The asymmetries are piling up and we’re cracking under the weight.

Judging by the record-high stock market and the record-low unemployment rate, the “recovery” has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy.

You can imagine them rubbing their hands with glee as they quote statistics such as: the 53 metropolitan areas in the U.S. with populations of 1 million or more accounted for two-thirds of the GDP growth and three-quarters of the job growth. A staggering 93% of the population growth in the U.S. in the past decade occurred in these urban centers.

And this asymmetry is even greater if we separate the top 10 metropolitan areas from the rest: super-cities with super-charged economies, fueled by enormous influxes of capital and people, which just so happen to make life unbearable as overcrowded, aging infrastructure breaks down and costs for housing, rent, taxes, utilities, fees etc. skyrocket out of reach of the bottom 95%.

The well-paid pundits viewing glowing statistics of growth never get around to examining the human costs of this lopsided “recovery”: the “winners” in increasingly unlivable urban centers are cracking under the pressure-cooker stress, burning out, flaming out, crashing.

The residents of all the regions sucked dry of capital and talent–the “losers” of neoliberal globalization’s concentrations of mobile capital and talent in a few favored megalopolises–are also cracking under the weight of a loss of dignity and secure livelihood, the two being intimately bound, much to the dismay of the supporters of “just pay them to go away and not bother us” Universal Basic Income (UBI).

In other words, the “winners” are losing, too. They’re losing their sanity in 3-hour daily commutes on jammed freeways and equally jammed streets as thousands of other commuters seek a work-around to the endless congestion.

They’re losing their dreams of a better life, as all the average-wage worker can afford to rent is a bed in a cramped living room that has been converted into sleeping quarters for two workers who don’t make six-figure salaries and who don’t have stock options in a Unicorn tech company.

They’re fixated on FIRE–financial independence, retire early–because they hate their job, their career and the sector they toil in, and they count the days until they’re free, free, free of the pressure, the stress, the BS work, and the insanity of daily life in a teeming rat-cage.

No wonder the FIRE movement is spreading like (ahem) wildfire. Nobody in their right mind wants to do their job for another 10 years, much less 20 or 25 years. Everybody is bailing out the moment they can, or if they burn out and crash, when they’re forced to.

Let’s say you want to start a business in a super-progressive city that fulfills all your most cherished ideals: paying your employees good wages, providing customers with value, and paying all your taxes and fees, of course, as a responsible progressive citizen.

Where do we start? How about the reality that virtually no one employed in the restaurant sector can afford to live in San Francisco unless they inherited a rent-controlled flat or scored one of the few subsidized housing openings?

| The city’s solution–mandating a $15/hour minimum wage–doesn’t magically make healthcare or rent affordable; all it does is increase the burden on small businesses that are hanging on by a thread.

The writer doesn’t even mention the sky-high rent she paid for her restaurant space. Rent alone drove this small food service business into the ground: Via Gelato owner plans to close Ward store, file for bankruptcy.

Working 100 hours a week couldn’t compensate for the crushing rent.

Even the well-paid are burning out. Astronomical household incomes (say, $300,000 annually) aren’t enough to buy a decayed bungalow for $1.3 million and pay for childcare, private-school tuition, healthcare, an aging parent and all the services the overworked wage-earners don’t have the time or energy to do themselves. Oh, and don’t forget the taxes. You’re rich, people, so pay up.

No wonder people who can afford to retire are bailing at 55 or 60, on the first day they qualify. Life’s too short to put up with the insane pressure and stress a day longer than you have to. |

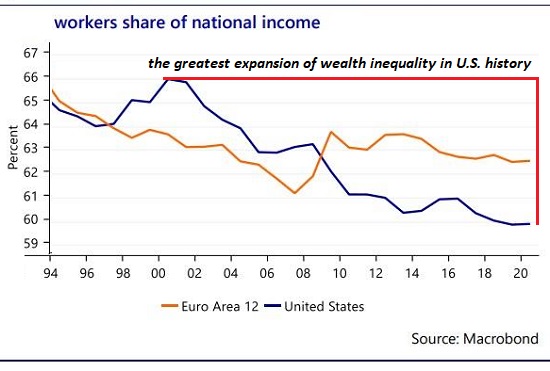

Workers Share of National Income, 1994-2020 - Click to enlarge |

| Not everybody feels it, of course. People who bought their modest house for $100,000 30 years ago can hug themselves silly that it’s now worth $1,000,000 (but with a still-modest property tax), and if they’re retired with a plump pension and gold-plated medical benefits, their biggest concern is finding ways to blow all the cash that’s piling up.

These lucky retirees wonder what all the fuss is about. “We worked hard for what we have,” etc. It’s easy to overlook being a lucky winner of the housing-bubble lottery and the equally bubblicious pension lottery, and easy not to ask yourself how you’d manage if you arrived in NYC, San Francisco, et al. now rather than 35 years ago.

The asymmetries are piling up and we’re cracking under the weight. When do we recover from the “recovery”? The answer appears to be “never.” |

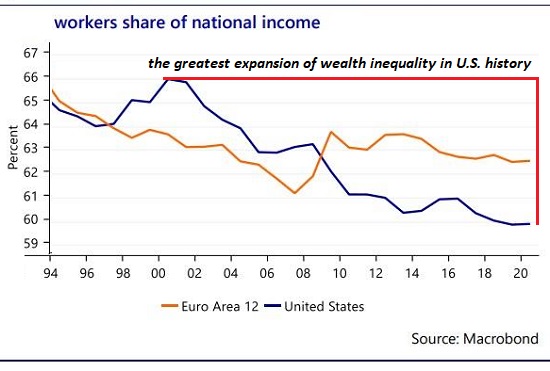

Concentration of Stock Ownership by Wealth Bracket - Click to enlarge |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newsletter