| Dollar softness this week will take some pressure off of the foreign currencies but it’s too early to sound the all clear. This piece focuses on how central banks around the world may be intervening to influence their currencies. Most of the world, particularly EM, is grappling with supporting weak currencies but a select few are dealing with stronger currencies. This is a very opaque process and so we are simply making our best guesses. As April reserves data trickle out, we will update our numbers.

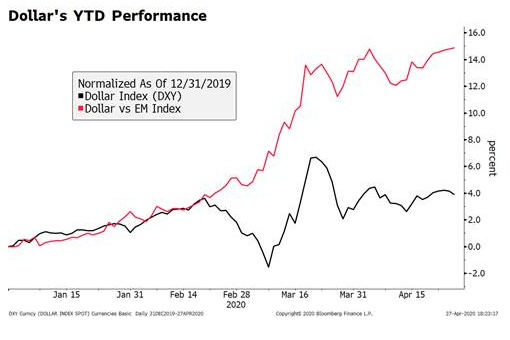

One must take care to adjust for valuation effects. That is, the dollar has risen about 3% YTD vs. the euro and 6% YTD vs. sterling and so the dollar value of any reserve holdings in those currencies will fall. On the other hand, the dollar has lost about 2% vs. the yen. We used the latest IMF Composition of Foreign Reserves (COFER) data for end-2019 and constructed an average portfolio of central bank reserve holdings by currency, and estimate that valuation effects have shaved about 3% off of global reserve holdings so far this year. |

Dollar's YTD Performance, 2020 |

| AMERICAS

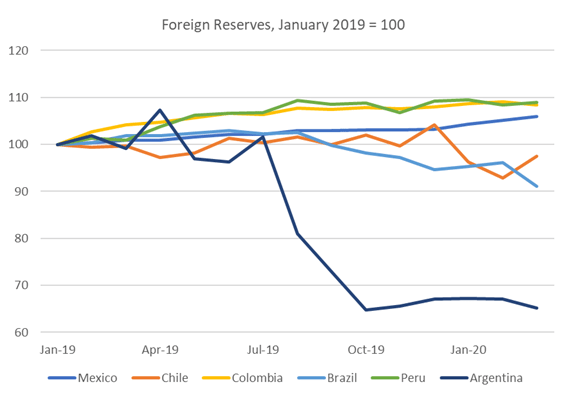

Argentina (ARS -10% YTD): Misguided efforts to support the peso last year led to a sharp decline in foreign reserves. With capital controls in place since September, there has been relatively little pressure on the peso and so no need to intervene. Foreign reserves ended March near $43.561 bln. Weekly data for April suggest some stability as reserves came in near $43.7 bln as of Friday. |

America Foreign Reserves, January, 2019 = 100 |

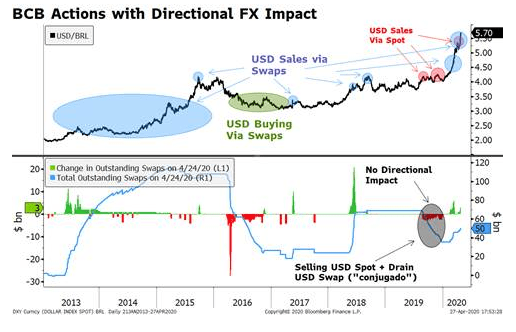

| Brazil (BRL -28% YTD): The central bank has up until recently relied more on FX swaps to support the real rather than outright intervention. However, recent intensification of BRL weakness has forced the bank to sell dollars outright in the spot market. This has led to reserves to drop sharply to $343.2 bln in March, the lowest since June 2011. Daily data for April show further erosion to around $341 bln as of Friday. Outstanding swaps have also increased to $51.764 bln currently from $35.484 at the start of this year.

Chile (CLP -12% YTD): Like Brazil, the central bank here has been relying more on FX swaps and forwards than outright intervention. However, it has intervened on the spot market from time to time. Foreign reserves ended March at $38 bln, down from over $40 bln in December. Colombia (COP -19% YTD): The central bank has taken a relatively hands-off approach to the exchange rate. However, the Treasury has recently been selling about $60 mln per day to help support the peso. Despite these sales, foreign reserves are near the highs at $53.3 bln in March. Mexico (MXN -22% YTD): Banco de Mexico has so far relied on selling FX hedges to support the peso, rather than outright intervention. Those hedges are settled in pesos and so have no impact on foreign reserves. Foreign reserves have actually climbed to a cycle high of $185.5 bln in March. Note that Banxico increased its FX hedge program to a maximum of $30 bln from $20 bln back in February 2019, and recently extended trading of these hedges after trading hours end. Peru (PEN -3% YTD): The central bank has had to deal recently with currency strength, not weakness. While taking a largely hands-off approach to the exchange rate, the bank has intervened from time to time this year to slow sol appreciation. As such, foreign reserves have risen and ended March at $68.2 bln, near all-time highs. |

BCB Actions with Direcrtional FX Impact, 2013-2020 |

| EUROPE/MIDDLE EAST/AFRICA

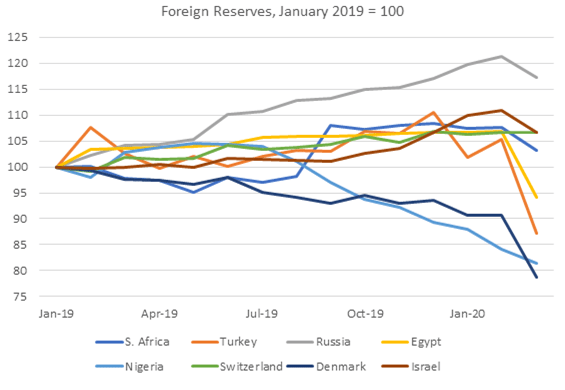

Denmark (DKK flat YTD vs. EUR): The krone is pegged to the euro and came under pressure this year. The central bank was forced to intervene in March to the tune of $9.4 bln, which accounts for foreign reserves dropping sharply to $55 bln from over $63 bln in February. Furthermore, the central bank hiked rates 15 bp on March 19 to help support the peg. Switzerland (CHF +3% YTD vs. EUR): The Swiss National Bank is one of the few central banks to be grappling with excessive currency strength. It is reluctant to take rates more negative and so instead has relied on direct intervention. Foreign currency reserves have risen to a record high $797 bln at the end of March. Sight deposits, a proxy for SNB intervention, jumped to a record high last week and suggests the SNB remains active this month. Israel (ILS -1% YTD): As part of its unconventional policies, the Bank of Israel has been intervening since 2008 to limit shekel gains. Foreign reserves have risen from a mere $28.6 bln in January 2008 to an all-time high of $131.2 bln in February. Reserves fell back to $126 bln in March, as the bank took some measures to help support the shekel as the impact of the pandemic spread. Russia (RUB -16% YTD): Lower oil prices have taken a toll on the economy and the ruble. We believe the central bank began intervening to limit currency weakness last month, as foreign reserves dropped sharply in March to $551 bln from the cycle high of $570 bln in February. South Africa (ZAR -25% YTD): The South Africa Reserve Bank takes a relatively hands-off approach to the exchange rate. As such, foreign reserves have remained fairly steady and stood at $52.4 bln at the end of March. Turkey (TRY -15% YTD): The central bank has taken a variety of administrative measures to help support the lira. However, these measures are only effective at the margin and the bank is likely to have supplemented this with direct intervention as well. Often, state-owned banks have been directed to carry out the dollars. Foreign reserves fell to $64 bln at the end of March, the lowest since April 2009. Weekly data show further erosion to only $54 bln through mid-April, the lowest since January 2006. Egypt (EGP +2% YTD): While the exchange rate was officially floated back in 2016, the pound is still loosely pegged to the dollar. With outflows being seen across most EM countries, foreign reserves fell over 10% to $40.1 bln in March, the lowest since January 2018. Nigeria (NGN -10% YTD): Nigeria is particularly dependent on oil. As a result of the collapse in oil prices, foreign reserves have fallen sharply and dollar liquidity has dried up. The central bank devalued the naira by 10% last month, but we suspect more needs to be done as foreign reserves have fallen to $35.2 bln in March, the lowest since November 2017. Daily reserves have fallen further to $33.6 bln as of last Wednesday. |

Europe/Middle East/Africa Foreign Reserves, January, 2019 = 100 |

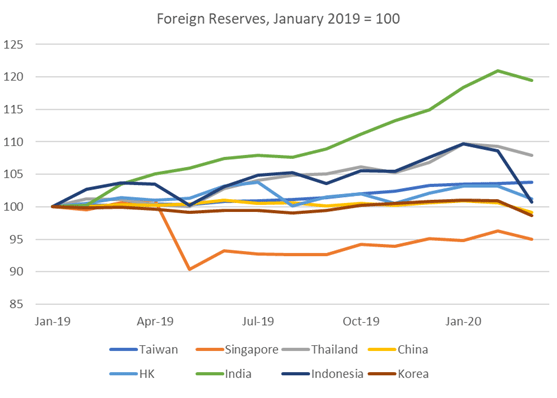

| ASIA

China (CNY -2% YTD): There is little doubt that policymakers have been leaning against yuan weakness this year. Yet this has been done largely via the fix, with the PBOC often fixing the yuan stronger than what models suggest. China’s huge war chest of foreign reserves remains stable at around $3.1 trln in March. Hong Kong (HKD +0.5% YTD): The Hong Kong Monetary Authority (HKMA) is one of the few central banks to be grappling with excessive currency strength. Because of the HKD peg, the HKMA is obliged to intervene when the currency approaches either end of the 7.75-7.85 trading band. This month, Hong Kong has seen inflows that have pushed HKD to the strong end. As a result, the HKMA has had to purchase $1.6 bln (and counting) to prevent excessive strength. Note that the HKMA has an unlimited amount of HKD to sell. India (INR -6% YTD): The Reserve Bank of India was thought to be intervening to support the rupee last month. As such, it’s not surprising that foreign reserves fell to $475.6 bln in March from an all-time high of $481.5 bln in February. Prior to March, the RBI was actively absorbing dollars. Indonesia (IDR -10% YTD): Bank Indonesia has confirmed that it has been intervening to support the rupiah. Foreign reserves fell sharply to $121 bln at the end of March, the lowest since January 2019. Korea (KRW -6% YTD): The Bank of Korea has largely stuck with verbal intervention this year as the won weakened. However, foreign reserves fell to $400 bln in March from $409 bln in February and suggests the BOK may have become more active. Singapore (SGD -5% YTD): The Monetary Authority of Singapore manages the currency within its so-called S$NEER trading band. It is obligated to intervene in order to keep it within that band. At its emergency meeting in March, the MAS reduced the slope to zero and re-centered the band to the prevailing level at the time. Foreign reserves stood at $279 bln at the end of March, near the recent highs. Taiwan (TWD flat YTD): The Taiwan dollar has not been impacted greatly and is one of the best performers within EM this year. As a result, the central bank has not had to support the currency and foreign reserves have risen to an all-time high of $480 bln in March. Thailand (THB -8% YTD): The baht has come under some pressure this year after outperforming last year. Bank of Thailand intervened last year to prevent excessive baht strength. As such, we do not believe it is acting this year to support the baht as some weakness is likely to be welcomed. Foreign reserves stood at $226.5 bln at the end of March, near record highs. |

Asia Foreign Reserves, January, 2019 = 100 |

Tags: Articles,developed markets,Emerging Markets,newsletter