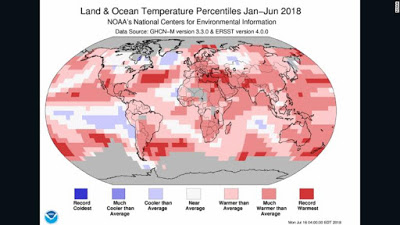

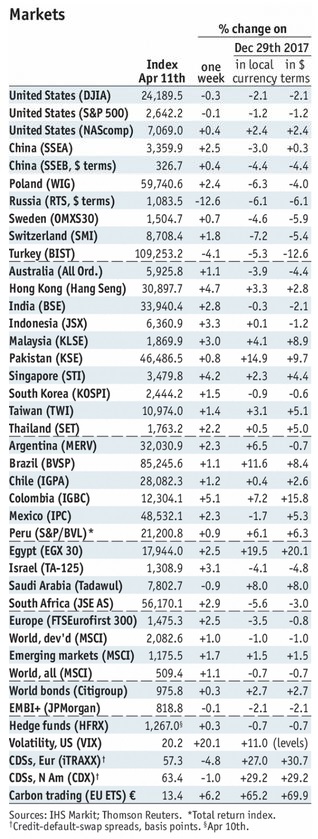

Stock MarketsEM FX was mixed Friday, capping a mixed week as a whole. COP, CLP, and MXN were the best performers last week, while RUB, BRL, and TRY were the worst. While concerns about trade wars and Syrian missile strikes have ebbed, risks to EM remain elevated. US retail sales Monday and Fed Beige Book Wednesday are the economic highlights this week. |

Stock Markets Emerging Markets, April 11 Source: economist.com - Click to enlarge |

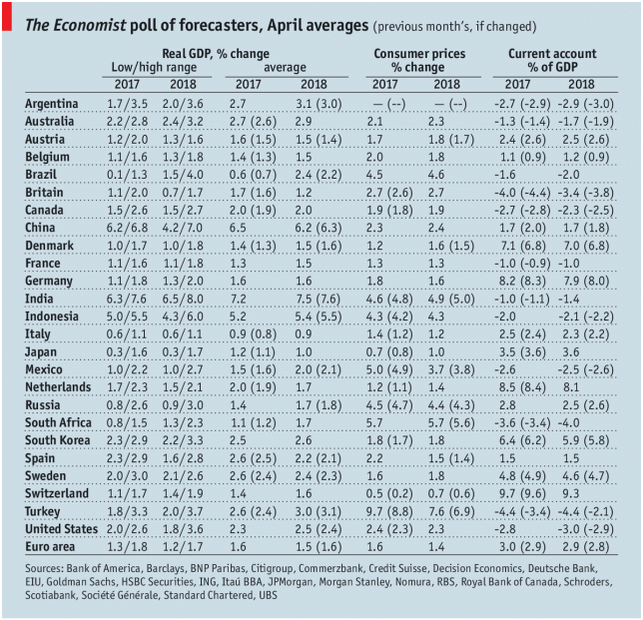

IndonesiaIndonesia reports March trade Monday. Bank Indonesia meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.4% y/y in March, near the bottom of the 3-5% target range. As such, Bank Indonesia should be able to keep rates on hold for most of this year. TurkeyTurkey reports February IP Monday, which is expected to rise 10.4% y/y vs. 12% in January. The economy remains fairly robust even as inflation remains elevated, raising concerns about overheating. The central bank next meets April 25, and much will depend on the lira. If it remains under pressure, the bank may be forced to tighten. IsraelBank of Israel meets Monday and is expected to keep rates steady at 0.10%. CPI will be reported over the weekend and is expected at 0.1% y/y, which is well below the 1-3% target range. The lack of any price pressures should allow the central bank to keep rates on hold this year. ColombiaColombia reports February retail sales and IP Monday. The former is expected to rise 5.7% y/y and the latter by 1.4% y/y. It then reports February trade Friday. Officials are starting to get concerned about the strong peso and its impact on the economy. Next policy meeting is April 25, and rates are expected to be cut 25 bp to 4.25%. SingaporeSingapore reports March trade Tuesday. NODX are expected to rise 4.2% y/y vs. -5.9% in February. Last Friday, the MAS tightened policy modestly whilst voicing some concerns about the global trade outlook. We expect the MAS to proceed cautiously. ChinaChina reports March retail sales and IP as well as Q1 GDP Tuesday. GDP growth is expected to remain steady at 6.8% y/y, while sales and IP are expected to pick up slightly. For now, the economic outlook is one of stability. MalaysiaMalaysia reports March CPI Wednesday, which is expected to rise 1.6% y/y vs. 1.4% in February. Although Bank Negara does not have an explicit inflation target, low price pressures should allow it to remain on hold for much of this year. Next policy meeting is May 10, rates are likely to be kept steady at 3.25%. South AfricaSouth Africa reports March CPI and February retail sales Wednesday. Inflation is expected at 4.1% y/y vs. 4.0% in February, while sales are expected to rise 3.0% y/y vs. 3.1% in January. Inflation is likely to remain in the bottom half of the 3-6% target range, which should allow for another 25 bp rate cut at the next SARB policy meeting May 24. PolandPoland reports March industrial and construction output as well as PPI Thursday. Real sector data is expected to slow from February, while PPI is expected to be flat y/y vs. -0.2% in February. The central bank tilted even more dovish last week, with Governor Glapinski talking about potential for a rate cut. For now, we see steady rates well into 2019. TaiwanTaiwan reports March export orders Friday. Regional indicators suggest activity has been slowing in Q1, and so the orders data will be watched closely. For now, low inflation and downside growth risks should keep the central bank on hold in 2018. BrazilBrazil reports mid-April IPCA inflation Friday, which is expected to rise 2.84% y/y vs. 2.8% in mid-March. If so, inflation would remain near the bottom of the 2.5-6.5% target range. The central bank signaled that the easing cycle would likely end after one more cut. Next COPOM meeting is May 16, and markets are pricing in one final 25 bp cut to 6.25%. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2018 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,win-thin