Switzerland: monetary policy

At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged from its previous meeting in March, stating that it continued to see the currency as “highly valued” and the “situation on foreign exchange markets as fragile”. The SNB made a specific reference to political uncertainty in Italy as well.

A dovish ECB, political uncertainties in Europe and the SNB’s downward revision of its medium-term inflation forecasts are leading us to change our call for the SNB. We now expect the first SNB policy rate hike on 19 September 2019 (previous forecast was for December 2018). Thus, the SNB’s move will only come after the first ECB deposit rate hike, which we expect after its policy meeting on 12 September 2019. We believe the SNB will raise the deposit rate by 25bp, compared with the 15bp rise we expect from the ECB.

2020 inflation revised down

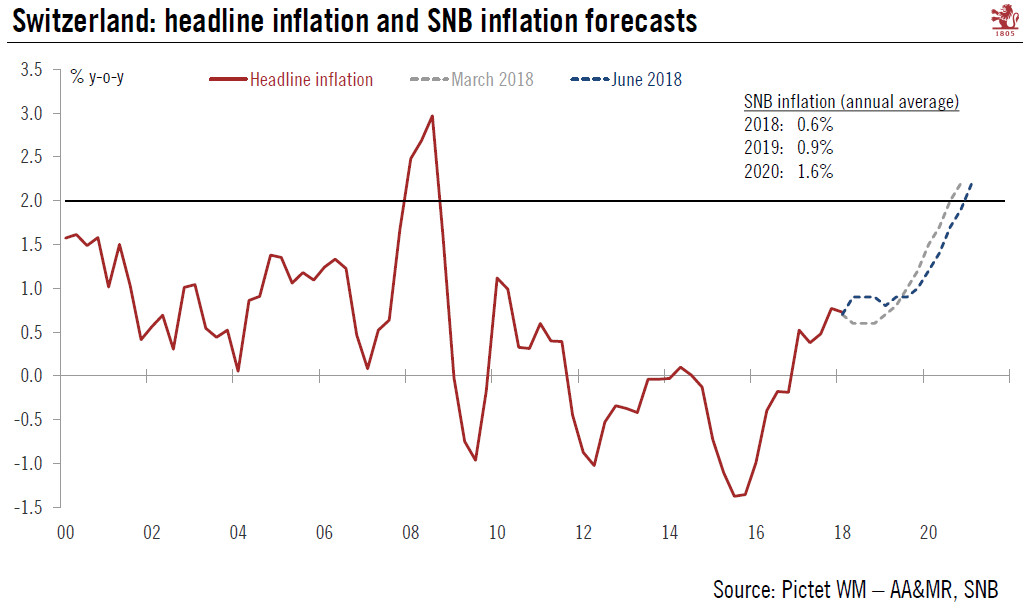

The new inflation forecasts show an upward revision of the 2018 forecast to 0.9% (from 0.6%), reflecting higher oil prices and in line with our forecasts. However, the SNB left its forecast for inflation in 2019 unchanged at 0.9% and revised down its forecast for 2020 to 1.6% from 1.9%, reflecting the “muted outlook in the euro area”, according to the SNB’s press release. One other explanation for this downward revision could be delayed expectations for ECB rate hikes, which in the SNB’s model (conditional on SNB policy rates remaining unchanged) is pointing to less depreciation of the CHF than before. The Q1 2021 SNB inflation forecast endpoint is now 2.2%. The SNB left its real GDP forecast for Switzerland this year unchanged at “around 2%”.

|

Clear signs from the ECB that it won’t raise rates until H2 2019 mean we are revising our expectations for monetary tightening in Switzerland. The Swiss National Bank’s (SNB) monetary meeting was held last week. The press release was little changed from the previous one. The SNB reiterated its willingness to intervene in the foreign exchange market if needed. The central bank’s assessment of the Swiss franc also remained unchanged, stating that it continued to see the currency as “highly valued” and the “situation on foreign exchange markets as fragile”. During the press conference, SNB president Thomas Jordan remained cautious overall. Importantly, the 2020 inflation forecast was revised down to 1.6% from 1.9%. A dovish ECB and political uncertainties in Europe as well as the SNB’s downward revision of its own medium-term inflation forecasts lead us change our call for the timing of SNB policy tightening. We now expect the first SNB policy rate hike in September 2019 (our previous forecast was for December 2018), after the first ECB depo rate hike the same month. We foresee a 25bp increase in the policy rate by the SNB. |

Swiss Headline Inflation and SNB Inflation Forecasts, 2000 - 2018(see more posts on Swiss headline inflation, ) |

First rate hike expected in September 2019

Previously, in our baseline scenario, we were expecting a December 2018 rate hike from the SNB, dependent on several factors. First, we thought the Swiss macroeconomic outlook would continue to improve, with a pick-up in growth and inflation. Second, we believed the ECB would end its QE program me this year with a firm commitment of a first ECB deposit rate hike in 2019. Third, we felt the risks surrounding the Italian elections would abate. And fourth, we thought the CHF would continue to decline or at best stabilise at CHF 1.20 per euro. Under these circumstances, we thought the SNB would be willing to move before the ECB —not least since its own inflation forecast was suggesting a medium-term inflation target overshoot if Swiss policy rates remained unchanged.

The Swiss macroeconomic outlook has indeed improved and is expected to continue doing so. But while the ECB has effectively decided to wind down its monthly asset purchases by end -2018, it announced this month that it expects to keep policy rates at current levels “at least through the summer of 2019”. Both decisions were conditional on incoming data, the ECB said, meaningthere is still uncertainty about the lift-off date. This uncertainty raises the risks for the SNB of movingbefore the ECB with its own policy rate hike. Volatility surrounding Italy is a further risk. Uncertainties regarding Italian fiscal plans may continue at least until the new government presents a draft budget to the European Commission in mid-October or before. This is adding to SNB concerns that the CHF could continue to appreciate again, with fears of a global trade also potentially pushing the CHF upward.

All these developments suggest the SNB will now raise rates later than previously envisaged and that the SNB will refrain from moving before the ECB. We now expect the first SNB policy rate hike in September 2019 instead of December 2018. This will be directly after the first hike of the ECB deporate, which we also expect in September 2019. We foresee the SNB raising its policy rate by 25 bp, compared with a rise of 15 bp from the ECB.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent,Swiss headline inflation