Monthly Archive: February 2021

Devisenreserven der SNB steigen im Januar um 3,90 Mrd Fr.

Die Devisenreserven der Schweizerischen Nationalbank (SNB) sind im Januar um 3,90 Milliarden Franken gestiegen. Per Ende des Berichtsmonats lag der Wert bei 896,15 Milliarden Franken, nachdem es Ende Dezember noch 892,25 Milliarden Franken gewesen waren.

Read More »

Read More »

Impfchaos: In Deutschland dominiert mehr und mehr planwirtschaftliches Denken

Zwei mögliche Kanzlerkandidaten wetteifern darum, wer am lautesten nach einer Planwirtschaft ruft, die das Impfchaos beseitigen soll.

Read More »

Read More »

Covid: responding to coronavirus denial

This week, the Swiss National COVID-19 Science Task Force published a guide on responding to coronavirus denial. During second wave, trust in the decisions of the Swiss authorities dropped below where it was in spring, and the social consensus on how to respond to the pandemic eroded over the summer, said the authors.

Read More »

Read More »

Can Novartis really make its medicines available to everyone?

Novartis has said it wants everyone in the world to be able to access its products, even multi-million-dollar gene therapies. Can its experiment work?

Read More »

Read More »

FX Daily, February 4: Negative Rates and the Bank of England: Having Your Cake and Eating it Too

Overview: The euro has been sold through $1.20 for the first time since December 1 and has now given back roughly half of the gains scored from the US election (~$1.16) to the early January high (~$.1.2350). More broadly, the greenback is bid against most of the major currencies, with the Australian dollar more resilient after reported record iron ore exports and all but a handful of emerging market currencies.

Read More »

Read More »

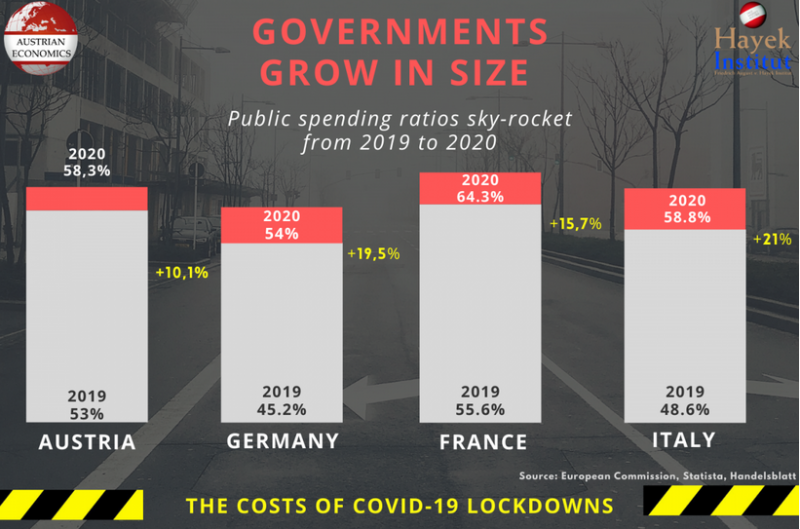

Governments Grow in Size

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events.

Read More »

Read More »

There’s Nothing Wrong with Short Selling

The recent GameStop short-squeeze drama has riveted financial markets. Given the historic unpopularity of short sellers (e.g., Holman Jenkins has written that “short-selling is…widely unpopular with everyone who has a stake in seeing stock prices go up”), the resulting heightened invective against them is not a surprise.

Read More »

Read More »

FX Daily, February 3: The Greenback Remains Resilient as the Bulls Drive Equities Higher

Equities have charged higher, and the greenback is mostly firmer. News that Draghi may become Italy's next Prime Minister has boosted Italian bonds. The PBOC unexpectedly drained liquidity, and this may have deterred buying of Chinese stocks, a notable exception in the regional rally.

Read More »

Read More »

There Is No “Optimum” Growth Rate for the Money Supply

Most economists hold that a growing economy requires a growing money stock on the grounds that growth gives rise to a greater demand for money that must be accommodated. Failing to do so, it is maintained, will lead to a decline in the prices of goods and services, which in turn will destabilize the economy and lead to an economic recession or, even worse, depression.

Read More »

Read More »

Wall Street Outsiders versus the Hedge Funds

The investment world was convulsed last week when at least one hedge fund (Melvin Capital) lost billions of dollars. The sudden, massive losses happened when a tidal wave of independent individual investors, spearheaded by posts on Reddit.com, triggered a short squeeze that torpedoed the hedge fund.

Read More »

Read More »

Are Switzerland’s new tax breaks for companies a licence to misbehave?

Switzerland has announced that companies will be able to deduct multi-million dollar fines incurred abroad from their tax bill. Critics argue it rewards bad behaviour.

Read More »

Read More »

Our Fragile, Brittle Stock Market

This heavily managed 'market structure' is far from equilibrium and extremely prone to instability.

Read More »

Read More »

“The bank and the government have essentially blended into one entity”

A lot has been said and written about the impact of the Covid crisis on the global economy and on the prospects of a strong recovery in 2021. Especially since the start of the year, there seems to be a consensus among government officials, institutional leaders and mainstream market analysts and pundits, pointing to an extremely positive outlook.

Read More »

Read More »

Julius Baer: mast do better

Swiss private bank Julius Baer has benefitted from rising global markets over the past year, but can it keep it up the momentum?

Read More »

Read More »

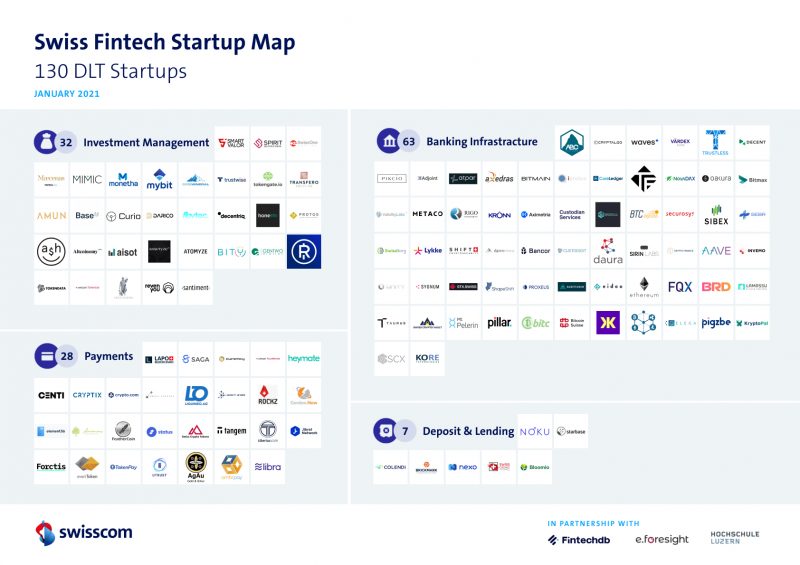

Switzerland’s Blockchain Fintech Industry in 2021

Switzerland is home to 130 startups that are applying blockchain and distributed ledger technology (DLT) to finance use cases, new data from Swisscom show. Most of these companies (48%) operate in the banking infrastructure vertical, followed by investment management (24%), and payments (21%).

Read More »

Read More »

SNB-Jordan: Haben gute Lösung zu höheren Gewinnausschüttungen getroffen

"Wenn es der Nationalbank über die Jahre gut geht, kann sie viel ausschütten. Wenn es aber schlechter geht, werden wir die Ausschüttungen wieder reduzieren", sagte Jordan weiter. Dabei stütze sich die neue, am vergangenen Freitag kommunizierte Vereinbarung auf die alten Abmachungen zur Ausschüttung an Bund und Kantone, nur dass die Bilanz und die Ausschüttungs-Reserve heute deutlich höher seien als vorher.

Read More »

Read More »

6 billion franc Swiss National Bank payment after new agreement

Switzerland’s Federal Department of Finance (FDF) and the Swiss National Bank (SNB), Switzerland’s central bank, have signed a new agreement on how SNB profits can be distributed.

Read More »

Read More »

The Great Reset, Part IV: “Stakeholder Capitalism” vs. “Neoliberalism”

Any discussion of “stakeholder capitalism” must begin by noting a paradox: like “neoliberalism,” its nemesis, “stakeholder capitalism” does not exist as such. There is no such economic system as “stakeholder capitalism,” just as there is no such economic system as “neoliberalism.” The two antipathetic twins are imaginary ghosts forever pitted against each other in a seemingly endless and frenzied tussle.

Read More »

Read More »