Central bankers and politicians in many countries have expressed concerns about Libra’s potential impact.

Facebook’s Libra cryptocurrency poses no threat to central banks or to financial law and order, the head of the Geneva-based Libra Association tells swissinfo.ch. Many regulators, politicians and central banks have reacted with alarm to the proposed new digital payments system.

Slated to launch next year, Libra plans to create a reserve of currencies – including US dollars, British pounds and euros – to stabilise the value of its digital coin. This has led to fears that Libra, with potential access to Facebook’s 2.5 billion users, could accumulate a large enough fund to interfere with central bank monetary policy.

Libra Associationexternal link Managing Director Bertrand Perez is operational head of the non-profit entity that is charged with managing this basket of currencies. He also outlines the association’s plans to create jobs in Geneva.

swissinfo.ch: Have you been surprised by the backlash from regulators against Libra?

Bertrand Perez: It’s normal that regulators are taking this seriously. Blockchain is a very powerful technology that will disrupt payment systems. People don’t want blockchain to open a pandora’s box and allow the bad guys to jump in with money laundering or financing of terrorism. Regulators recognise the need for faster, cheaper and more inclusive ways to transmit money, but their role is also to protect us from bad actions.

We are proactively engaged with regulators to prove that we are putting into place a number of anti-money laundering and ‘Know your Customer’ safeguards to keep out the bad actors.

swissinfo.ch: Will Libra be some kind of private central bank?

B.P.: We will not be engaging in any monetary policy – that is the responsibility of central banks. We won’t create money, we will simply back each token created with the equivalent amount of money in our reserve to ensure that anyone can cash in Libra to their own currencies when they want. We will not compete with central banks or present a risk to them or their currencies. Libra is simply a digital image of the currencies in our basket.

swissinfo.ch: If the Libra reserve of currencies grows too large could it unintentionally influence their value?

B.P.: The volume of euros or dollars in circulation is huge and whatever we have in our reserve will be a drop in the ocean.

The reserve will expand and decrease as people buy and redeem Libra coins, but it would never reach such high levels. It would only do this if people sat on the coins hoping they would rise in value. But Libra is a payment system, not a speculative asset. People will be buying Libras, sending them to others and the recipient will re-convert them to their own currency.

swissinfo.ch: Will you need a banking license in Switzerland?

B.P.: No. FINMA [the Swiss financial regulator] has clearly statedexternal link that Libra will require a payment system license but because we will have a reserve, it’s a bit different from other systems. So FINMA indicates it will ask us to comply with a few additional requirements. The regulator is doing this the smart way with a new type of payment system license.

swissinfo.ch: Libra will no longer launch in the first half of 2020 but has left the date more open. Will there be any further delays?

B.P.: The project is so broad and big with so many dimensions, it’s hard to commit to an exact deadline date. But the exact launch date is not as important as doing this in coordination with regulators. When we reach a point that regulators tell us they are comfortable with what we are doing then we could state an accurate starting date. We want to build a system that will last a long time, be valuable to many people and which is fully compliant with regulations.

swissinfo.ch: How does the Libra Association plan to expand in Geneva?

B.P.: Our plan is to grow the team over the course of the next six months in a significant way. We will be recruiting a broad range of talents, including compliance, financial operations, technology, network monitoring and development of our ecosystem of partners. We will build up to several tens of employees, but it’s hard to say how many exactly.

swissinfo.ch: How will you collaborate with local entities?

B.P.: We are cooperating with academics, such as CREAexternal link [marketing and communication school] and the University of Geneva’s blockchain programme for developers. That will help enhance the blockchain ecosystem and potentially provide us with future developers. We will also collaborate with start-up incubators, such as wecanexternal link, because we know that fintechs will be emerging that will develop new services on top of the Libra blockchain.

Geneva is also home to many NGOs. We feel this is the best way to address the problems of financial inclusion is to collaborate with these organisations. They are the ones on the ground who know exactly what the problems are and how we can help to solve them.

What is Libra?

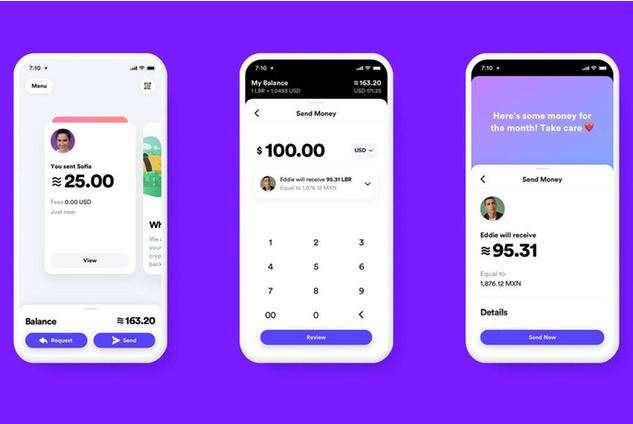

Announced by Facebook earlier this year, Libra will be a purely digital currency. It will run on a digital ledger technology (DLT) platform that allows people to send money directly to each other without the need for banks to keep tabs on transactions.

Libra says this system will make it much faster and cheaper to transmit money, particularly across national borders.

The digital currency will be used to buy all the normal consumer items that people pay for with their traditional currencies. Another targeted use case is the multi-billion dollar remittances market.

Libra users will need to know that they can buy a coffee with the same number of coins from one day to another. This is not possible with other cryptocurrencies, such as bitcoin, whose value can swing dramatically over short periods of time.

To reduce price volatility, the value of Libra coins will be linked to a reserve of traditional currencies. This reserve will be managed by the Libra Association, a collection of companies (including Facebook) and non-profit groups that form a governing council for the projectexternal link.

Tags: Business,newsletter,Sci & Tech