|

Currencies don’t melt down randomly. This is only the first stage of a complete re-ordering of the global financial system.

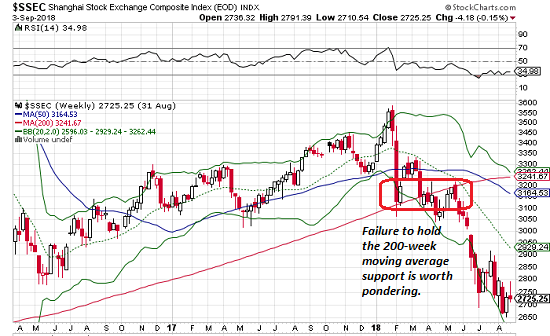

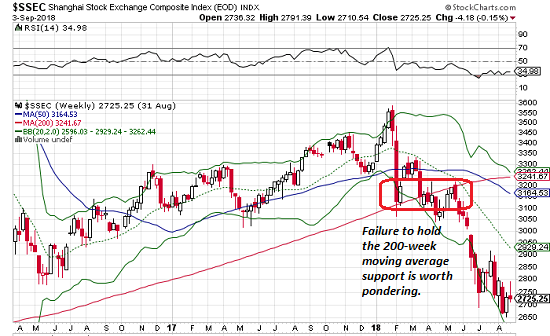

Take a look at the Shanghai Stock Market (China) and tell me what you see:

|

Shanghai Stock Exchange Composite Index - Click to enlarge |

|

A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once the support finally broke, the index crashed.

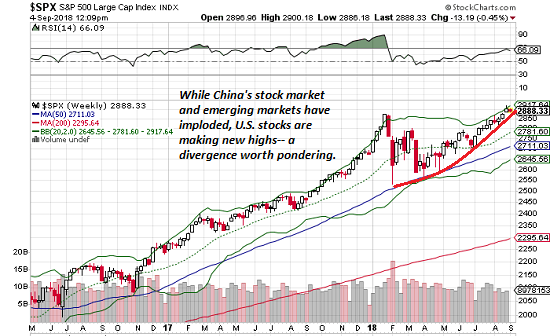

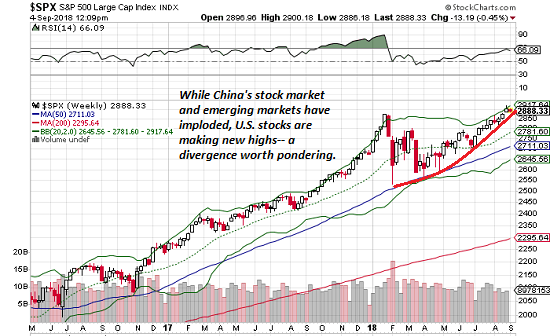

Now take a look at the U.S. S&P 500 stock market (SPX):

SPX is soaring to new highs, not just climbing a wall of worry but leaping over it. So the engine of global growth–China–is exhibiting signs of serious disorder, and the world’s consumerist paradise–the U.S.– is on a euphoric high (Ibogaine in the water supply?)

This divergence is worth pondering. How can the two economies that have powered a 28-year Bull Market in just about everything (setting aside that spot of bother in 2008-09) be responding so differently to the global economy and global financial system’s woes?

|

S&P 500 Large Cap Index(see more posts on S&P 500 Large Cap Index, ) - Click to enlarge |

There’s a rule of thumb that’s also worth pondering. While the stock market attracts all the media attention–every news cast reports the daily closing the the Dow Jones Industrial Average, the SPX and the Nasdaq stock index–the bond market is larger and more consequential. And larger still is the currency market–foreign exchange (FX).

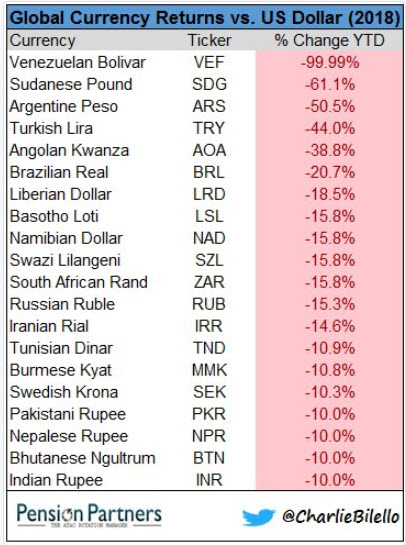

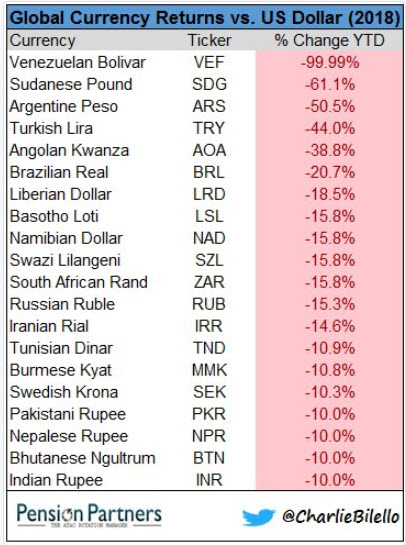

As the chart below illustrates, a great many currencies around the world are in complete meltdown. This is not normal. Nations that over-borrow, over-spend and print too much of their currency to generate an illusion of solvency eventually experience a currency crisis as investors and traders lose faith in the currency as a store of value, i.e. the faith that it will have the same (or more) purchasing power in a month that it has today.

Here’s the key takeaway: a currency crisis is a symptom of a deeper disease–it is not the illness. The same is true of stock market declines like the Shanghai Index that break long-term support levels: a crashing stock market is a symptom of a deeper disease, it’s not the illness.

The fact that so many currencies are melting down at the same time is telling us the global financial system is unraveling, and unraveling fast. This is a symptom of a fatal disease. Currencies reflect all sorts of financial information; they’re akin to taking an economy’s pulse: trade balances, debt levels, interest rates, central bank policies, fiscal policies, and so on.

The global financial system is inter-connected, but this is not a viable excuse for the meltdown. The general explanation floating around is that currency weakness is like the flu: one currency gets it, and then it spreads to other weak currencies.

This diagnosis is misleading. What’s actually happening is the unprecedented global bubble of debt and assets of the past decade is popping, and it’s laying waste to the most indebted, over-leveraged and mismanaged nations first, either via stock market declines or meltdowns in currencies.

These are symptoms. The disease is the “fixes” of the past decade–extreme expansions of debt and asset valuations–are unraveling. The global financial system suffered a seizure in 2008-09, a non-linear manifestation of a system completely out of whack: the $500 billion subprime mortgage market almost took down the entire $200 trillion global financial system.

That’s the acme of a brittle, fragile system: a small input (subprime mortgage defaults) yields an enormous output (global financial meltdown).

What nobody dares talk about is the “fixes” have made the global financial system even more vulnerable than it was in 2008. The global meltdown of currencies is evidence that the symptomatic “solutions” to the brush with collapse in 2008-09–skyrocketing debt and asset bubbles– fixed nothing. All they did was inflate an even larger, more vulnerable bubble.

| Currencies don’t melt down randomly. This is only the first stage of a complete re-ordering of the global financial system, a re-ordering that will reprice all the assets currently bubbling at absurd levels to much lower valuations.

The illusion that the U.S. is immune to the unraveling of debt and asset valuations won’t last. When the defaults start piling up, so will the losses, and when asset bubbles pop, incomes and spending decline. Although few seem to notice, almost half the profits of the S&P 500 corporations are earned overseas.

The belief that U.S. markets are somehow disconnected from global markets and immune to the repricing of risk, debt, assets and currencies is magical thinking.

|

Global Currency Returns vs. US Dollar (2018) - Click to enlarge |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newsletter,

S&P 500 Large Cap Index