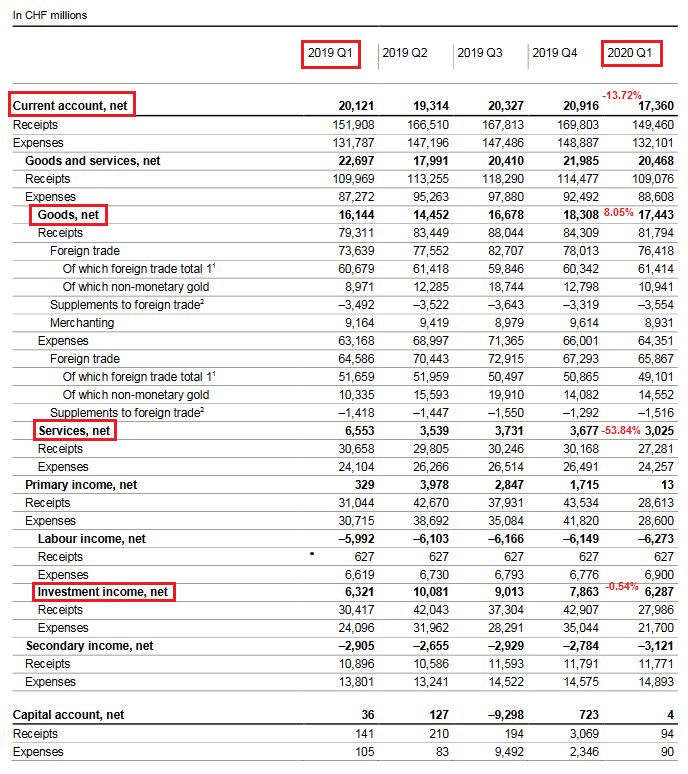

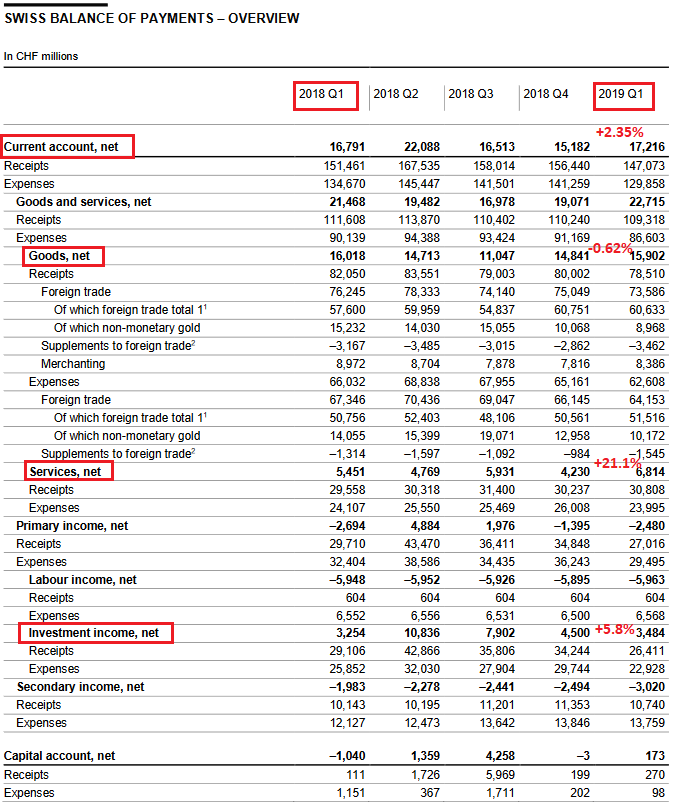

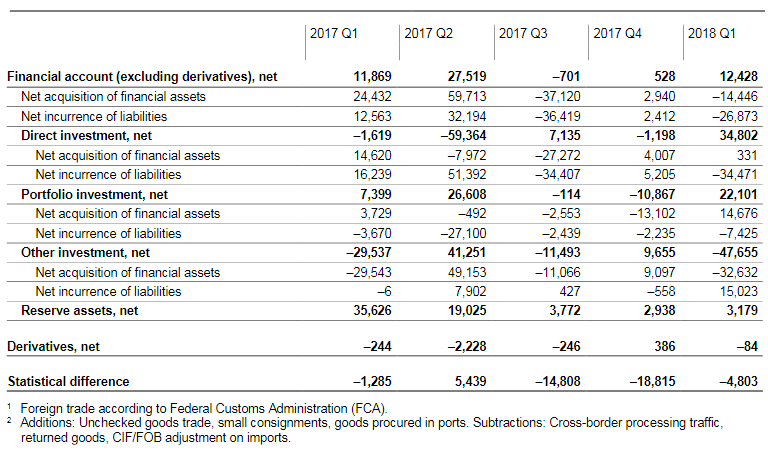

Current AccountKey figures:Current Account: Up 41% against Q1/2017 to 18.1 bn. CHF

|

Current Account Switzerland Q1 2018 Extract from the Balance of Payments Q1 2018 Source: snb.ch - Click to enlarge |

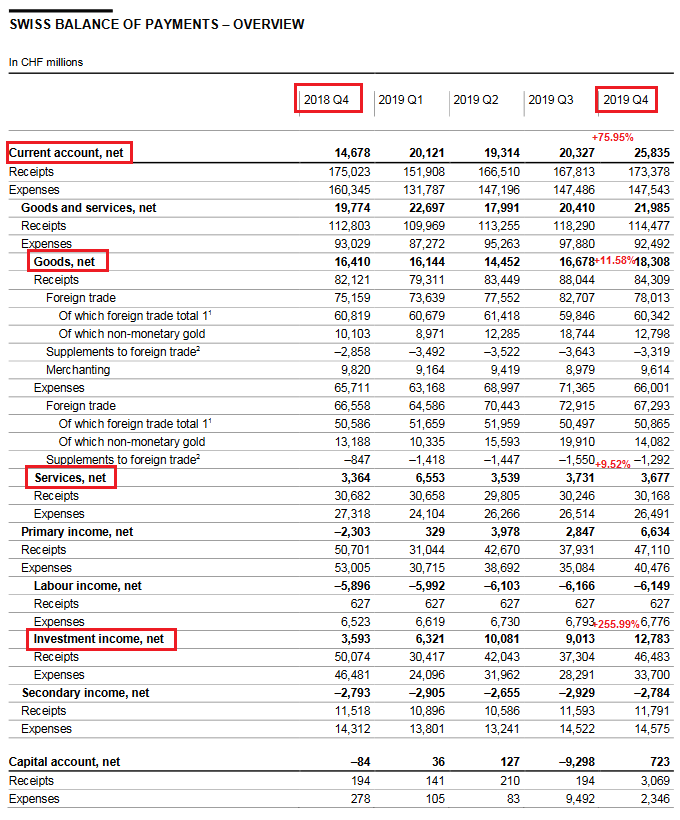

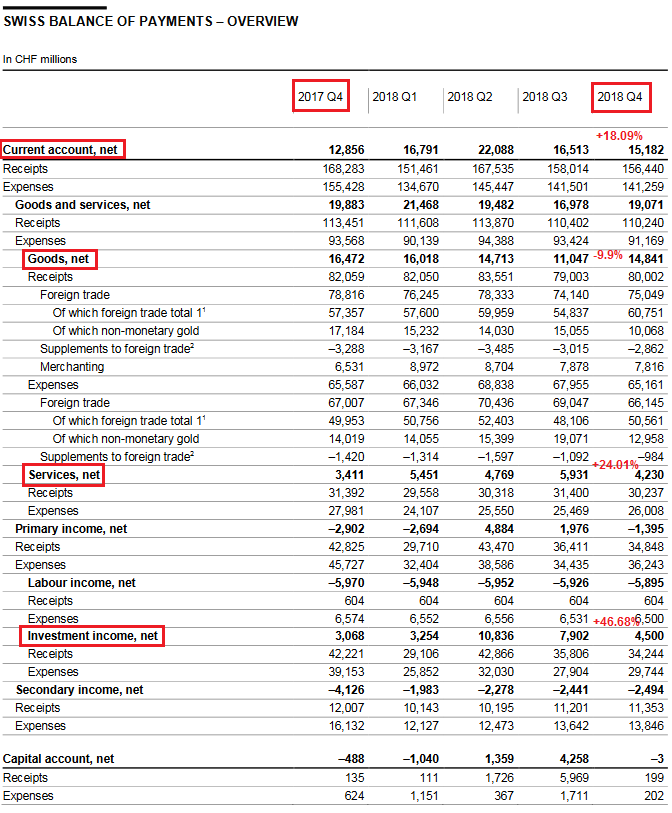

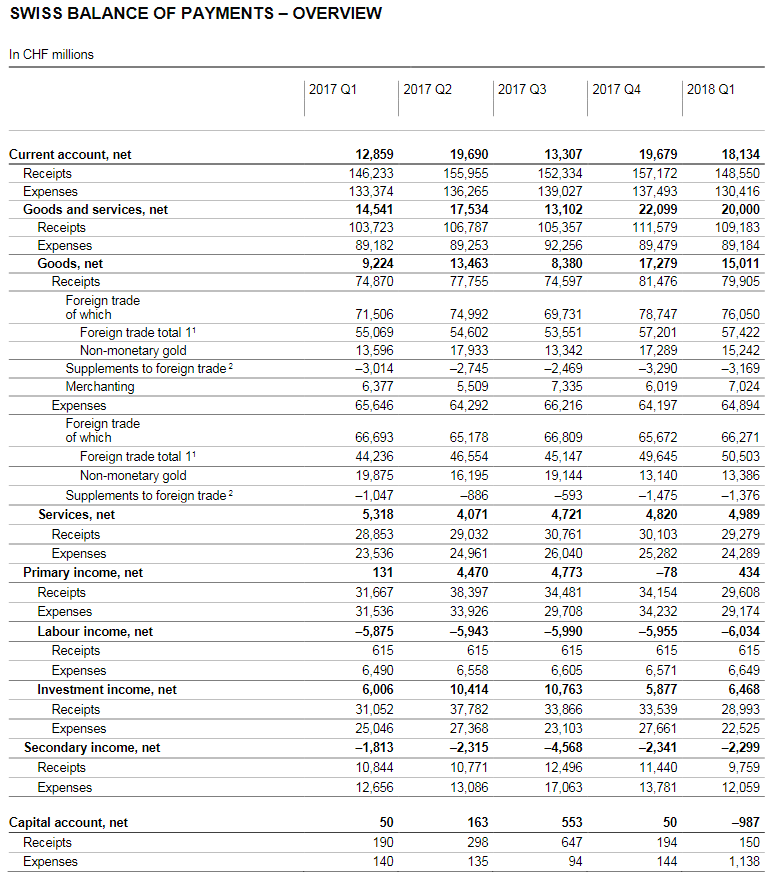

Financial accountThe following is from the official press release and gives more details on the other parts of the financial account.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q1 2018 Source: snb.ch - Click to enlarge |

Switzerland’s International investment positionAssetsCompared with the previous quarter, stocks of assets declined by a total of CHF 35 billion to CHF 4,733 billion. This decrease was primarily attributable to the other investment item, where stocks were down CHF 31 billion to CHF 827 billion, mainly as a result of transactions. Stocks were also lower in the case of portfolio investment, declining by CHF 12 billion to CHF 1,363 billion, this despite the fact that the transactions reported in the financial account showed a net acquisition. The decrease was partly due to valuation losses stemming from lower prices on foreign markets, and in part also to exchange rate losses on assets in US dollars. Stocks in reserve assets declined by CHF 7 billion to CHF 785 billion owing to valuation losses. Meanwhile, direct investment stocks were CHF 11 billion higher at CHF 1,670 billion and stocks of derivatives rose by CHF 4 billion to CHF 87 billion. LiabilitiesStocks of liabilities were CHF 60 billion lower quarter-on-quarter at CHF 3,861 billion. Besides the transactions reported in the financial account (net incurrence of liabilities), this decrease was above all attributable to valuation losses. The latter were particularly prevalent in the case of portfolio investment, where stocks declined by CHF 62 billion to CHF 1,113 billion owing to the lower share prices on the Swiss Exchange. Stocks of direct investment decreased by CHF 12 billion to CHF 1,440 billion. Stocks rose in the remaining components, however, with other investment recording a CHF 10 billion increase to CHF 1,217 billion on the back of transactions and derivatives rising CHF 5 billion to CHF 91 billion. Net international investment positionGiven that stocks of liabilities showed a more pronounced decline than stocks of assets (CHF –60 billion vs CHF–35 billion), the net international investment position increased by CHF 25 billion to CHF 872 billion. |

Switzerland International Investment Position(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q1 2018 Source: snb.ch - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position