| One of the most common debates that has occurred in the United States for the past six decades is the discussion of the poverty rate. As the narrative goes, the US has an unusually high poverty rate compared to equivalent nations in the OECD (Organisation for Economic Co-operation and Development). Although it’s true that the measure of poverty is flawed, especially when compared cross-nationally, this piece addresses the reasons why the poverty rate in the US in particular has not improved.

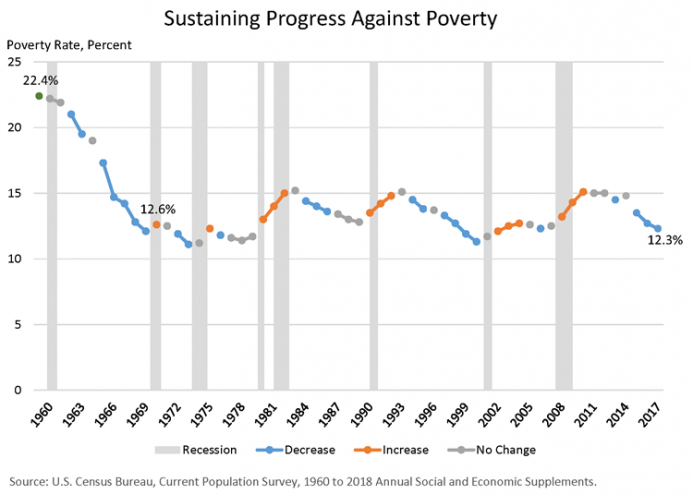

If we look at the graph below, we see that official poverty rates fell 44 percent between 1960 and 1969 then spent the next fifty years fluctuating between an 11 and 15 percent poverty rate. It’s this lack of improvement over a five-decade period that is interesting, especially considering that poverty rates had consistently been dropping for over a century. |

Sustaining Progress Against Poverty, 1960-2017 |

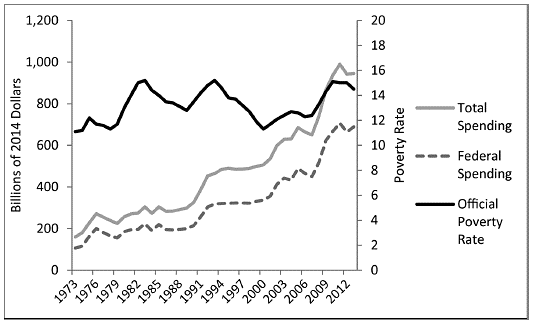

Incentive ProblemsOne of the key problems is that during the 1960s the Great Society programs were implemented, particularly the War on Poverty. Over this period, spending on anti-poverty programs exploded five times in inflation adjusted dollars, going from 3 percent of public spending to 20 percent between 1973 and today. Yet the poverty rate stubbornly ignored all this lucrative expenditure. A key problem is that none of these programs built in an incentive system to graduate people off the assistance. Push systems, systems where a person is ejected from assistance if they prove unwilling to improve themselves, are nonexistent, while pull systems, like job training programs, are ineffective at best. Without these systems, people neither have the tools nor the drive to exit these programs. These programs, in effect, have generated a culture of dependency. Out of sixty-nine welfare programs that the government operates, just two, EITC (earned income tax credit) and the child refund credit, require any kind of employment and even then are tax discounts. Further, the expansion of various handout programs has successfully eradicated the stigma of public assistance, removing the social pressure to improve and exit. When nearly half the population receives public assistance, not including individuals receiving a paycheck for public sector work, people view it as normal and acceptable. |

Poverty Rate, 1973-2012 |

Public Sector Interference

For those who do legitimately want to break the cycle of dependency, the public sector isn’t making things any easier. One of the major problems with the welfare structure is that it requires funding in the form of taxes, debt, and inflation. The tax structure necessary to fund redistribution schemes naturally creates a Tax Dead Zone. What this dead zone does is create an income range where, after all taxes and benefits are accounted for, earning an extra dollar in gross income results in either no change or a reduction in net income.

Essentially, the extra dollar in earnings is taxed at 100 percent or more, penalizing the current recipient for attempting to exit public assistance. This dead space is nearly $20,000 in range, meaning that if the person estimates they’re unable to consistently earn above roughly $60,000 a year, it’s better to not try and to stick around $18,000 a year since the net benefit structure at $18,000 results in more resources to live on than at $45,000. It is mathematically impossible to design a welfare and tax structure that doesn’t, at some point, penalize a welfare recipient for earning more money.

Another insidious trap is the regulatory structure. People who are current welfare recipients tend to have few or no job skills. This is particularly true for younger individuals who haven’t had a first job yet. What the regulatory state does is drive up the cost of employment. When employment costs are raised, be it through a minimum wage or workplace rules, a higher skill level is demanded from the worker to generate sufficient revenues to justify the cost. If the applicant isn’t sufficiently skilled, they won’t get hired.

Unemployment can create a cycle of further unemployment in this environment. Since skills degrade over time, a person who elects to take twenty-six weeks of paid unemployment instead of a temporary lower-skilled role will be at a major disadvantage. Long-term unemployment becomes a trap, since the individual will no longer possess sufficient skills to cover the cost in wage mandates, taxes, and regulatory impositions of hiring them. If public unemployment benefits didn’t exist and the state didn’t artificially inflate the cost of employment, this individual wouldn’t have been lured into taking a six-month vacation and wouldn’t have struggled to justify the costs of their employment.

The impacts are particularly bad in terms of generational poverty. The minimum wage has a strong negative impact on youth employment rates. Teens who are unemployed enjoy significantly lower lifetime earnings and are more likely to be unemployed as adults compared to their peers who held a part-time job. This, in turn, leads to greater utilization of public sector benefits.

Incentives for Government

Based on its poor track record, one wonders if government even wants to solve the poverty problem. Seattle, for instance, spends roughly $100,000 per homeless resident of the city on homeless relief programs. The major beneficiaries of this public largess are charity organizations that claim to assist the poor but use that money to pay themselves salaries in excess of $200,000 for a single executive. Major agencies, including the Department of Health and Human Services, employ tens of thousands of people.

What would happen should poverty and homelessness be eradicated? No more $200,000 salary. No more job for tens of thousands of people. No more $8 million temporary tents.

Poverty and homeless assistance has turned into a big business. We now have a Homeless Industrial Complex, and poverty assistance has become big business. The public sector appears to be fully invested in ensuring that poverty and homelessness persist. Without the homeless, what do we need with a Low-Income Housing Institute? Without the poor, how could the Department of Agriculture justify $100 billion a year in the farm bill? There is little evidence that the state cares to solve the issue, only caring to make homelessness and poverty a viable lifestyle choice.

The Future

The state has, by accident or by design, created a permanent underclass. Radical elimination of regulatory impositions and the elimination of the minimum wage are merely the first steps toward solving the problem of poverty. The underlying issue is that the transition into a nation that can truly eradicate poverty will be painful. People trapped in public dependency won’t develop skills overnight, and odds are that they may never develop the skills needed for well-paid employment. Breaking habits is difficult and the sad reality is that catching up is a myth. People behind now will always be behind; if there were a magical means to accelerate skill development, everyone would be using it and the same person would still be behind.

But we can lay the groundwork for future generations not to have to battle through these public sector barriers, and we can return to the poverty improvement rate seen before the Great Society disrupted the process.

Full story here Are you the author? Previous post See more for Next postTags: newsletter