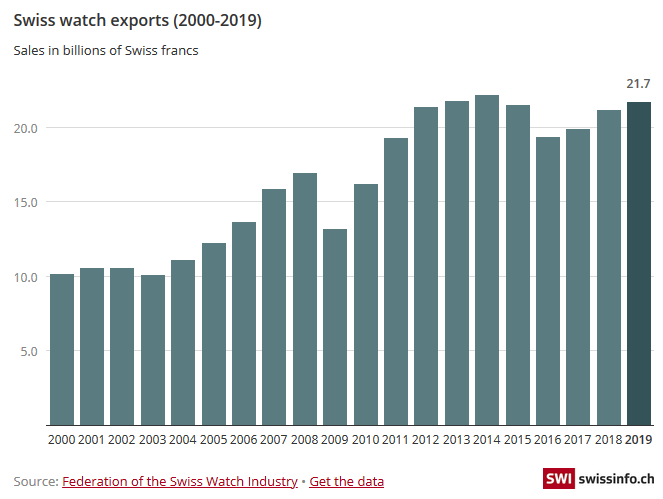

| Swiss watch manufacturers exported timepieces worth over CHF21 billion ($21.7 billion) last year – the industry’s third-best result ever.

Watchmaking is Switzerland’s third-biggest export sector after pharmaceutical and machine tools. Almost 95% of production is sold abroad, the majority to Asia. First the good news. Despite a complicated business year which saw a net drop in sales in Hong Kong, the main destination for Swiss-made watches, firms ended 2019 extremely positively. |

Entry-level Swiss watches like the famous Swatch, did not sell well last year unlike more expensive luxury “Swiss-made” models. |

| The value of watch exports rose for the third consecutive year to CHF21 billion in 2019, close to the 2014 record.

According to figures published on Tuesdayexternal link by the Federation of the Swiss Watch Industry, the biggest markets for Swiss watches last year were Hong Kong (-11,4%, CHF2.7 billion), United States (+8,6%, CHF2.4 billion), China (+16%, CHF2 billion), Japan (+19,9%, CHF1.6 billion) and Britain (+10,8%, CHF1.3 billion). Lower volumesThe more worrying news is that Swiss watchmakers sold only 20 million watches abroad last year – three million fewer than in 2018. “This historically low level, even below that of 2009, is comparable with volumes exported during the lows of the 1980s,” said the federation. The growth in exports mainly concerns watches worth over CHF3,000. The lower segments all saw lower growth in 2019. The main reasons were competition from internet watches, such as the Apple Watch, and tougher rules for firms using the “Swiss made” label. There are two very different schools of thought currently doing the rounds in the watchmaking industry. There are those who believe that watchmaking’s future will only be secured thanks to luxury watches that cost several thousand or tens of thousands of Swiss francs sold to rich customers around the world, especially in emerging countries. While others fear that the lower volumes will end up hurting the Swiss machine tool industry and will have an impact on the entire sector. |

Swiss watch exports (2000-2019) |

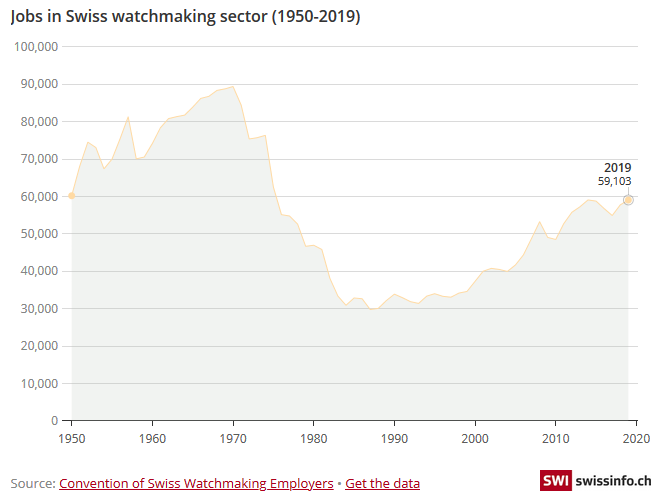

Extra jobsBut the healthy export situation has given a positive boost to employment. Over 12 months, the watchmaking industry created 1,300 new jobs, an increase of 2% on 2018. The Convention of Swiss Watchmaking Employersexternal link says 59,000 people are currently employed producing “Swiss made” timepieces. This is similar to the previous peak in 2014. “After a significant increase in manufacturing staff in 2018, almost all new personnel in 2019 are on the administrative side. This is a classic situation during a favourable business period,” said the employers’ association spokesperson Ludovic Voillat. |

Jobs in Swiss watchmaking sector (1950-2019) |

Stagnation ahead

But fears that watchmaking is being dominated by a growing number of service-related jobs in sales, marketing and communication are unsubstantiated.

“These past ten years, the ratio of jobs in production (70%) versus administration (30%) has remained stable,” said Voillat.

Despite increased automation, manual watchmaking expertise is still crucial, especially in the luxury watch segment.

“Even if robots are tested, assembly work is mainly done by hand,” said Voillat.

In the coming 12 months, the employers’ association nonetheless expects job levels to stagnate due to the economic situation and instability around the world. The drop in volume could also have a negative impact on employment in the medium term.

“For the moment, brands and suppliers producing entry-level watches are doing their utmost to preserve jobs and internal expertise. But if this trend continues, job cuts could be expected,” said Voillat.

Translated from French by Simon Bradley Full story here Are you the author? Previous post See more for Next postTags: Business,newsletter,Work