Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy.

Although it might not share gold’s illustrious history, having served as real money for millennia, platinum has certainly earned its place among the best precious metals investment options. Its very name, derived from the Spanish “platino”, translates to “little silver” and already gives some hints as to its past.

Having entered the stage much later than gold and silver, with the first European reference to platinum only dating back to 1557, for a long time it was seen as a nuisance and a mere impurity in gold that had to be eliminated and discarded. It would take almost two centuries for its value to be widely recognised, but today the metal is indispensable, both in industry and in the investment world.

A healthy demand outlook

Apart from its scarcity, which already contributes to its function as a store of value, platinum also has important industrial uses, driving up demand and supporting higher price levels.

Today, platinum, or “white gold” as it is often known, is widely used as a catalyst. Its most important use is in automobile engines as a catalytic converter, which is essential in reducing emissions. Additionally, it has petrochemical applications in the oil industry, while it is also used in electronics and wiring, in dentistry and in medical instruments and devices, as well as in jewelry. Of course, a very large part of the demand for the metal also comes from its investment appeal, and it is the third most traded precious metal.

As for its outlook, its industrial applications in the automotive sectors are very important and the shifts that took place in the last decade support the expectations of elevated price levels going forward. The global wave of tighter emissions regulations and other environmental protection legislation, contributed to a surge in demand for platinum, but also for palladium, which is also used as catalyst in car engines and up until a few years ago was still seen as a cheaper alternative.

The switch to palladium, which is the preferred catalyst in gasoline engines, was seen as a serious challenge to platinum, the preferred catalyst in diesel engines, while the threat was compounded by the recent emissions scandals, as automakers such as Volkswagen were caught rigging diesel-engine tests. Subsequently, platinum’s price collapsed, while speculation and large bets on palladium allowed for the price to skyrocket in the last two years. In recent months, shortages pushed the price to record highs, near $1,600, as Russia, the world’s largest palladium producer, placed new pressure on supplies. Since last August, the price of palladium has exploded, recording an increase of almost 90%.

As a result of the mounting pressure that this price spike is exerting on the automotive industry, carmakers are now increasingly talking about a switch back to platinum, that is presently much more affordable. Such a shift is not uncommon at all, and as Trevor Raymond, director of research at the World Platinum Investment Council (WPIC), pointed out in a recent interview: “”Platinum has substituted for palladium in gasoline cars in past price peaks”, pointing to a previous spike of palladium in 2000.

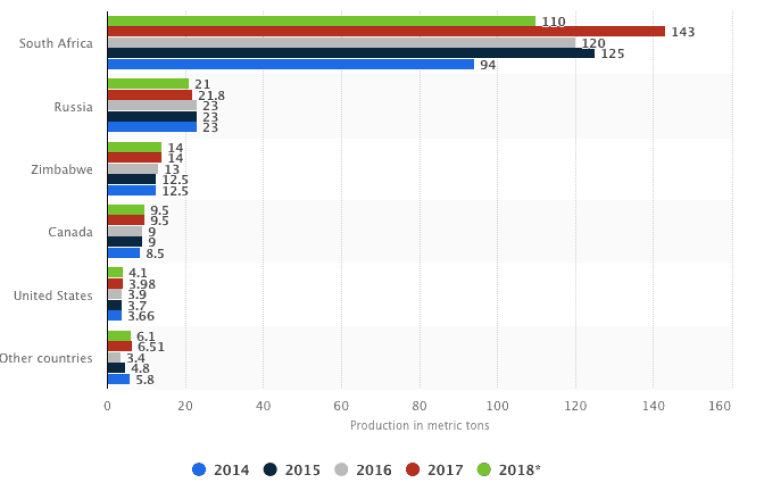

Looking at the supply side, platinum production, much like palladium, is also very concentrated, with 97% of the world’s platinum originating from five countries and with the top four refiners accounting for 67% of total platinum production. South Africa is by far the largest producer in the world, with an output between 94 and 110 metric tons a year from 2010 to 2018. Russia comes in at a distant second place, with 21-23 metric tons in the same period.

| Major countries in global mine production of platinum from 2014 to 2018

(in metric tons) Overall, the metal’s strong industrial demand is seen as a positive factor for its future price developments and a supportive force in reaching higher levels. However, as is the case with silver too that also enjoys many industrial uses, there is always the danger that a harsh economic crisis, at least during its early stages, could impact the price, as industrial activity and orders would weaken. Nevertheless, as we have seen in the past, a recovery soon follows and the long-term investment case for both metals continues to be solid. |

Global mine Production of Platinum, 2014 to 2018 Source: Statista - Click to enlarge |

Investment considerations

According to the latest report from the WPIC, the first half of this year saw unprecedented investment demand for platinum, as investors seem to be already anticipating the impact of these key shifts in the platinum market. Total investment demand increased by 855,000 ounces and of that, 720,000 ounces went into exchange-traded products, an increasingly popular way to gain exposure to the metal’s price movements. As Trevor Raymond put it, “For a lot of investors it just looks like everything is pointing in the right direction for platinum.” Indeed, the price of the metal has recently begun to reflect this, as it broke through $900 per ounce in early September, the first time it has reached that level since June 2018.

However, apart from the strong case that can be made for platinum’s demand and anticipated price developments, the metal also provides some additional investment and practical benefits. For those investors who truly understand the point of precious metals and therefore choose to hold physical bars and coins, unlike speculators who prefer paper instruments, platinum can store a lot of value in a very small bar, offering a strong portability advantage, similar to gold. This is important for conservative, long-term investors who prefer to keep their holdings outside the banking system, as it allows for cheaper storage and easier transport, even in harsh crisis scenarios.

Platinum also has an additional advantage, one that can make it preferable even to gold under the right (or in this case, wrong) circumstances. Gold, with its long history of outperforming and outliving fiat currencies and with its strong connection to most if not all cultures and religions on the planet, has long been on the radar of regulators and central planners of all kinds. It has a history of confiscation and of various state-imposed limitations, which is precisely why I always highlight the importance of keeping at least some of your holdings outside your home country and in a safe jurisdiction like Switzerland. However, platinum is seen as much less of a threat and thus restrictions targeting the metal are far less likely.

Moreover, it is also important to consider that platinum can, in most jurisdictions, be subject to VAT taxes. This is why it is essential to do your research and to choose the right partner for your investment. A reputable and established precious metals company, like pro aurum Switzerland, has the necessary know-how and proper structures in place and can thus help ensure tax efficiency in a compliant and transparent way.

Overall, I consider platinum a very interesting strategic option and it can be a wise addition to one’s existing gold and silver holdings. Given the solid fundamental outlook and its practical advantages, it can play an important, diversifying role in any precious metals strategy.

Full story here Are you the author? Previous post See more for Next postTags: Claudio Grass,Gold,Monetary,ProAurum,Switzerland,Thoughts