Monthly Archive: February 2021

FX Daily, February 17: Follow-Through Dollar Buying after Yesterday’s Reversal Tests the Bears

Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday's highs. Sterling's surge is also being tempered. Most emerging market currencies are lower as well.

Read More »

Read More »

Swiss competition watchdog to investigate Mastercard

The competition authority suspects the global credit card firm of using its position to prevent the rollout of a new, more uniform, ATM system across Switzerland.

Read More »

Read More »

“Self-control and self-respect have become undervalued”

After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go undiscussed.

Read More »

Read More »

Down with the Presidency

The modern institution of the presidency is the primary political evil Americans face, and the cause of nearly all our woes. It squanders the national wealth and starts unjust wars against foreign peoples that have never done us any harm. It wrecks our families, tramples on our rights, invades our communities, and spies on our bank accounts. It skews the culture toward decadence and trash. It tells lie after lie. Teachers used to tell school kids...

Read More »

Read More »

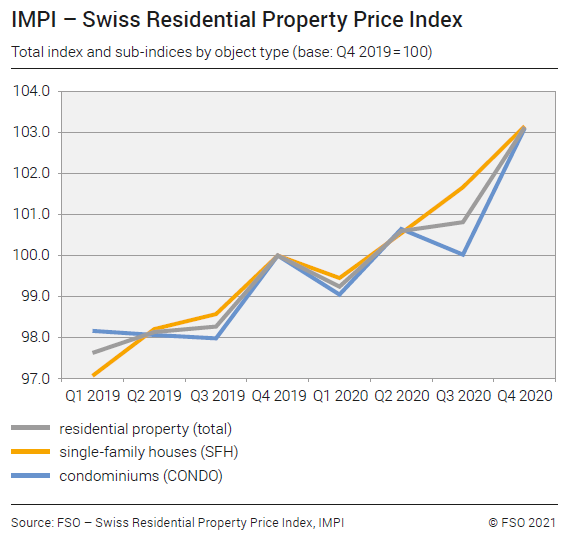

Residential property prices continue to rise

Residential property prices in Switzerland rose sharply in the final quarter of 2020, and by an average 2.5% for the year as a whole, according to the Federal Statistics Office.

Read More »

Read More »

FX Daily, February 16: Greenback Remains Heavy

The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today, the Dow Jones Stoxx 600 is consolidating.

Read More »

Read More »

Hear Swiss stories for the world on The Swiss Connection podcast

What’s it like to move back to – or away from – Switzerland during a pandemic? What does gold mined in Peru have to do with Switzerland? Did you know that “nostalgia” is a Swiss invention?

Read More »

Read More »

Unhappy Endings: Deception Has Gone Global

Looking Behind the LabelsRegardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles.Not all those of the extreme left, for example, are all that “woke” and not everyone on the far right, to be fair, is a “domestic terrorist.

Read More »

Read More »

Average annual inflation rate for residential property in 2020 was 2.5 percent

16.02.2021 - The Swiss residential property price index (IMPI) increased in the 4th quarter 2020 compared with the previous quarter by 2.3% and reached 103.1 points (4th quarter 2019 = 100). Compared with the same quarter of the previous year, inflation was 3.1%. The average annual inflation rate for residential property in 2020 was 2.5%.

Read More »

Read More »

The Fight over Economics Is a Fight over Culture

The Left long ago figured out how to get ordinary people interested in economic policy. The strategy is two pronged. The first part is to frame the problem as a moral problem. The second part is to make the fight over economic policy into a fight over something much bigger than economics: it's a fight between views of what it means to be a good person. The Left knows how to make the war over economics into a war over culture.

Read More »

Read More »

FX Daily, February 15: Sterling Continues to Run Higher and US Winter Storm Gives Oil Another Boost

US and Greater Chinese markets are closed today, but the markets are moving. Equities are bid. The Nikkei led the Asia Pacific region with a 2% gain and pushed above 30000 for the first time since 1990.

Read More »

Read More »

Understanding Minimum Wage Mandates: Empirical Studies Aren’t Enough

It is only through the increase in capital goods, i.e., through the enhancement and the expansion of the infrastructure, that labor can become more productive and earn a higher hourly wage.

Read More »

Read More »

Report shows slump in foreign investment in Swiss real estate

The share of foreign investment in Swiss commercial real estate fell from 15% before 2011 to 5% between 2017 and 2019, according to new research. The issue of foreigners buying cheap Swiss property during the Covid-19 pandemic is being discussed in Bern.

Read More »

Read More »

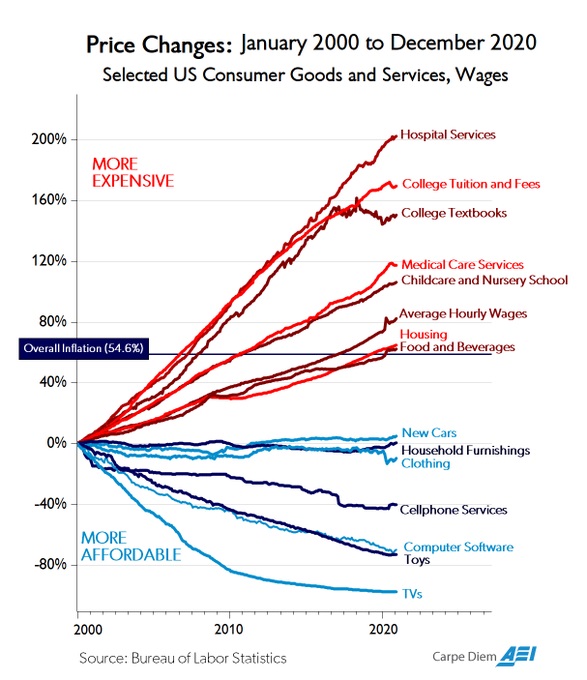

In One Image, Everything You Need to Know about Government Intervention

While I freely self-identify as a libertarian, I don’t think of myself as a philosophical ideologue. Instead, I’m someone who likes digging into data to determine the impact of government policy. And because I’ve repeatedly noticed that more government almost always leads to worse outcomes, I’ve become a practical ideologue.

Read More »

Read More »

The Depression of the 1780s and the Banking Struggle

It has been alleged—from that day to this—that the depression which hit the United States, especially the commercial cities, was caused by “excessive” imports by Americans beginning in 1783.

Read More »

Read More »

Swiss spent record amount on food in 2020

Consumers spent 11.3% more on food and beverages in brick-and-mortar shops last year than they did in 2019, helping the food retail trade to pull in a record turnover of nearly CHF30 billion ($33.7 billion).

Read More »

Read More »

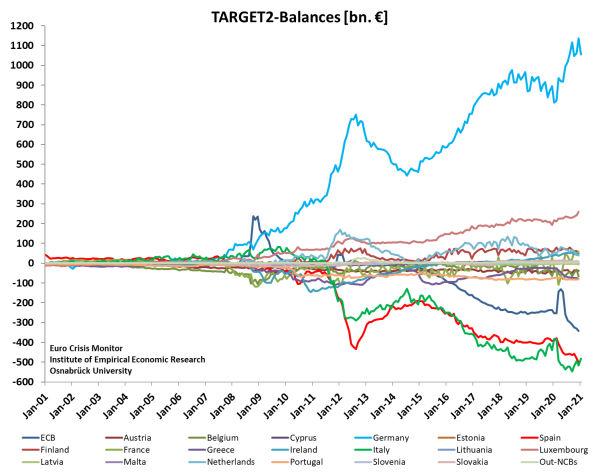

The World Needs a Gold-Backed Deutsche Mark

The seeds of sound-money destruction were sown at the 1944 Bretton Woods Conference, which established that US dollars could be held as central bank reserves and were redeemable for gold by the US Treasury at thirty-five dollars an ounce. This was the so-called gold exchange standard, but only foreign central banks and some multinational organizations, such as the International Monetary Fund (IMF), enjoyed this right of redemption. The system...

Read More »

Read More »

European banks need new chiefs

EUROPEAN BANKS’ fourth-quarter earnings, releases of which are clustered around early February, have been surprisingly perky. Those with trading arms, such as UBS or BNP Paribas, rode on buoyant markets. State support helped contain bad loans; few banks needed to top up provisions.

Read More »

Read More »

How Wall Street Became an Enemy of Free Markets

After decades of financialization and government favors, Wall Street now has little to do with free, functioning markets anymore and has largely become an adjunct of the central bank. Today, entrepreneurship is out, and bailouts are in.

Read More »

Read More »

Gold Price Forecast – LBMA Survey Published

2021-02-14

by Stephen Flood

2021-02-14

Read More »