|

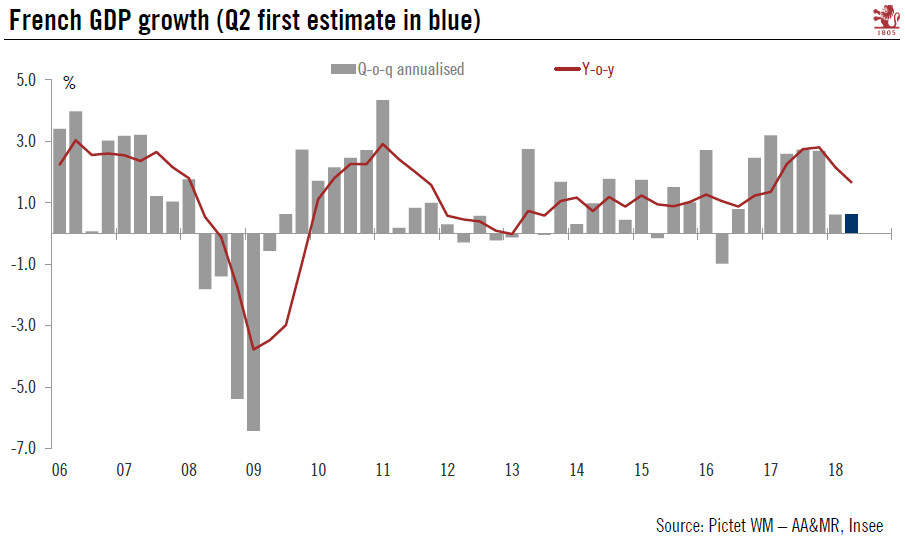

A number of one-off factors hurt growth dynamics, but there are many reasons to think that expansion will pick up in the rest of this year. France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%. The key source of disappointment was private consumption, which was hit by one-off factors such as unseasonal weather and transport strikes. More positively, investment accelerated sharply, thanks largely to a surge in corporate investment. Carryover effects mean that even with zero growth in the remaining two quarters of 2018, French GDP would grow by 1.3% on average this year. Given the recent stabilisation in business surveys, the end of rail transport strikes and the World Cup win, real GDP growth will likely pick up in Q3. Overall, we remain confident about the growth outlook for France, although risks are skewed to the downside. We expect French GDP to grow 1.6% in 2018 as a whole. France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q (0.6% q-o-q annualised; 1.7% y-o-y) in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%. The key source of disappointment was private consumption, which was hit by temporary factors. The carry over effect for 2018 reached 1.3%, meaning that even with zero growth in the remaining two quarters of 2018, French GDP would grow by 1.3% on average this year. We remain confident about the growth outlook for France, although risks are skewed to the downside. Given the recent stabilisation in business surveys, the end of rail transport strikes and the World Cup win, real GDP growth will likely pick up in Q3. We expect French GDP to grow 1.6% in 2018 as a whole. |

France GDP Q2 2018(see more posts on France Gross Domestic Product, ) |

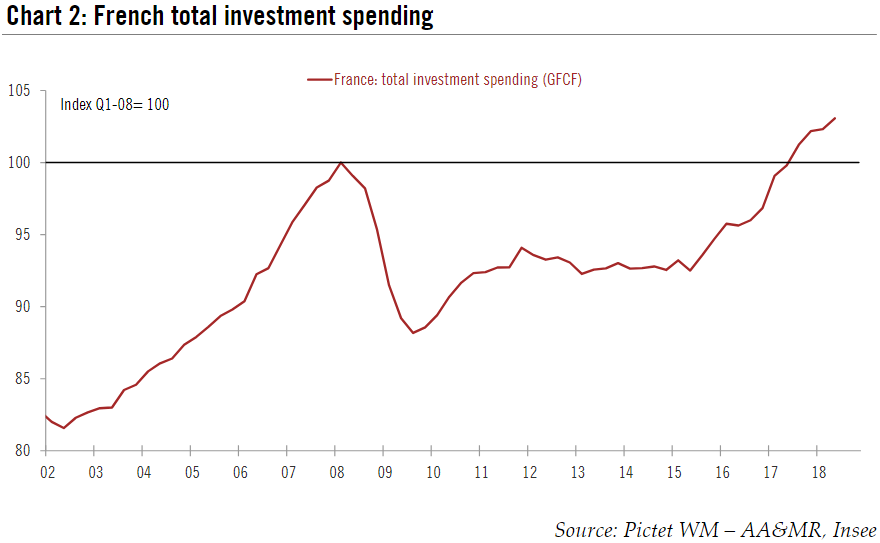

Acceleration in investment offsets contraction in consumptionThe breakdown of GDP data show s that private consumption (-0.1% q-o-q after +0.2% in Q1), France’s main growth engine, contracted for the first time since Q3 2016. The INSEE press release noted that the decline in consumer spending was mainly due to declines in expenditure on food, energy and services. Spending on utilities was hit by unseasonably warm temperatures in April, while the decline in spending on services stemmed largely from transport strikes. Downbeat private consumption data were offset somewhat by an acceleration in investment (+0.7% in Q2 after +0.1% the previous quarter), thanks especially to a surge in corporate investment (+1.1% after +0.1%). The latter was mainly due to an upswing in manufactured goods investment (+1.2% after -1.1%). General government spending (+0.4% after +0.2%) also accelerated in Q2. Imports (+1.7% after −0.3%) rebounded in Q2 as did exports, but to a lesser extent (+0.6% after −0.4%).

Overall, domestic demand remained the main growth driver and contributed as much to French GDP growth as in Q1 (+0.2 points) (excluding inventory changes). By contrast, foreign trade balance contributed negatively to GDP growth (−0.3 points in Q2, after a neutral contribution in Q1). Conversely, changes in inventories drove GDP on (+0.3 points after a neutral contribution in Q1).

|

France Total Investment Spending |

Tags: France Gross Domestic Product,Macroview,newslettersent