The Swiss National Bank has today published its report Banks in Switzerland 2018 and the corresponding data for its annual banking statistics.1 The most significant events are summarised below.

OverviewAs at the end of 2018, there were 248 banks in Switzerland. Of this number, 216 reported a profit with an aggregated total of CHF 12.8 billion. Losses amounting to CHF 1.3 billion were recorded by 32 banks. The aggregate result of the period across all banks was thus CHF 11.5 billion, an increase of CHF 1.7 billion over 2017. The big banks contributed CHF 4.9 billion to the result of the period, with cantonal banks and stock exchange banks adding CHF 2.9 billion and CHF 1.5 billion respectively. The aggregate balance sheet total for all banks in Switzerland decreased slightly by 0.8% or CHF 24.4 billion to CHF 3,225.0 billion. In particular, foreign-controlled banks (–3.8%) and big banks (–2.9%) reported lower balance sheet totals. However, there were also increases recorded in this respect, above all in the case of cantonal banks (4.3%) and stock exchange banks (2.1%). The rise in domestic mortgage loans continued (3.6%2 to CHF 1,010.2 billion), with marked increases in the case of Raiffeisen banks (4.4%) and the cantonal banks (4.1%).On the liabilities side, customer deposits rose slightly overall (1.5% to CHF 1,814.8 billion). |

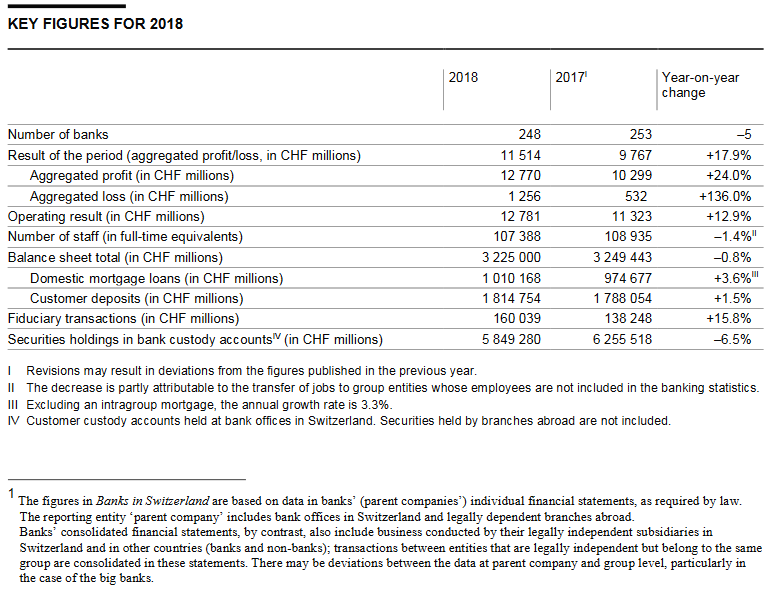

Key Figures for 2018 Source: snb.ch - Click to enlarge |

Customer holdings of securities in bank custody accounts decreased, with declining share prices a significant factor in this regard. By the end of the year, they totalled CHF 5,849.3 billion (–6.5%). Shares nevertheless remained the most important category of securities, followed by collective investment schemes. There was a marked increase in fiduciary funds administered by banks in 2018, rising by CHF 21.8 billion or 15.8% to CHF 160.0 billion against the backdrop of higher US dollar money market rates. However, they remain well below the high of CHF 482.9 billion set in 2007.

In terms of full-time equivalents, the number of staff declined by 1,547 to 107,388, with a decrease of 1,240 recorded in Switzerland. As in 2017, part of this drop is attributable to banks having transferred jobs to other group entities not included in the banking statistics. This was primarily the case at big banks (–1,257) and foreign-controlled banks (–1,000). Meanwhile, the stock exchange banks registered higher headcount both in Switzerland and abroad, with increases of 292 and 221 respectively.

Further information

−The report Banks in Switzerland 2018 (English, German and French), with extensive commentaries and notes on interpreting the data with regard to statistical effects, can be downloaded at www.snb.ch, Statistics, Reports and press releases, Banks in Switzerland, as can the Overview of reporting banks in Switzerland 2018/2019.

−The printed version of Banks in Switzerland 2018can be obtained from the SNB library.

−Data (charts and tables), methodological basis and notes are available on the SNB’s data portal at data.snb.ch.

Full story here Are you the author? Previous post See more for Next postTags: newsletter