top of that, Krugman holds to the Thomas Piketty theme that over time wealthy people receive increasing returns to the capital they own so that we see the proverbial scenario of “the rich getting richer and the poor becoming poorer.” Once that becomes a guiding narrative, of course, everything that happens seems to fulfill the Krugman-Piketty theme.

Over time, hoarding by the rich throws sand into the gears of the perpetual motion machine, grinding the economy to a halt and throwing it into recession. While pundits like Karl Marx, Keynes, and Krugman will deviate among themselves as to the causes of economic downturns, they generally agree that the system implodes from within and only can be turned around by massive governmental involvement.

The Keynes-Krugman “solution” to this obvious problem is for government to create a system of massive wealth transfers from the wealthy to everyone else. High wages generated through labor union activism, high marginal tax rates, and a huge welfare system serve to take income away from the wealthy, give it to others who will continue to spend and keep the perpetual motion machine well oiled and moving. Thus, high taxes and high wages obtained via coercive activities by organized labor actually help everyone from the poorest people to the wealthy business owners. Lower-income people receive money, goods, and services while the wealthy find that their enterprises flourish when people have more money to spend. It is win-win for everyone.

Given his tendency to mangle economic history, it is not surprising that Krugman falsely blames Ronald Reagan for the decline of labor unions just as he falsely claims that organized labor created prosperity. He writes:

Why are unions in America so weak? While the details are in dispute, U.S. politics took a sharp anti-union turn under Ronald Reagan, encouraging employers to play hardball against union organizers. This meant that as the center of gravity of the U.S. economy shifted from manufacturing to services, workers in the growing sectors were left largely un-unionized.

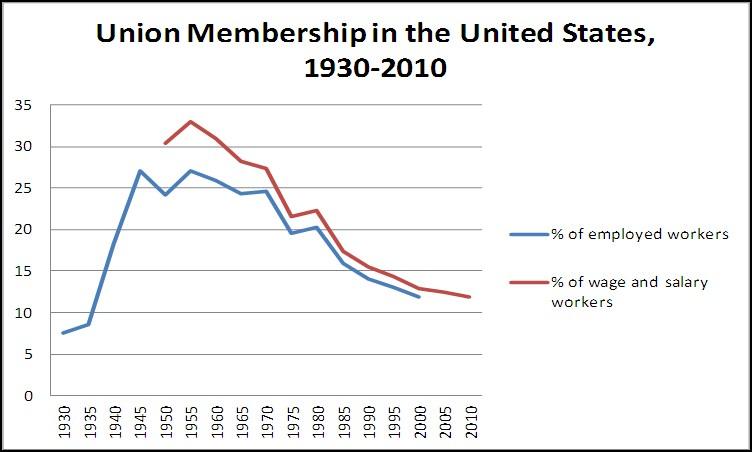

First, and most important, union membership as a percentage of the population had declined ever since its peak in the post–World War II economy. In the early 1950s, about a third of US workers were in unions, but by 1980, that number had declined to about 20 percent. Union membership did decline during the Reagan years, but that decline continued even after eight years of Bill Clinton, who had the enthusiastic support of organized labor. The graph below shows the pattern. As one can see, union membership fell drastically in the late 1960s to the mid-1970s, a time when the US economy went through two recessions, which at that time meant the loss of unionized manufacturing jobs.

The Reagan-killed-the-unions myth came about because of Reagan’s response to the air traffic controllers’ strike in 1981. The union, which had the acronym PATCO (Professional Air Traffic Controllers Organization), actually endorsed Reagan in 1980 (along with the Teamsters—because Reagan agreed to delay trucking deregulation for two years, something Krugman ignores). In August 1981, the union struck, throwing airline traffic into mass confusion. (I flew from New York City to Atlanta the first weekend of the strike, and it definitely was a chaotic time.)

Union Membership in the United States, 1930-2010

Reagan responded by firing the striking workers and ordering the hiring of new controllers. The strike quickly was broken, along with PATCO, and air travel soon returned to normal. Democrats accused Reagan of “union busting” and worse. It is difficult to place the PATCO incident in larger context, since PATCO was a relatively small union and it represented government employees whose illegal actions (it was against the law for federal employees to go on strike) had serious consequences on flight travel and endangered the jobs and safety of airline employees, many of them unionized themselves. Nonetheless, entities like the New York Times chose to take the view that this was the turning point in labor history, an event that permanently changed the landscape for organized labor.

However, there is another explanation that doesn’t require the invocation of symbols. In late 1981 and through much of 1982, the US economy suffered through a massive recession, one that altered much of the economic landscape in this country. For example, much of the steel industry that once defined cities like Pittsburgh and Allentown in Pennsylvania and Youngstown, Ohio, closed shop and did not reopen. This recession hit the unionized sectors hard and had a significant effect in unionized jobs in domestic steel, automobiles, and textiles. This was not by design (in other words, the recession was not a Reagan-organized conspiracy) but rather the result of excesses that had built up over the years that slowly made these industries uncompetitive.

According to US Department of Labor statistics, the highest rates of unemployment during the 1982 recession came in construction (20 percent), manufacturing (12.3 percent), and mining (13.4 percent), along with agriculture (14.5 percent). All of these lines of production are tied to capital goods and are highly unionized. While all of these sectors did rebound during the recovery, which began in 1983, the scope of manufacturing changed in the USA, especially in the automobile industry. During the recession of 1982, not only did the sale of domestic automobiles fall drastically, but sales of Japanese-owned Toyota, Honda, and Nissan rose almost 30 percent from the late 1970s into the early 1980s. Ford Motor Company’s employment alone fell by about 46 percent due to the recession.

The recession alone would have had a devastating effect on union employment, an effect much more significant than the failed PATCO strike. To further accelerate the drop in union employment, President Jimmy Carter’s massive deregulation efforts in the latter years of his term in office would ultimately change the scope of competition in passenger airlines, trucking, railroads, and telecommunications, all highly unionized industries.

It is much harder for labor unions to organize workforces in competitive industries than it is in industries that are made legal monopolies, which is what the regulatory systems governing these industries actually did. Take trucking for example. Before passage of the 1980 Motor Carrier Act, there were about 1.3 million truck drivers, with the industry dominated by the Teamsters Union. After deregulation swept away many barriers to entry, the number of truck drivers had increased to 3.5 million by 2018. Not surprisingly, average real pay of truck drivers is not as high as it was when they mostly were unionized and the industry kept artificially small. However, contra Krugman, the current dearth of unionized drivers is not due to newly discovered hardball tactics of employers but rather the realities of competition, and one of the results has been that unit costs of rail and surface transportation have fallen in real terms in the past forty years, which has contributed greatly to a higher standard of living.

All of these examples present a much more clear picture of the decline of organized labor in private industries than Krugman’s “The Evil Ronald Reagan Did It” narrative. One can excuse a union partisan for such ignorance, but when a Nobel-winning economist makes such an erroneous pronouncement, the only proper response is outright scorn and derision.

Indeed, we should be thankful that, at least in private industry, organized labor has lost the stranglehold it once had in this country. Unions gained drastically after 1935 due to passage of the Fair Labor Standards Act and the Roosevelt administration’s backing of organized labor. Furthermore, unions gained their share in the labor force during World War II, when it became next to necessary for businesses to accept unions in order to be eligible for federal contracts, which often were the only production game in town.

Contrary to what Krugman might argue, the mercurial growth of organized labor in the US workforce was much more the work of government prodding and outright coercion than it was a natural progression of the American workplace. Given that, perhaps we should not be surprised to know that less than a decade after World War II ended, unions as a percentage of private employment in this country began to decline, and that downward path has continued for more than six decades.

While the Joe Biden administration no doubt wants to boost union fortunes—Biden even calling for a federal version of the disastrous AB 5 in California, which put a lot of people out of work—one doubts that the president can make much of a difference. The reason for the decline of unions in this country has not gone away, and it isn’t Ronald Reagan.

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter

Permanent link to this article: https://snbchf.com/2021/04/l-anderson-why-empowering-labor-definitely-economy/