Post Hoc FallacyOn Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down. Were the DJIA operating within the framework of a free capital market it would be normal for the index to go both up and down. But remember, the U.S. stock market is hardly a free market. Not when it is under the influence of extreme Fed intervention. When the Fed speaks, the DJIA should go up. At least, that is the opinion of President Trump. And as Powell spoke, the Real Donald Trump took to Twitter and delivered his play-by-play assessment:

President Trump, no doubt, was falling for the post hoc fallacy by linking correlation with causation. Was this intentional? Was it ignorance? You decide. Regardless, the Fed is culpable in its own right for creating the condition where the stock market only goes up. Still, the Fed’s influence is not without limits. Certainly, the stock market will one day slip through its grip. But when? |

|

Cheap and YummyThe DJIA has gone up and to the right for nearly 11 years. During this time there have been several moderate corrections. Yet nothing to set off a serious panic. After this extended bull market run, many investors have swallowed the belief – hook, line, and sinker – that the Fed has erected safety bumpers along the stock market’s path. That, somehow, the Fed has fabricated a market free of risk. That Fed Chair Powell, or his successor, will always save the day with more liquidity. |

Great Financial Crisis |

| Thus, bad news is good news. A slowing economy, rising unemployment rate, earnings recession, trade war, global pandemic, drone strikes, presidential impeachment trial, melting glaciers… you name it. The worse the news is, the better.

Because bad news means more Fed liquidity. And more Fed liquidity means higher stock prices. And higher stock prices means the nirvana of inflated stock portfolios. And the nirvana of inflated stock portfolios means an enlightened and purpose driven life. And an enlightened and purpose driven life means he who dies with the most toys wins. What to make of it? Years ago a friend of ours had grand plans of opening a restaurant called, Cheap and Yummy. His firm belief was that it would be a no fail proposition, so long as he could deliver on the big promise of cheap and yummy food. Who doesn’t want yummy food on the cheap? Of course, the restaurant never advanced from being just an idea. And, quite frankly, the idea was a joke. No tangible steps were ever taken to bring it to fruition, as far as we know. Here is the point… |

|

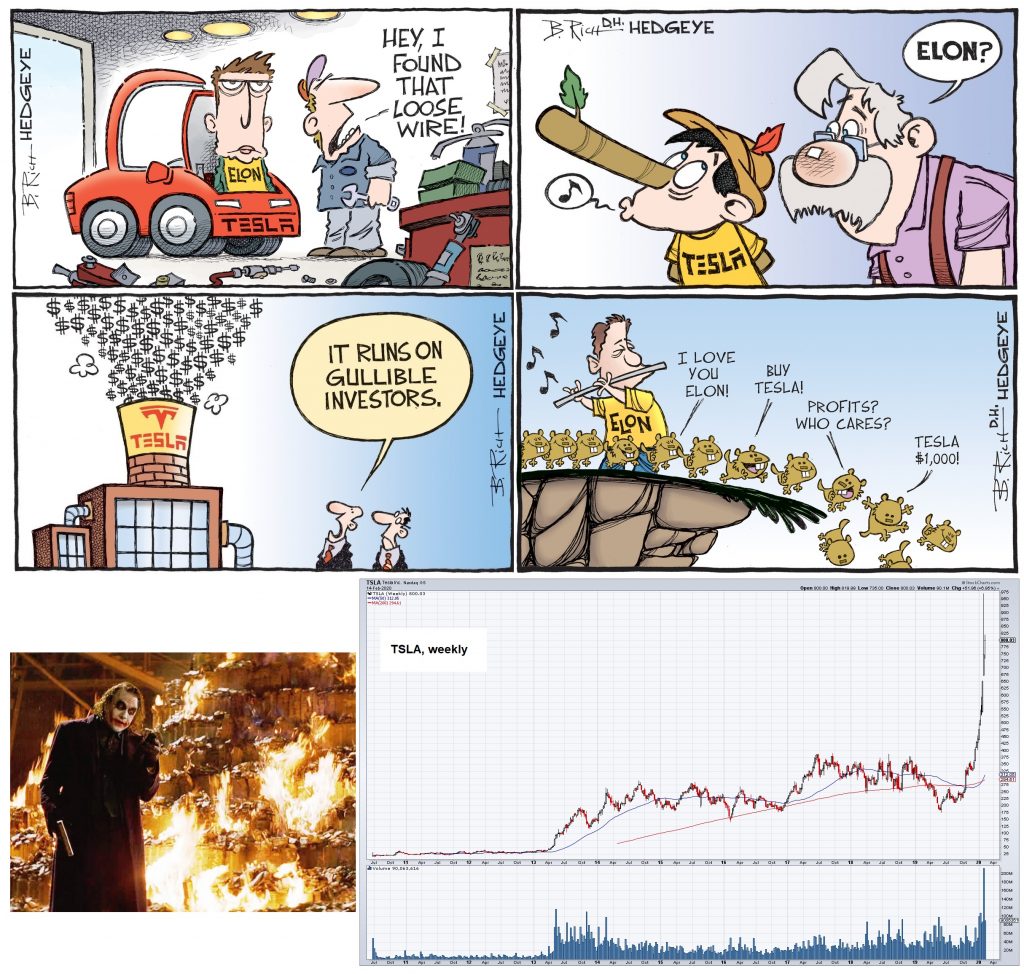

The Secret to Fun and Easy Stock Market RichesAfter 40 years of increasing liquidity blasts into credit markets, the Fed has promised investors a much larger – and much more dangerous – joke of an idea: That investing in stocks is fun and easy. However, you must know an important secret. And what you must know about this important secret is that for most thinking people, it is counter-intuitive. Specifically, the secret to fun and easy stock market riches, as promised by the Fed, is to not think. The evidence is overwhelming. The most successful investors over the last 11 years are those who shut off their brains and just bought stocks no matter what. They have been the real winners. Investors who recognized the obvious disconnect between the stock market and the underlying economy most likely sold years ago. Some have even been sitting in cash, in disbelief, this entire time. They have missed out big time. Moreover, investors who maintained focus on fundamental analysis, sensible asset allocation and value stocks have been punished for their prudence. They didn’t know the secret to fun and easy stock market riches. Instead, they made the fatal mistake of using their brains. Therefore, shut off your brain and buy shares of Tesla. Don’t question the fact that Tesla sets money on fire. Just buy! Full disclosure: We are 100 percent certain the secret to fun and easy stock market riches will work perfectly well until the precise moment it works perfectly badly. Caution is advised at this juncture. |

It is fair to say that there are considerable differences of opinion over TSLA… before the recent blow-off move to the upside, almost one third of the share float was sold short. Not surprisingly, this short position has in the meantime declined, but this example certainly illustrates the dangers of betting against a heavily shorted “fantasy stock” during a stock market bubble. Tesla may well succeed and today’s valuation may look justifiable one day. However, we suspect that after having disemboweled the shorts, it will probably soon proceed to do the same to longs who were late to the party. [PT] |

Charts by St. Louis Fed, stockcharts

Chart annotations and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: newsletter,On Economy,The Stock Market