We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast.

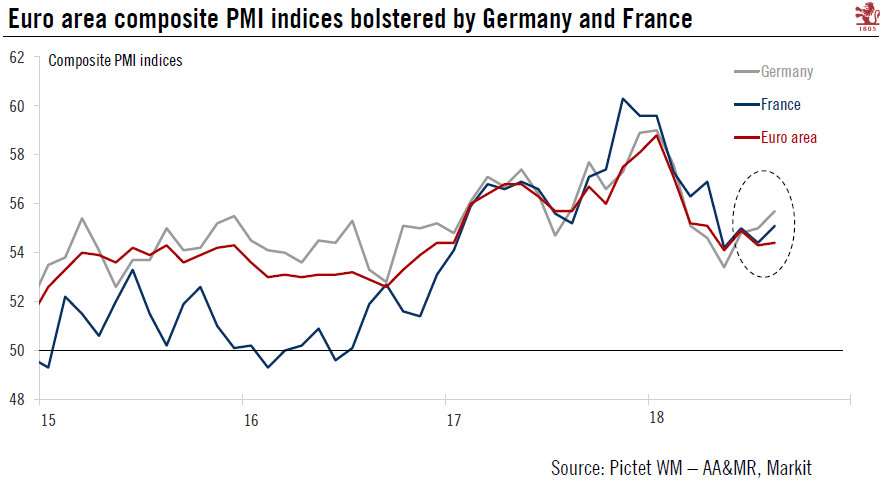

Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q pace recorded in Q2. But, the change in PMI sub-components across countries and sectors was less encouraging.

| First, the relatively larger rebound in French and German indices (+0.7 point on average in August) implied renewed weakness in the periphery, with Markit indicating that future business expectations fell to a five-year low outside the two largest countries. Second, forward-leading indicators in the manufacturing sector in particular failed to improve, with new export orders falling slightly further, suggesting that weaker foreign demand and trade tensions continued to weigh on sentiment. Last but not least, price pressures were seen as intensifying in most countries and sectors amid growing signs of ‘bad inflation’, i.e. rising commodity prices, wages and other input costs that were only partially passed on to consumer prices because companies were still constrained in terms of margins.

Leading euro area indicators have broadly stabilised during the summer, at levels consistent with our revised forecast of 2% GDP growth in 2018. But, the balance of risks remains tilted to the downside. Crucially, (geo-)political uncertainty, trade tensions and higher input prices are not conducive to higher corporate investment spending, which we still see as the key ingredient to stronger euro area growth over the medium-term. |

Composite PMIs Germany, France and Eurozone, 2015 - 2018(see more posts on Eurozone Composite PMI, Germany Composite PMI, ) |

Tags: Eurozone Composite PMI,Germany Composite PMI,Macroview,newsletter