The official statement that accompanies each every FOMC policy action is by nature bland and sterile. Still, despite the sparseness of printed words those that are included can say a lot. Here’s its essence for what just wrapped up in December 2018:

|

Global Systematically Important Banks 2017-2018 |

| The statement used the word “strong” three times in the paragraph before, too. You can see just how much the unemployment rate grabs these empty suits in spite of so much else.

Markets reacted uniformly with AYFKM. What else can they say, and trade, at this point? Powell has trapped himself in Yellen’s prior position. If he’s not careful, he’ll smile his way past that all the way to Bernanke’s “contained.” Things are accelerating to the downside, not stabilizing. |

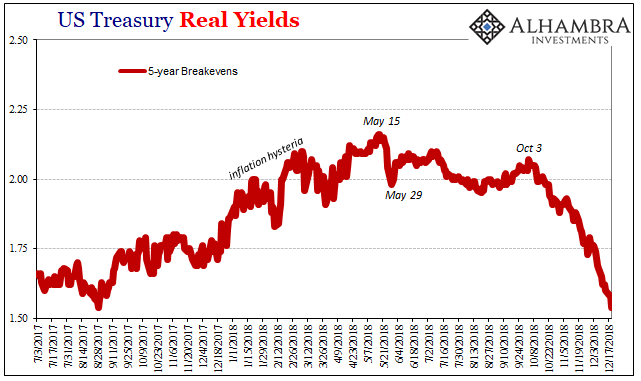

US Treasury Real Yields 2017-2018 |

How about:

|

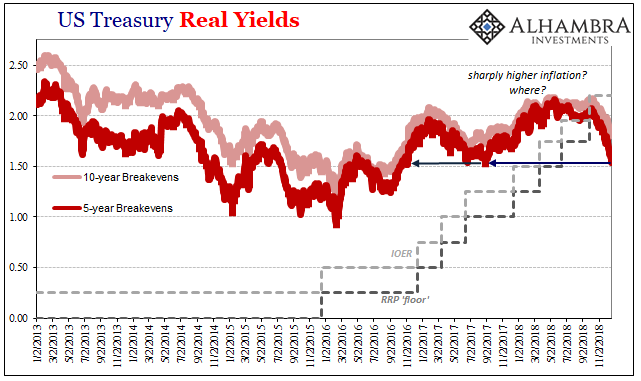

US Treasury Real Yields 2013-2018 |

| Strong. Definitely healthy. As noted earlier, there’s something to this SIFI business, just not what regulators were shooting for when they created the designation.

Congrats Chairman Powell, you are officially a market joke. This will actually be healthy in the long run. Only then can we really talk about strong – and mean it. |

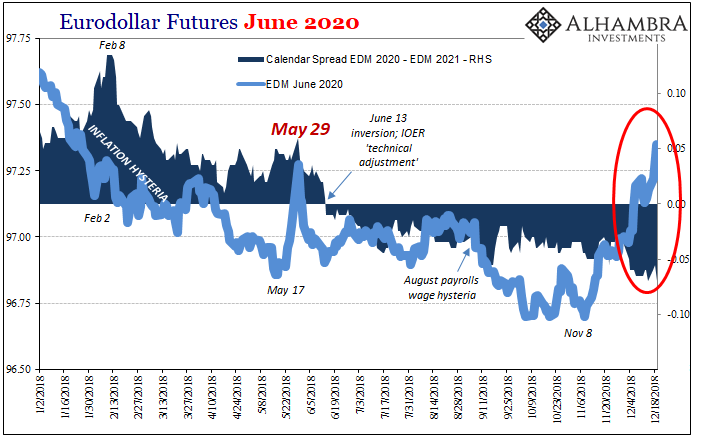

Eurodollar Futures June 2020 |

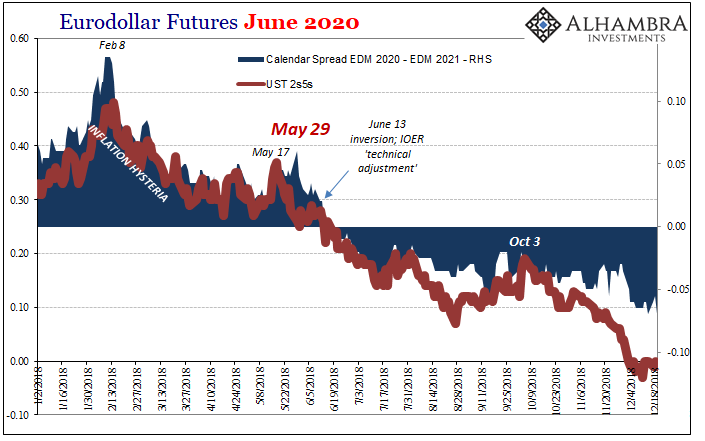

Eurodollar Futures June 2020 |

|

NYMEX WTI Futures 2016-2018 |

Tags: currencies,economy,Federal Reserve/Monetary Policy,Markets,newsletter