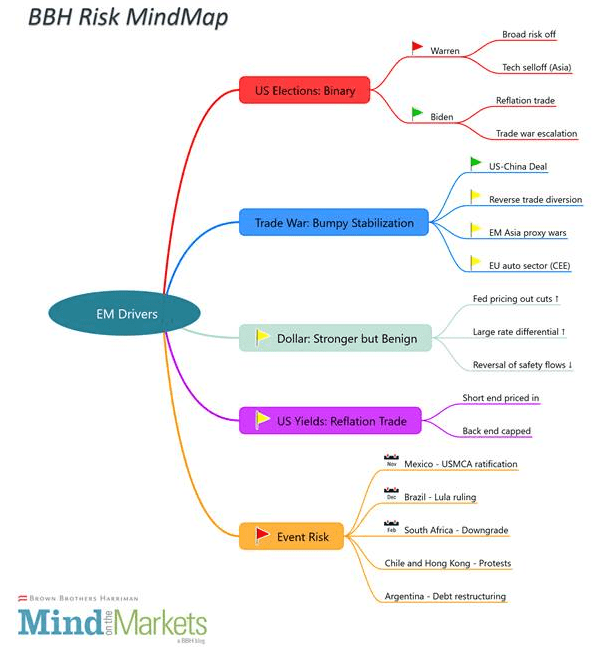

| With year-end upon us, we review some of the key risks to EM assets and how we think they progress from here. In short, the two most significant downside risks would be a decisive improvement in Elizabeth Warren’s polling figures and an upset in the US-China trade negotiations.

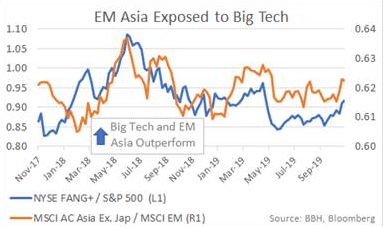

We expect a stronger dollar and higher yields in the near-term but with the upside for both capped, leaving us with a modestly favourable risk-taking environment. In terms of risk distributions, EM Asia is most exposed to exogenous factors (proxy trade wars, trade rebalancing, Warren-led tech sell-off), while Latin America and South Africa are most exposed to idiosyncratic event risks. US Elections: Binary The nomination of Elizabeth Warren would be a negative outcome for markets in general and to EM Asia assets in particular. Her platform concerns just about every segment of financial markets, but the clearest transmission to EM is likely to come from her antagonism (primarily via antitrust) towards the tech sector. This means that Asia could be in for some turbulent times. As a simple proxy for this risk we compare two ratios: MSCI Asia x-Japan/MSCI EM vs. FANG+ stocks/S&P 500. (Where FANG+ is Facebook, Amazon, Netflix, Google, and Apple). The chart below shows how closely the fortunes of EM Asia equity markets are tied to big tech companies. If Biden wins the Democratic nomination, our main concern is a re-escalation of the trade war. Trump will likely try to exploit the perception that Biden is weak on foreign policy, with a more conventional approach and a less exiting platform. However, we doubt Trump would go as far as risking an economic fallout by provoking China so close to the elections. Instead, we expect Trump to look further afield for other targets (see below) to assert his foreign policy credentials. We will update this discussion to include Michael Bloomberg if he decides to run for president. |

BBH Risk MingMap |

| Trade War: Bumpy Stabilization

We expect continued improvement on the US-China trade front, but also a more erratic path for US foreign policy. The scenario we outlined in our piece A New Stage of the US-China Conflict has played out nicely, as well as our warnings last week that volatility will pick up from here. There are two reasons for this. First, there will more posturing and public friction between the US and China going into the final negotiating stages of the deal. Our instinct is to fade these headlines since the incentives on both sides remain aligned; nothing we have heard so far changed our baseline call a deal in December (even if symbolic). Second, we expect more aggression towards China from the US Congress in the coming months. Recall that aside from the presidency, all 435 seats in the House will be contested in the November 2020 elections, along with 34 of the 100 Senate seats, and that anti-China for both Democratic and Republican voters is on the rise. If we are right about a completed Phase One deal this year, there are at least three potential implications for EMs:

|

EM Asia Exposed to Big Tech, 2017-2019 |

| The Dollar: Stronger but Benign

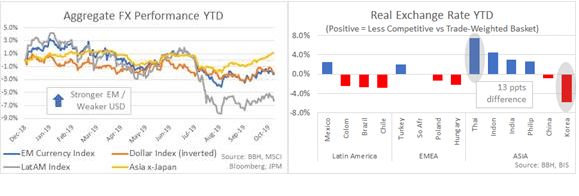

We see a stronger dollar in the near term as a headwind for EM local assets, but not enough to offset the benefits of a US-China trade deal. The immediate factors arguing for dollar appreciation include still more pricing out of Fed cuts, wide rate differentials for the foreseeable future, and the reversal of what is left from flight-to-safety flows from trade war tail-risks. But these factors should diminish in intensity, and portfolio diversification outflows from the US should rise as we move down the proverbial dollar smile. If our lower external volatility scenario plays out, we should also expect idiosyncratic factors to play a larger role for EM returns. In aggregate, currencies were tracking the broad dollar moves until around August, and then there was a huge regional split. Since the start of Q4, EM Asia began to outperform, EMEA stayed somewhere in the middle, while Latin America underperformed (first Argentina, then Brazil, then Chile). Taking a broader view, it looks like we will be starting 2020 with some important divergences in the real effective interest rate (REER) between regions that built up over the year. Using the BIS’s metric, we see that Korea has become considerably more competitive against a weighted basket of its trading partners, while the opposite is true for Thailand, Indonesia, and India. In Latin America, Mexico is ending the year with a loss of competitiveness, but Brazil, Colombia, and Chile are gaining. The moves in EMEA have been more muted. |

Aggregate FX Performance YTD/Real Exchange Rate YTD |

Higher US Rates: The Reflation Trade

We think rates in the US are more likely to go up than down from here, but not enough to pose a significant threat to EM. The bottom line is that rates are rising for “good reasons.” Investors are less pessimistic about the global economy and the tail risks from the US-China trade war are less menacing. The same goes for hard Brexit risks. In the short end, this means no more need for insurance cuts by the Fed, as we had expected. But with less than 10% of implied probability of a cut priced in for the December meeting and close to 50% for 2020, there is not much pricing out left while still allowing for some risk premium. Meanwhile, in the back end of the Treasury curve, we don’t think there will be much more to go with the 10-year trading close to 2.0%. There is still plenty of liquidity out there chasing relatively few (and expensive) assets, so we expect any uptick in US rates to be capped by voracious demand for yield. For EM, this outlook warrants a more defensive near-term posture in local markets, but with a view to receive rates as opportunities arise, especially from US-driven sell-offs.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Emerging Markets,newsletter