In the eyes of many, covid-19 has truly accelerated things. Tech aficionados have been rejoicing as virtual meetings, Zoom calls, and overall digitization within companies have seen a serious boost. At the same time, the corona crisis has intensified another contemporary development that people generally don’t really care about: today’s ongoing expansion of the money supply.

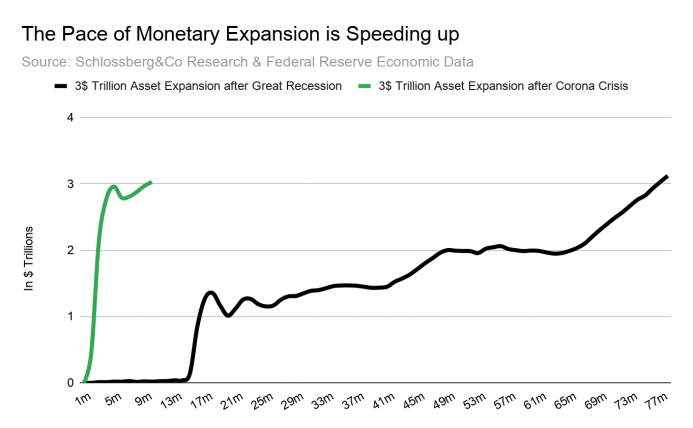

Although monetary policy had been ultraexpansionary even well before the virus hit the world, central bankers are currently upping the ante once again. While it took the Federal Reserve almost six years to create 3.5 trillion in new US dollar liquidity, this time around it took only ten months to unleash a monetary tsunami of $3 trillion with the projection of at least another $1.8 trillion next year.

While these astronomical numbers don’t really speak to the general public anymore, another astonishing fact resonated with them: after March 2020 alone, the US banking system is reported to have increased the M1 money supply by 37 percent. What this means in plain words is that 37 percent of all outstanding dollars and dollar bank deposits that have ever existed have been created this year. If one bears in mind that monetary aggregates like M0, M1, and M2 today no longer give an accurate account of all the money in the system because they do not account for the shadow banking’s collateral multiplier, one can only guess that the actual extent of monetary expansion must be a lot greater.

Fiscal Policy as Disguised Monetary Policy

The swaths of liquidity created by the world’s central banks are complemented by fiscal measures on the part of governments. Here, too, the US government is leading the way, having launched stimulus packages in the trillions, and other countries are also eagerly going into debt to counteract the recession. Because of all this borrowing, by the end of this year, global debt levels are expected to reach a new record of $277 trillion, according to an estimate by the Institute of International Finance. This would amount to a debt-to-GDP ratio of 365 percent.

In politics it is currently debated whether monetary or fiscal policy should have precedence. This debate is just a mirage, though. Today fiscal policy in the form of government stimulus is monetary policy, after all. Government debt has become the most popular and most sought-after asset in monetary policy actions. Fiscal policy has thus mutated into monetary policy in disguise as newly created debt is increasingly taken in by central banks and siloed in their balance sheets. The inevitable consequence is that the quality of their balance sheets—and thus the quality of our money—is continuously deteriorating.

The Consequences of Too Much Money

To have central banks conduct ever more expansionary monetary policy based entirely on debt is politicians’ go-to solution today, as it marks the path of least resistance. Creating ever more money is convenient because this way virtually any interest group can be financially sedated.

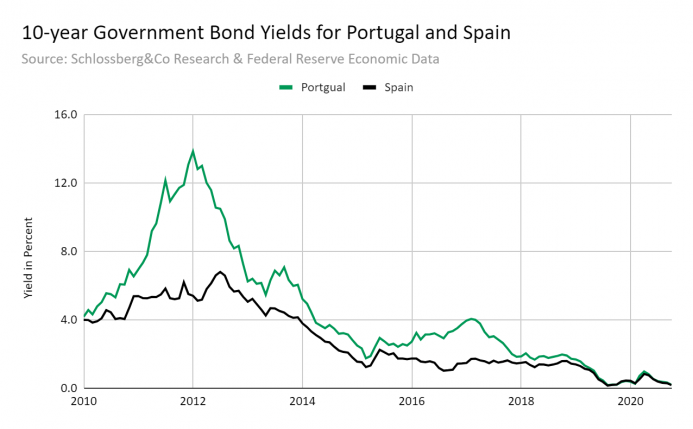

The obvious yet perfidious result of this: too much money is sloshing around looking for yields. Governments like Spain’s or Portugal’s, which are hardly known to be model boys when it comes to financial prudence as reliable debtors, are currently able to borrow money at zero cost. This seems to be completely nuts if one bears in mind that during the European debt crisis their high borrowing costs—in Portugal’s case up to 14 percent for its ten-year bond—forced the European Union to approve multibillion-euro bailout packages.

Financial markets have gone crazy. Not only do Swiss and German bonds have a negative interest rate, but the Spanish ten-year bond also recently dipped into negative territory for the first time, albeit for a brief period. Buying these new zero-to-negative-yield bonds is the European central bank (ECB), as an analysis by Germany’s DZ Bank shows.

The European bond is on the verge of vanishing. Just as Europe will gradually follow in Japan’s footsteps and increasingly experience the social consequences of zero interest rates, its bond market is being “japanified.” The Bank of Japan (BOJ) has long been overtaken by the fate of being virtually the sole bidder on Japan’s government bonds (JGB). The ECB is currently facing the same risk, and there really seems to be no way out of it. Just as has been the case in Japan, Europe’s central bankers are siloing ever more government bonds, depriving the private sector of this “high-powered” collateral and making monetary policy ever more difficult. In this regard too, Mises’s famous spiral of intervention will keep on spinning as technocrats and apparatchiks have to come up with new out-of-the-box “solutions.”

Too Much Money, Too Much Inequality

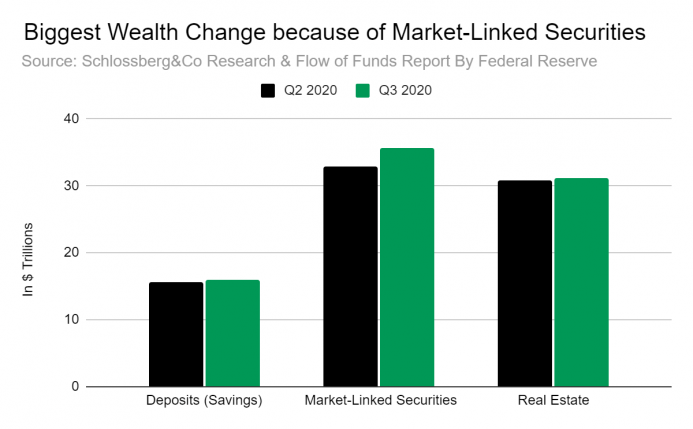

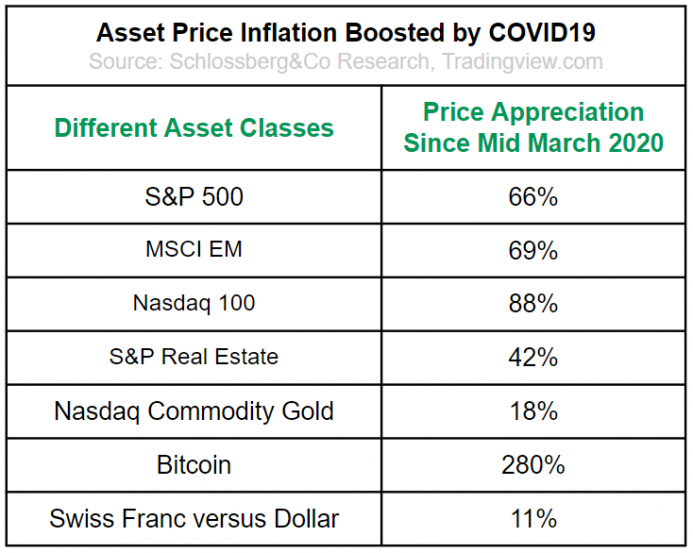

Paradoxically, because of this deluge of money in the system, asset price inflation will continue and see to it that today’s politically fraught wealth inequality will rise further. Assets of all sorts have seen price appreciation because of newly created liquidity flowing into them. At the same time, the stimulus checks to the US population illustrate quite nicely how well-meaning policy decisions actually exacerbate things by creating more wealth inequality.

Those who put their $1,200 in government grants into bitcoin as recently as mid-April have, as of December 16, made a whopping $3,749. Those among the recipients of these funds who are clever enough to anticipate such actions by others in time have most likely positioned themselves accordingly and have benefited disproportionately. In the end, it is second- or even third-order effects that increase wealth inequality and thwart any political measures trying to achieve the opposite.

Watch Out for Dumb Money Traders

The fact that too much money is around can ultimately be regarded as the result of what can be called today’s institutionalization of money creation. Because bank deposits and money balances—whether in a safe or piggy bank—are being pulverized by the day, more and more ordinary people feel obliged to join this game, i.e., the financial markets, in the hopes of being able to partake of this asset price inflation.

Today’s ultraexpansionary monetary policy is thus forcing more inexperienced people to become invested in the stock market than would be the case with more normal monetary policy. This push factor, combined with today’s technological possibility to invest easily, leads to an ever-increasing mass of so-called dumb money in the markets.

A word of caution: the term “dumb money” is not meant to denounce these investors. It merely soberly recognizes the fact that loads of people are currently being driven to invest in financial assets of which they have little knowledge, while simultaneously lacking the tools properly analyze them. Just as clueless sheep are led to the slaughterhouse, these investors are mercilessly exposed to the many pitfalls of financial markets. So to the detriment of financial markets, central banks today not only create a lot of ever-cheaper money, but also create more and more dumb money.

The detriment becomes clear in one very crucial aspect: because swaths of dumb money are chasing each and every share of stock, seeing a favorable window of opportunity to buy “cheap” stocks when markets drop, short sellers take the beating. Although the March 2020 sell-off was a profitable event for some short sellers, this year will most likely go down as one of the worst years for investors trying to profit from declining market prices.

Judging from an analysis by data provider Hedge Fund Research, a prominent index of short-selling hedge funds is down 32 percent annually. This comes as no real surprise given that a global monetary policy bazooka has been firing all year long at an increasing pace, turning short selling into an ever more dangerous endeavor. The vast amount of liquidity reflating asset prices at the slightest downtick is ultimately fabricating a sort of stability that only breeds instability under the surface. Too much money will one day be followed by too many tears.

Full story here Are you the author? Previous post See more for Next postTags: newsletter