- The tug of war between extending vs. softening lockdowns continues

- The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden

- Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut

- Japan Prime Minister Abe’s approval rating is taking a hit; China’s trade figures for March came in far better than expected

| The dollar is mostly softer against the majors as Europe returns from holiday. Stockie and Swissie are outperforming, while Loonie and Kiwi are underperforming. EM currencies are mixed. The CEE currencies are outperforming, while ZAR and MXN are underperforming. MSCI Asia Pacific was up 1.7% on the day, with the Nikkei rising 3.1%. MSCI EM is up 1.0% so far today, with the Shanghai Composite rising 1.6%. Euro Stoxx 600 is up 0.6% near midday, while US futures are pointing to a higher open. 10-year UST yields are down 2 bp at 0.75%, while the 3-month to 10-year spread is down 4 bp to stand at +54 bp. Commodity prices are mostly higher, with Brent oil flat, copper up 0.5%, and gold up 0.4%.

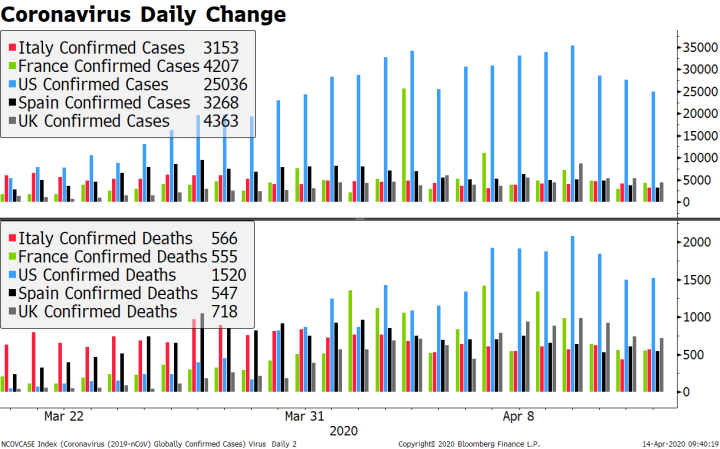

The tug of war between extending vs. softening lockdowns continues. Different outcomes are being seen across countries. Italy and Spain, where the worst seems to be over, are on track for gradual re-opening. US President Trump is also pushing in this direction. France, the UK, Japan, India, and others are moving towards extending or hardening their lockdowns. |

Coronavirus Daily Change, 2020 |

| The dollar remains under modest pressure but we think it will eventually recover. Last time this happened back in March, the dollar eventually recovered and we see the same dynamic in play now. DXY appears on track to test the March 27 low near 98.27. Looking ahead, 97.873 area is key as a break below would set up a test of the March 9 low near 94.65. Ahead of that is the 200-day moving average coming in near 98.185 currently.

AMERICAS Bernie Sanders has endorsed Joe Biden. Results from the Wisconsin Democratic primary last week show why Sanders had no choice but to suspend his campaign. Biden won nearly two thirds of the vote, mirroring Biden’s most recent margins of victory. There was simply no way Sanders could make up any ground and so he did the right thing by dropping out and endorsing Biden. Recall this is very different than what we saw in 2016,when Sanders held on to the very end, lost, and then was reluctant to endorse Hillary Clinton. As we’ve noted for the last couple of weeks, the weekly claims data show that the swing states that President Trump has to win have suffered greatly in terms of job losses. Looking at last week’s claims data, California was again the worst with 935k, followed by Georgia at 388k and Michigan at 385k. New York is fourth at 345k, followed by Texas at 314k, Pennsylvania at 284k, and Ohio at 224k. The other takeaway from last week’s Wisconsin primary is that the liberal challenger for the state Supreme Court seat beat the conservative incumbent backed by President Trump. There is only one minor US data point today, which is March import/export prices. There are some Fed speakers, however, as Bullard, Evans, and Bostic all appear today. |

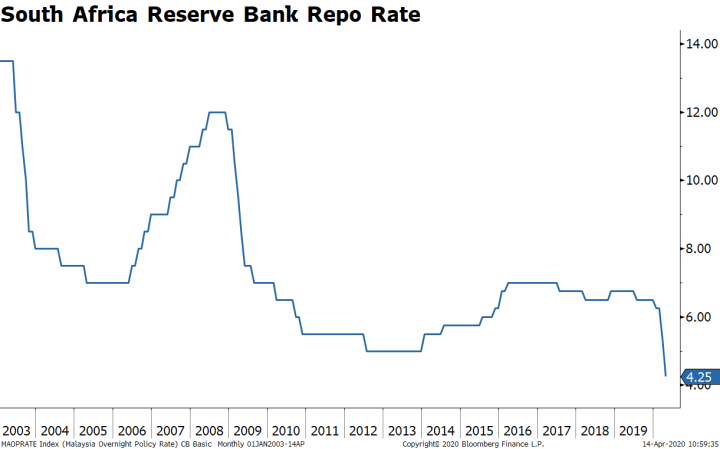

South Africa Reserve Bank Repo Rate, 2003-2019 |

| EUROPE/MIDDLE EAST/AFRICA

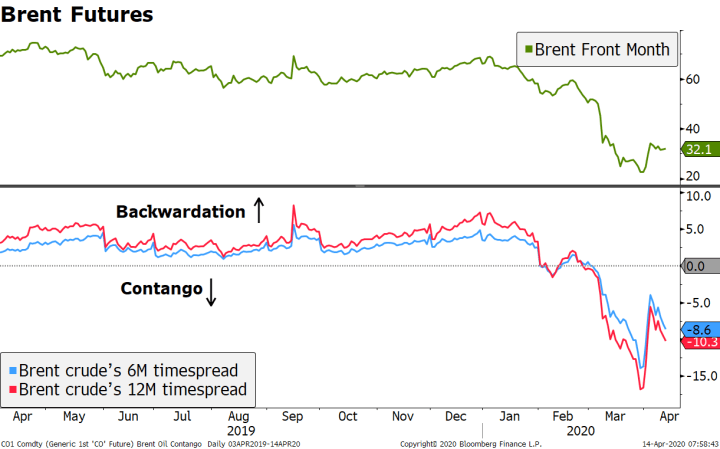

Europe reopens from holiday today but the news stream remains light. In the absence of any fundamental developments, we continue to focus on the technicals. The euro continues to struggle in the $1.0950-70, which coincides with the 50% retracement objective of the March-April drop. Sterling continues to edge higher and traded at its highest level today since March 13 near $1.2575. Clean break of the $1.2515 level (62% retracement objective of the March drop) sets up a test of the March 9 high near $1.32. The 200-day moving average near $1.2655 currently will likely offer some intermediate resistance. Lastly, the EUR/GBP cross is making new lows for this move and is on track to test the February low near .8282. The South African Reserve Bank cut rates 100 bp to a record low 4.25% in an unscheduled meeting today. This comes just after the government announced an extension to the lockdowns in the country until the end of the month. Officials face a very difficult balancing act with the economy entering the crisis in a precarious state. With no material fiscal response so far, SARB is trying to take on the counter-cyclical stimulus. Unsurprisingly, the rand is down nearly 1% today and a whopping 23.5% year to date, making it the worst performing major EM currency. Brent crude is up just over 2% ($0.70) over the last two sessions to $32.14 per barrel on the back of the 9.7 mln bbl/day output cut agreement over the weekend. The deal was global, between deliberate cuts by OPEC+ and “organic” cuts by producers (such as the US) which will see productions fall naturally. There is a lot of fuzziness over the numbers, as expected, but the fact that oil is not selling off on the news is probably sign of success. Of note, the oil futures curve has started to re-steepen again (greater contango) in the aftermath of the meeting, suggesting traders are not that convinced the near-term impact on the oil glut will be decisive. |

Brent Futures, 2019-2020 |

| ASIA

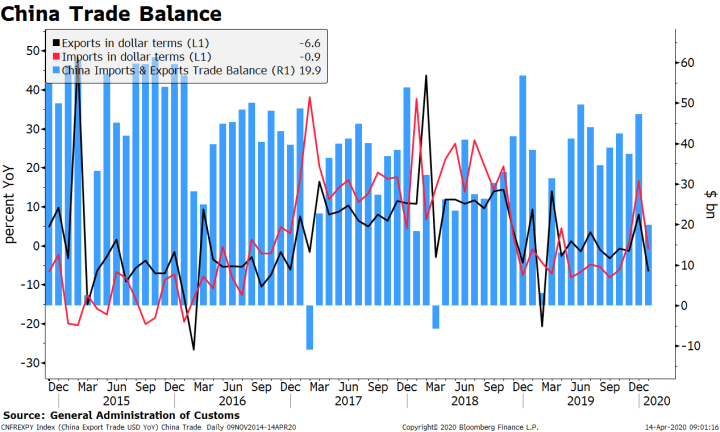

Japan Prime Minister Abe’s approval rating is taking a hit as the virus outlook worsens and the government gears up for more restrictive measures. The most recent set of polls now show a higher number of people disapproving than approving of his cabinet. While most agree with calling for a state of emergency, the vast majority saw it as coming too late. Aside from more restrictive measures, the government has announced a near $1 trln rescue plan, worth about 20% of GDP. Japan has about 7.5K confirmed cases and 143 deaths, but has also undertaken comparatively low number of tests, just 600 per million of population (compared to about 17K in Italy, 16K in Germany, and 9K in the US). China’s trade figures for March came in far better than expected. Exports contracted -6.6% y/y vs. -13.9% expected and imports fell only -0.9% y/y vs. -9.8% expected. The trade balance for the month came in at $20 bln, down from $47 bln in February and a $38 bln average for the last five years. While a positive outcome, we still find it very difficult to put a lot of weight on these numbers – or any economic numbers, for that matter. The fog of war is still too thick. Still, data would seem to confirm that activity in China is recovering. Retail sales, IP, and Q1 GDP will all be reported Friday. |

China Trade Balance, 2015-2020 |

Bank Indonesia kept its rates on hold at 4.50% but reduced required reserves instead. Most were looking for a 25 bp cut. The RR was cut by 200 bp for commercial banks and 50 bp for shariah-compliant lenders. To us, this is a clear signal that officials are concerned about further rupiah depreciation, the worse performing currency year to date (-11.5% against the dollar). Despite today’s decision, there is still ample space for easing and we would imagine it will happen once EM FX markets settle down. The currency is little changed on the day.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,newsletter