The Lure of Easy MoneyRight now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia? The stock of the semiconductor company is up more than 170 percent over the last 9-months. Perhaps it will double again from here. Of course, there is nothing like an epic stock market bubble that warms the hearts and softens the minds of men to ideas that would otherwise be impossible. One idea du jour, for example, is that low interest rates justify high valuations. Another is that the Fed can permanently inflate stocks using its seemingly unlimited supply of credit. These ideas, and many others, are nearing their expiration date. As they turn from ripe to rot, investors that are counting on there always being a greater fool will discover what happens when you overpay for a stream of future cash flows. In short, future returns stink. Making any investment requires a combination of analysis, judgment, risk/reward expectations, time horizon, and personal finance considerations. Providence and luck are also important factors. You can do everything right, at least on surface, and yet still suffer unfortunate losses. This is especially so when it comes to stock market investing. You may buy precisely the right stock at precisely the wrong time. Something previously unknown may come to light, and the bottom drops out. Asset diversification and position sizing are critical to managing these risks. An S&P 500 index fund, at the moment, will not cut it. |

NVDA, weekly, over the past 6 years.NVDA, weekly, over the past 6 years. The stock really started to take off after the 2016 election surprisingly brought an administration to power that was willing to cut taxes and roll back regulations. This vastly improved the competitive position of US-based companies in the world and boosted their profit margins. Other favorable narratives accompanied the rise of NVDA and other tech stocks specifically, such as the cryptocurrency mania and the increase in demand fostered by the pandemic. Add to that the biggest driver of them all – an unprecedented exercise in money printing by the Fed and other central banks – and a bubble for the ages emerged. And that is where we now are: in the greatest stock market mania of all time. |

Fear and GreedAt critical stages in the stock market – like now – your long-term success comes down to what you don’t do, as opposed to what you do. Above all, you want to avoid doing something stupid; something that will set you back a decade – or more – on your goal of accumulating long-term investment wealth. Currently, the stock market is at a critical stage. After peaking at 3,386 on February 19, the S&P 500 abruptly loss over 33 percent, reaching an interim bottom of 2,237 on March 23. Since then, as of yesterday’s close at 3,722 (December 17, a new all-time closing high), the S&P 500 is up over 66 percent. In addition to the S&P 500 Index, the Dow Jones Industrial Average (DJIA) and the Nasdaq also attained record closing highs. Investing in stocks certainly appears enticing at the moment. But remember, investing psychology goes contrary to other types of purchases. While most people can quickly discern a bargain price for a pair of jeans or a flat screen TV, with stocks, they have the uncanny ability to buy high and sell low. The emotions of fear and greed always seem to get the best of them. |

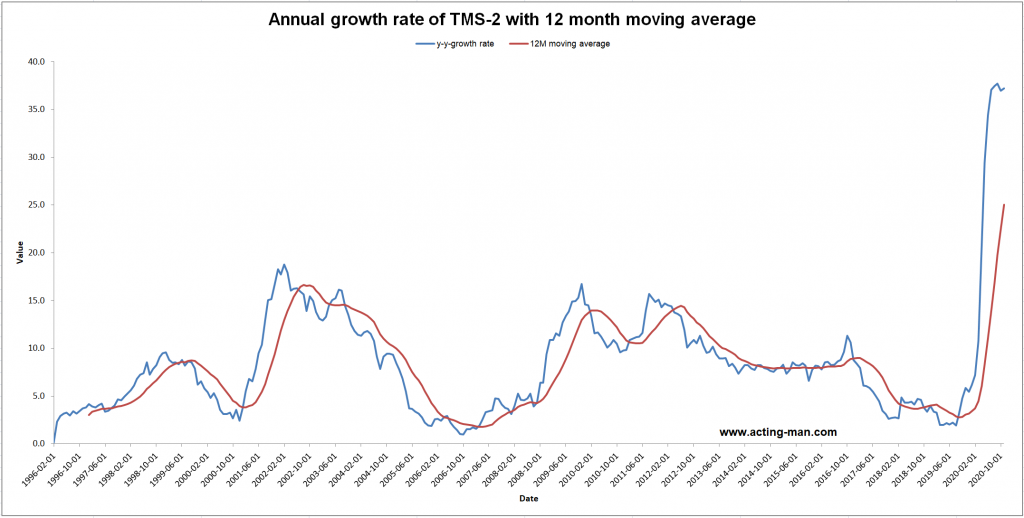

US – TMS-2 (broad true money supply), monthly year-on-year growth rate with 12-month moving averageUS – TMS-2 (broad true money supply), monthly year-on-year growth rate with 12-month moving average. The most recent data point is +37.2% as of November 2020. Needless to say, this is money printing at a truly staggering pace. What is particularly noteworthy in addition to the sheer extent of the surge is that it has not put in a sharp peak from which it begins to decline as it has in the past, but that extremely high growth rates have so far continued for 8 months running. Obviously this has buoyed all sorts of asset prices and it is difficult to tell how long it will continue to do so. One would expect there to be a limit at some point, but we have no historical data that are really useful for comparison purposes. |

| However, it should be noted that money printing is capable of overruling a plethora of other considerations, particularly if market participants become concerned about the purchasing power of the currency.

Perhaps, as the economy opens back up, growth will come roaring back. Maybe the new corona-virus vaccine will soon make this all a really bad dream. With these prospects, would now not be a great time to buy stocks? This rosy scenario appears to be what many investors are banking on. They continue to push stocks higher with every positive report of a vaccine roll-out or a new stimulus bill from Congress. Who knows? Maybe they are right. Still, we have some reservations. This is an extremely dangerous stock market. There are plenty of unknowns with respect to the economy and markets. How much economic damage did the lockdowns do? How long will it take for the economy to recover? What are the implications for the massive deficit spending and monetary stimulus measures that have been undertaken? When will this bubble finally pop? |

|

Grantham’s ‘Real McCoy’ Bubble in a World Gone MadOn June 17, billionaire investor and co-founder of the Boston-based money manager GMO, Jeremy Grantham, sounded the alarm. During a CNBC interview with Wilfred Frost, Grantham warned that the U.S. stock market’s rebound amid the coronavirus pandemic is a bubble that will end up hurting many investors.

In the months since Grantham’s warning the stock market bubble has continued to inflate to new highs. This move has gone against GMO, which had cut its fund’s stock exposure to 25 percent. The only way to avoid the bath is to remove oneself from the scene – but that involves substantial career risk for professional fund managers, particularly if the bubble just keeps expanding relentlessly. On November 24, Bloomberg reported that GMO’s flagship Benchmark-Free Allocation Fund trailed the S&P 500 by 14 percent year-to-date. On top of that, investors have pulled $2.2 billion from the fund in the last 10 months. Still, we are certain Grantham will be vindicated in good time. And investors that stuck with him will be rewarded for their patience. Here is why… |

|

Grantham has accurately predicted the end of several bubbles over his lengthy career. He correctly predicted the bursting of the Japanese Nikkei stock market bubble in the late 1980s, the dot com bubble in 2000, and the housing bubble in the mid-2000s.

Grantham’s philosophy is very practical. His focus is centered on the commonly used phrase ‘reversion to the mean.’ This is an observation that all asset classes and markets will revert to mean historical levels from extreme highs and lows.

Reversion to the mean, as an investment philosophy, is the recognition that financial asset prices in relation to their underlying value will get out of whack from time to time.

The greed and euphoria of a bull market will overshoot into a dangerous bubble. Similarly, during a fear driven bear market and mass liquidation, financial asset prices fall to a deep discount to their underlying value.

Of course, the time to buy is when prices are low. So, too, the time to sell is when prices are high. While reversion to the mean may be an accurate forecaster of the long-term price movement of a financial asset, it is a terrible indicator for market timing.

Who knows, this grumpy creature may be waiting just around the corner – the turn of the year is traditionally a risky time for bubbles. The above-mentioned Nikkei is testament to this, as it peaked precisely on the final trading day of 1989 – at a level it has never seen again since.

Bubbles often inflate much further and grow much more extreme than a rational observer would expect. In a world gone mad, the deviation can grow wider and more extreme before the reversion occurs. Nonetheless, Grantham’s analysis and the alarm that it sounds should be taken seriously.

The fact that the stock market has continued to rise – including the recent record closing highs for the S&P 500, DJIA, and Nasdaq – since Grantham called this a ‘real McCoy bubble’ does not disprove his assertion. Rather, it validates it.

Full story here Are you the author? Previous post See more for Next postTags: