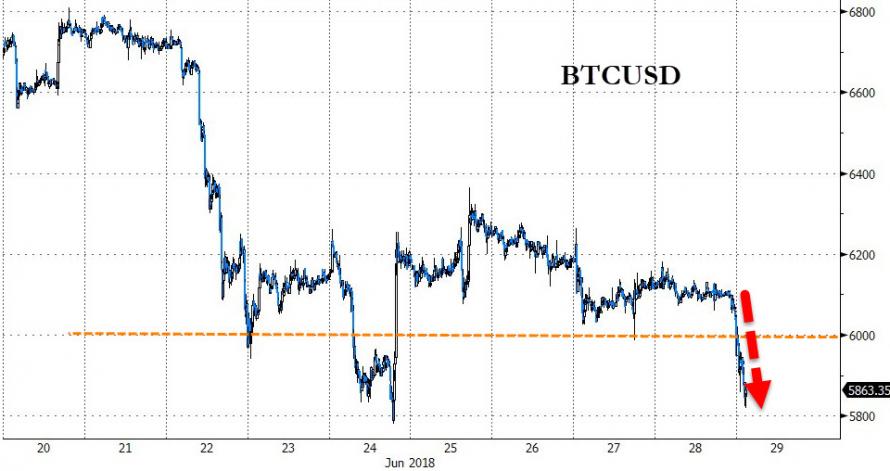

| Bitcoin has tumbled back below $6,000 in early Asia trading and the rest of the crypto space is following suit. No imediate catalyst for the move – aside from technical pressure – but tougher AML rules in South Korea and US Congress being told Bitcoin is a threat to the US election may have sparked it earlier in the week and this is follow-through.

Bitcoin can’t catch a bid off the weekend’s $6,000 slump… |

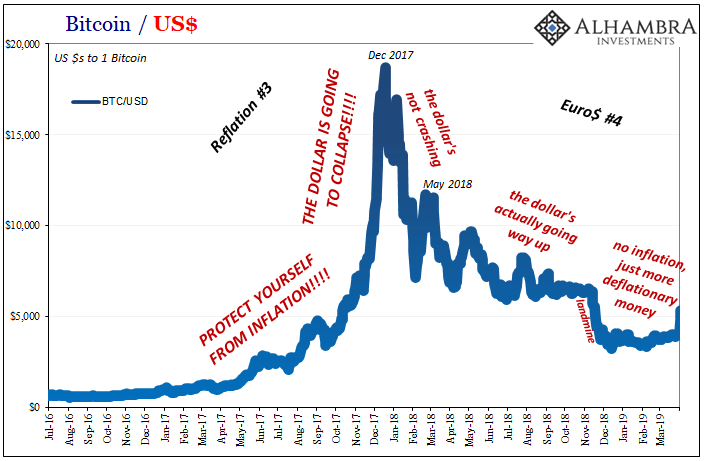

BTC/USD, Monthly Jun 2018(see more posts on BTC-USD, ) |

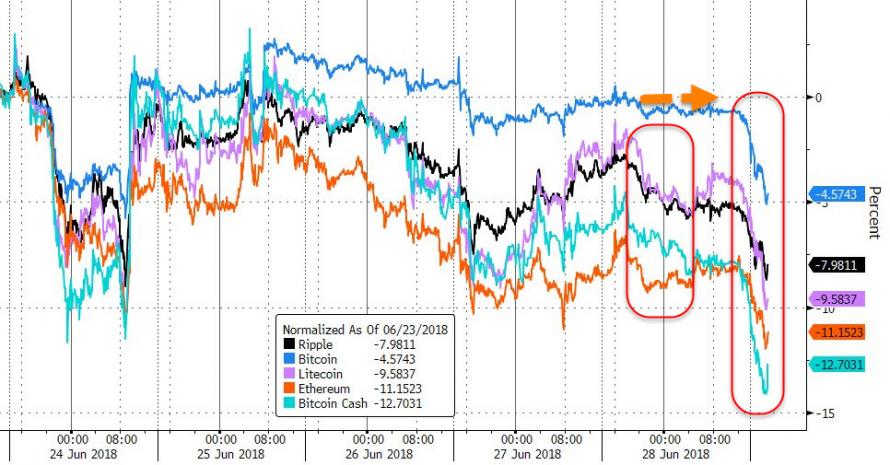

| And as usual, the rest of crypto is following (though we note that Bitcoin had been steady as the rest of crypto fell)…

As we noted, other than just momentum running through the psychological $6,000 barrier, there is little immediate headline catalyst. But two stories of note this week may have helped drive some of the weakness. |

Cryptocurrencies fell, Weekly Jun 2018(see more posts on Cryptocurrencies, ) |

As CoinTelegraph reports, South Korea’s top financial regulator has released a set of revised anti-money laundering (AML) guidelines for virtual currencies, according to a press release published this week.

The press release notes that the Financial Services Commission (FSC) conducted on-site inspections of three domestic banks – Nonghyup, Kookmin, and Hana Bank – the results of which prompted the update to AML guidelines.

The new guidelines note that cryptocurrency exchanges must conduct Customer Due Diligence (CDD) and Enhanced Customer Identification (EDD) to ensure the trade purposes and funding sources of users are legitimate. If a business refuses or is unable to provide information for customer verification, the guidelines note that any transactions from that entity must be rejected or terminated.

According to the revised guidelines, crypto exchanges are also responsible for making certain that foreigners are not using local crypto exchanges, criminals are not using the personal accounts of other people to launder money, and that there are no suspicious transactions and payment processing, CCN news site writes.

And, as CCN reports, for a significant part of 2017 and even this year, social media platforms have taken a lot of heat over their alleged role in influencing the 2016 U.S. presidential election. And for a period of time on Tuesday during a congressional hearing, cryptocurrencies were put in the same spot — at least with regards to the future.

According to Dueweke, the danger of using virtual currencies to influence the U.S. electoral process is acuter now considering that there are state actors who are hostile to the United States that are turning to cryptocurrencies as a way of bypassing the financial system of the West as well as its Anti-Money Laundering and Know-Your-Client regulatory requirements. Per Dueweke Russia was a particularly big threat.

“Considering that a large percentage of global criminal hackers and many cybercriminals are Russian or speak Russian (it is estimated that 25% of Darknet content is Russian), and given Russia’s current state of tension with the United States and Europe, this development should be closely monitored,” Dueweke warned in his prepared testimony.

This comes about a week since the U.S. Secret Service’s Office of Investigations deputy director, Robert Novy, called on lawmakers to enact legislation which would curb the use of anonymity-enhanced cryptocurrencies or privacy coins. Novy was testifying before a Terrorism and Illicit Finance subcommittee of the U.S. House of Representatives Committee on Financial Services.

So while many were worried about The Fed or regulators cracking down on cryptos – now it’s even worse – Congress will unleash the full FUD in their ignorance.

Full story here Are you the author? Previous post See more for Next postTags: BTC-USD,Cryptocurrencies,newslettersent