The services sector is proving resilient, but manufacturing disappoints.

Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since June 2013.

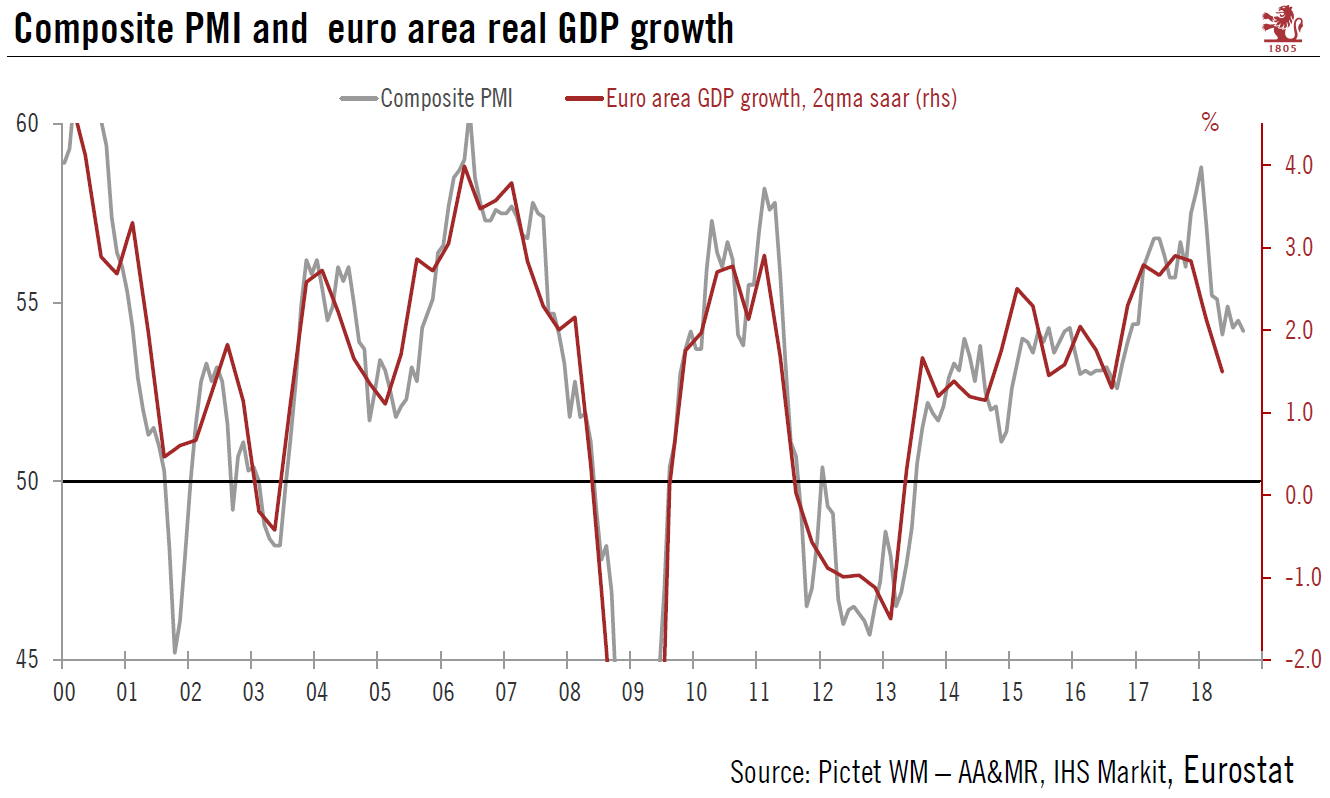

| Overall, euro area composite PMI remains consistent with our forecast of 2% GDP growth in 2018. But growth outside of Germany and France improved only marginally from August’s 22-month low, rounding off the worst quarter for business sentiment in the euro area in two years.

In Germany, the PMI survey showed a strong divergence between services and manufacturing in September. For the first time since April 2016, the manufacturing index was below the services index. Manufacturing new export orders fell below the 50 threshold for the first time since July 2015. Furthermore, Markit stated a sharp deterioration in manufacturers’ sentiment towards future output. By contrast, services activity rose at its second-fastest rate in over four years in September. Overall, the German services sector continues to act as a support to the economy, while the manufacturing sector still shows weakness. In France, the composite PMI slipped in September and came in below consensus expectations. Manufacturing fell to a four-month low, while the services index was somewhat stronger, but also slipped.. However, jobs growth remained firm in both sectors. Overall, headline PMI continues to fall, but remains generally solid, and forward-looking indices for services continue to be upbeat. |

Eurozone Composite PMI and Euro Area Real GDP, 2000 - 2018(see more posts on Eurozone Composite PMI, ) |

Tags: European manufacturing,Eurozone Composite PMI,Macroview,newsletter